Question

Consider the following bank balance sheet (fixed rates and pure discount securities unless indicated otherwise). Interest rates on liabilities are 10 percent and on assets

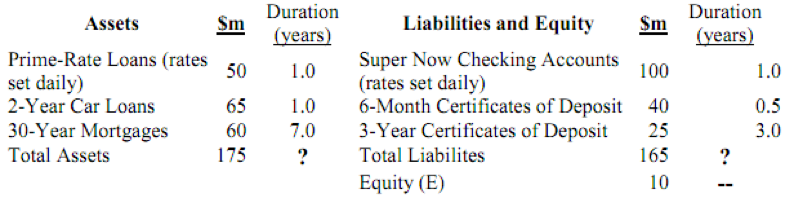

Consider the following bank balance sheet (fixed rates and pure discount securities unless indicated otherwise). Interest rates on liabilities are 10 percent and on assets are 12 percent.

a. What is the duration of assets, DA, liabilites, DL, and Equity, E.

b. The bank will benefit or be hurt if all interest rates rise (assume by the same amount).

c. Compute the repricing gap for the bank using those assets and liabilities repricing or maturing in 2 years or less. From this information, will the bank be hurt or benefit by a 200 basis point rise in interest rates on assets and liabilities?

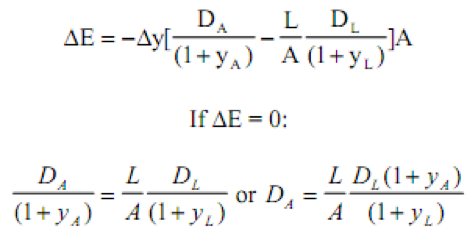

d. If the bank gets an additional $100 in a 6-month certificate of deposit, what investments (using the above portfolio possibilities) should it make to control interest rate risk (? y = 200 basis point change in all interest rates) by changing the duration of its portfolio? State the advantages and disadvantages of using net worth immunization and asset/liability duration as a means of controlling interest rate risk. Define your terms.

?E = change in market value of the portfolio, DA = duration of assets, DL = duration of liabilities, DE = duration of the portfolio or equity, E = market value of equity, L = market value of liabilities, A = market value of assets, and ?y = change in interest rates.

Duration (years) Duration Assets Liabilities and Equity Sm years Super Now Checking Accounts (rates set daily) Prime-Rate Loans (rates set daily 2-Year Car Loans 30-Year Mortgages Total Assets 50 .0 100 1.0 65 .0 -Month Certificates of Depos 40 60 7.0 3-Year Certificates of Deposit 25 165 0.5 3.0 175 Total Liabilites Equity (E) 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started