Jack and Diane are a married couple in their late 40s. After discussing their financial situation with their accountant, financial planner and life insurance

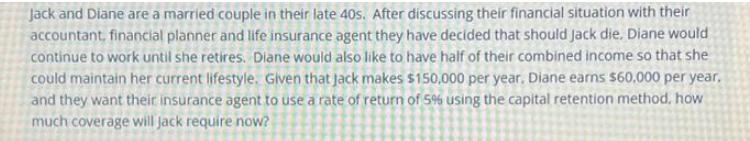

Jack and Diane are a married couple in their late 40s. After discussing their financial situation with their accountant, financial planner and life insurance agent they have decided that should Jack die. Diane would continue to work until she retires. Diane would also like to have half of their combined income so that she could maintain her current lifestyle. Given that Jack makes $150,000 per year. Diane earns $60.000 per year, and they want their insurance agent to use a rate of return of 5% using the capital retention method, how much coverage will jack require now?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine how much life insurance coverage Jack would require we can us...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started