Answered step by step

Verified Expert Solution

Question

1 Approved Answer

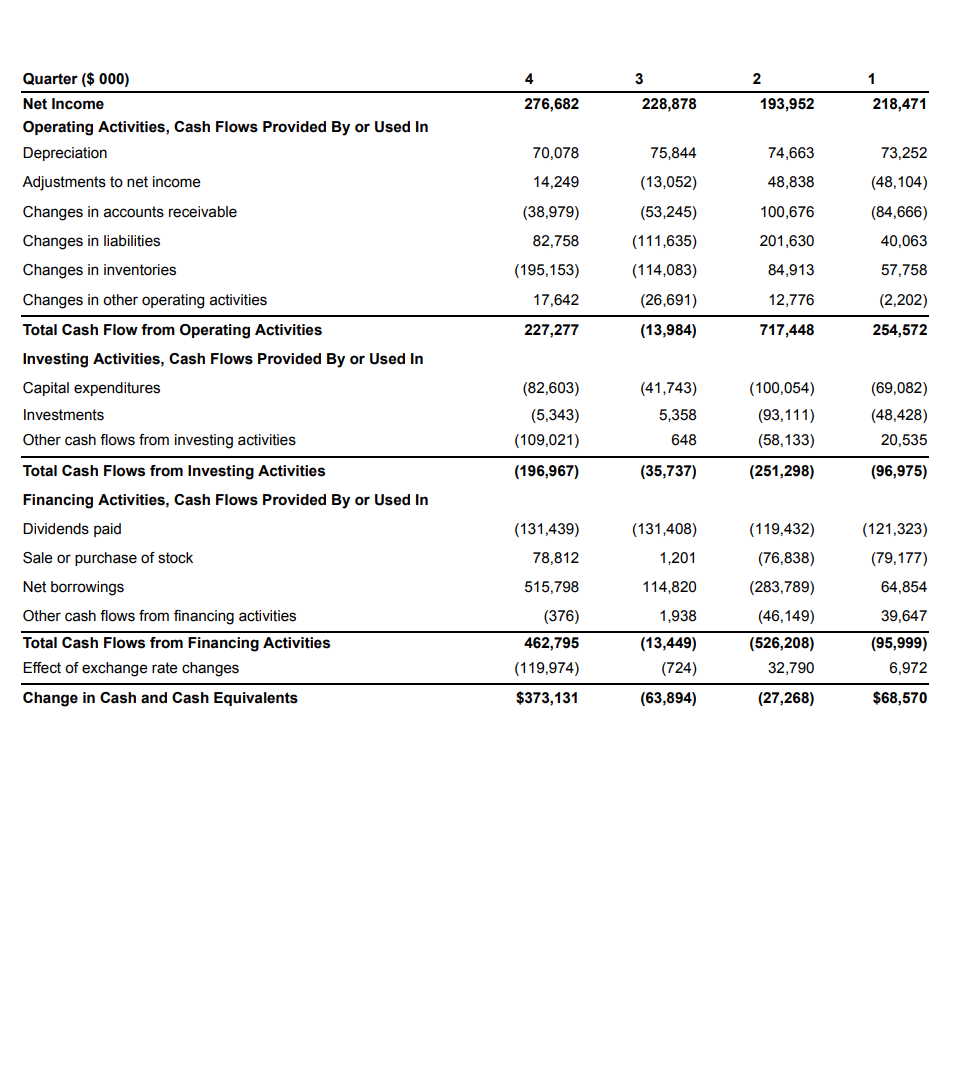

Consider the following cash flow statement. a. What were the company's cumulative earnings over these four quarters? What were its cumulative cash flows from operating

Consider the following cash flow statement.

a. What were the company's cumulative earnings over these four quarters? What were its cumulative cash flows from operating activities?

b. What fraction of the cash from operating activities was used for investment over the four quarters?

c. What fraction of the cash from operating activities was used for financing activities over the four quarters?

4 3 1 2 193,952 276,682 228,878 218,471 70,078 75,844 74,663 73,252 14.249 48,838 (48,104) (38,979) 82,758 (13,052) (53,245) (111,635) (114,083) (26,691) 100,676 201,630 Quarter ($ 000) Net Income Operating Activities, Cash Flows Provided By or Used In Depreciation Adjustments to net income Changes in accounts receivable Changes in liabilities Changes in inventories Changes in other operating activities Total Cash Flow from Operating Activities Investing Activities, Cash Flows Provided By or Used In Capital expenditures Investments Other cash flows from investing activities (84,666) 40,063 (195,153) 84,913 57,758 17,642 12,776 (2,202) 227,277 (13,984) 717,448 254,572 (82,603) (5,343) (109,021) (41,743) 5,358 (100,054) (93,111) (58,133) (69,082) (48,428) 20,535 648 (196,967) (35,737) (251,298) (96,975) (131,439) (131,408) (119,432) (76,838) 78,812 1,201 Total Cash Flows from Investing Activities Financing Activities, Cash Flows Provided By or Used In Dividends paid Sale or purchase of stock Net borrowings Other cash flows from financing activities Total Cash Flows from Financing Activities Effect of exchange rate changes Change in Cash and Cash Equivalents (121,323) (79,177) 64,854 515,798 114,820 (283,789) 1,938 39,647 (376) 462,795 (119,974) $373,131 (13,449) (724) (63,894) (46,149) (526,208) 32,790 (95,999) 6,972 (27,268) $68,570Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started