Answered step by step

Verified Expert Solution

Question

1 Approved Answer

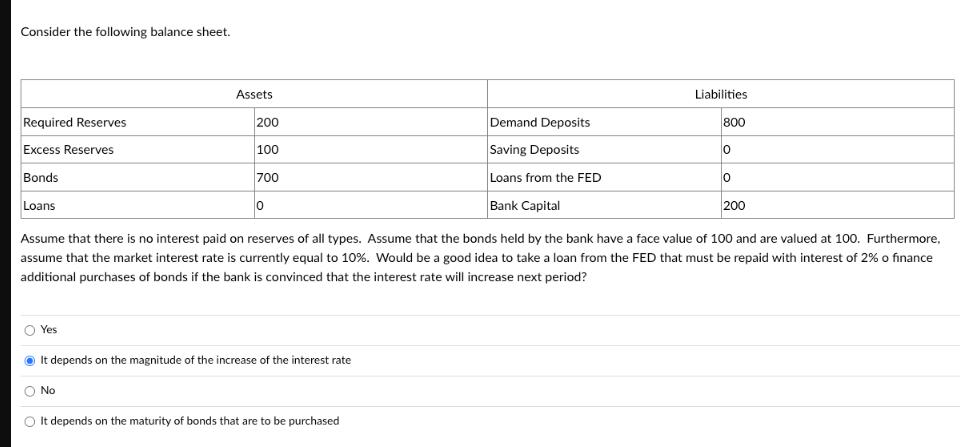

Consider the following balance sheet. Required Reserves Excess Reserves Bonds Loans Assets O Yes 200 100 700 0 It depends on the magnitude of

Consider the following balance sheet. Required Reserves Excess Reserves Bonds Loans Assets O Yes 200 100 700 0 It depends on the magnitude of the increase of the interest rate O No Demand Deposits Saving Deposits Loans from the FED Bank Capital It depends on the maturity of bonds that are to be purchased Liabilities 800 0 Assume that there is no interest paid on reserves of all types. Assume that the bonds held by the bank have a face value of 100 and are valued at 100. Furthermore, assume that the market interest rate is currently equal to 10%. Would be a good idea to take a loan from the FED that must be repaid with interest of 2% o finance additional purchases of bonds if the bank is convinced that the interest rate will increase next period? 0 200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

No based on the information provided it wouldnt be a good idea for the bank to take a loan from the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started