Answered step by step

Verified Expert Solution

Question

1 Approved Answer

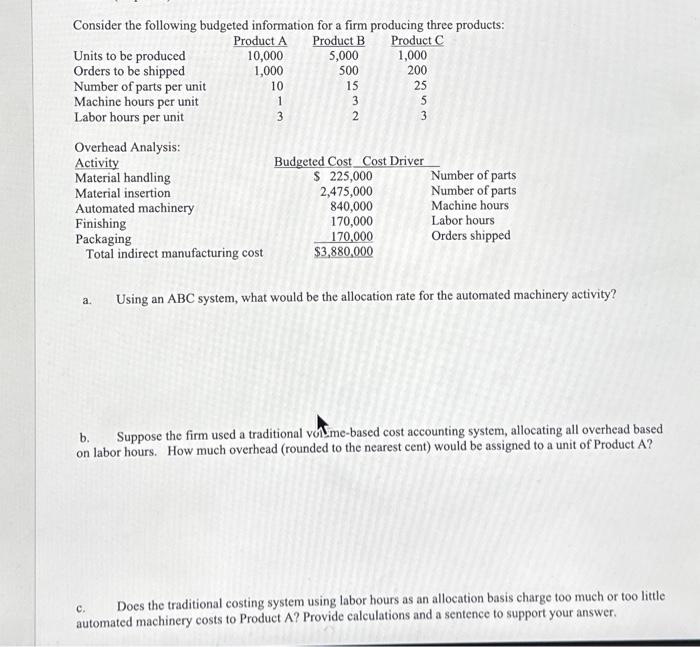

Consider the following budgeted information for a firm producing three products: Product A Product B Product C Units to be produced Orders to be shipped

Consider the following budgeted information for a firm producing three products: Product A Product B Product C Units to be produced Orders to be shipped Number of parts per unit Machine hours per unit Labor hours per unit Overhead Analysis: Activity Material handling Material insertion Automated machinery Finishing Packaging Total indirect manufacturing cost a. 10,000 1,000 10 1 3 C. 5,000 500 15 3 2 1,000 200 25 5 3 Budgeted Cost Cost Driver $ 225,000 2,475,000 840,000 170,000 170,000 $3,880,000 Number of parts Number of parts Machine hours Labor hours Orders shipped Using an ABC system, what would be the allocation rate for the automated machinery activity? b. Suppose the firm used a traditional volume-based cost accounting system, allocating all overhead based on labor hours. How much overhead (rounded to the nearest cent) would be assigned to a unit of Product A? Does the traditional costing system using labor hours as an allocation basis charge too much or too little automated machinery costs to Product A? Provide calculations and a sentence to support your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started