Question

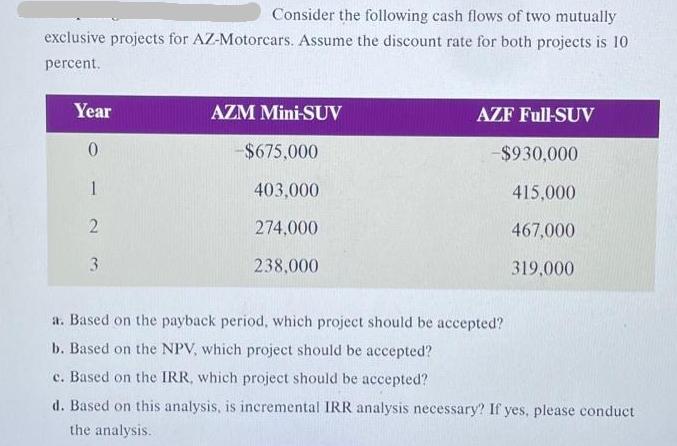

Consider the following cash flows of two mutually exclusive projects for AZ-Motorcars. Assume the discount rate for both projects is 10 percent. Year 0

Consider the following cash flows of two mutually exclusive projects for AZ-Motorcars. Assume the discount rate for both projects is 10 percent. Year 0 1 2 3 AZM Mini-SUV --$675,000 403,000 274,000 238,000 AZF Full-SUV -$930,000 415,000 467,000 319,000 a. Based on the payback period, which project should be accepted? b. Based on the NPV, which project should be accepted? c. Based on the IRR, which project should be accepted? d. Based on this analysis, is incremental IRR analysis necessary? If yes, please conduct the analysis.

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Capital Budgeting These are methods used by businesses to evaluate and select investment projects Th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance Core Principles And Applications

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

6th Edition

1260571122, 978-1260571127

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App