Answered step by step

Verified Expert Solution

Question

1 Approved Answer

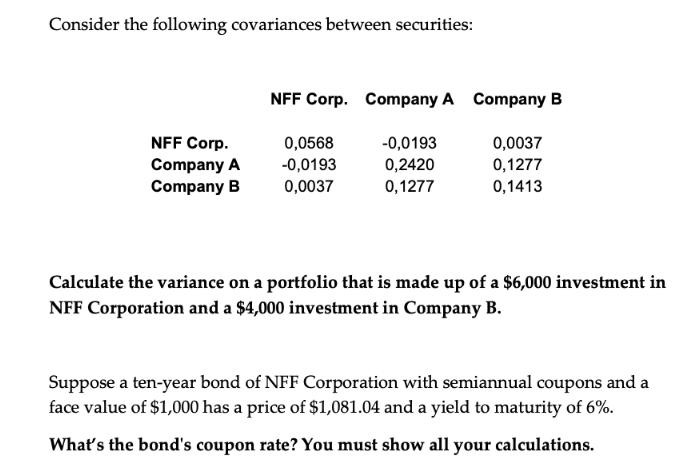

Consider the following covariances between securities: NFF Corp. Company A Company B NFF Corp. Company A Company B 0,0568 -0,0193 0,0037 -0,0193 0,2420 0,1277

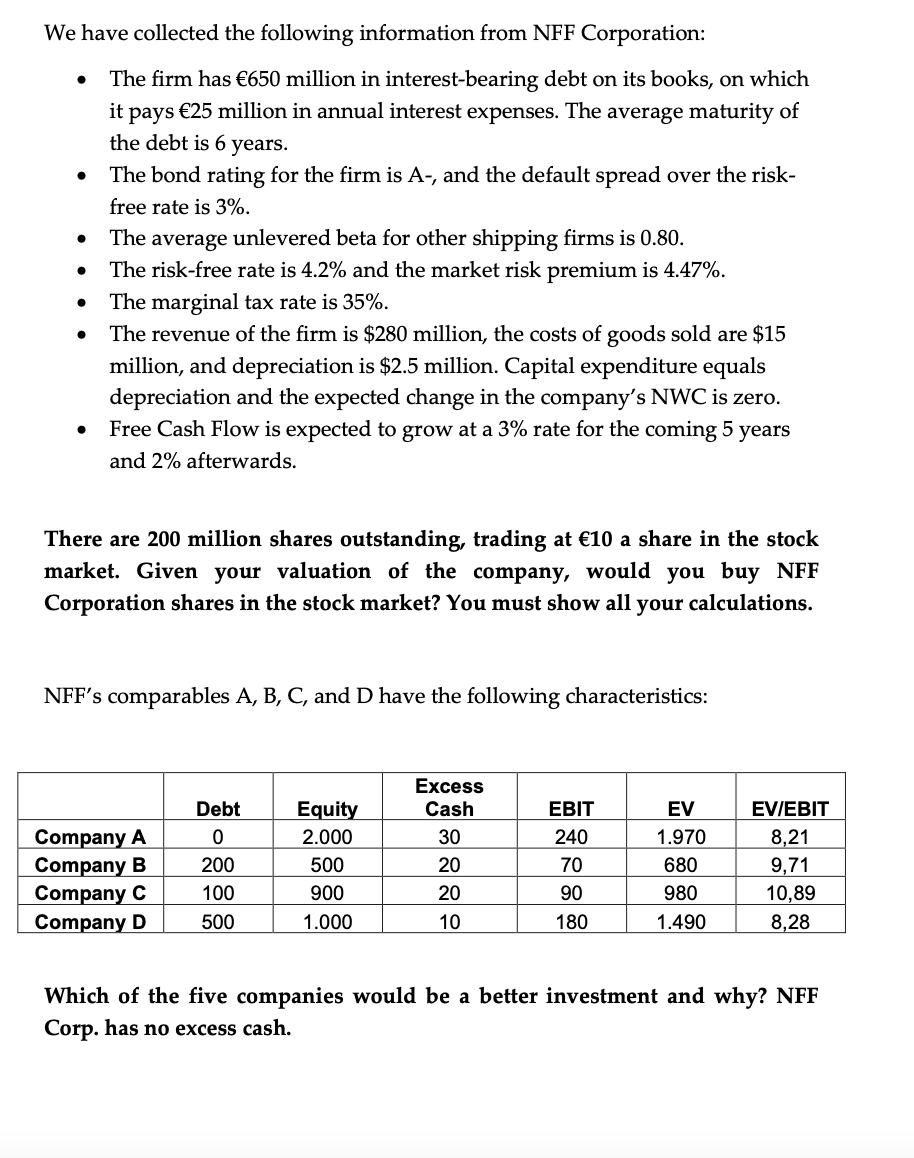

Consider the following covariances between securities: NFF Corp. Company A Company B NFF Corp. Company A Company B 0,0568 -0,0193 0,0037 -0,0193 0,2420 0,1277 0,0037 0,1277 0,1413 Calculate the variance on a portfolio that is made up of a $6,000 investment in NFF Corporation and a $4,000 investment in Company B. Suppose a ten-year bond of NFF Corporation with semiannual coupons and a face value of $1,000 has a price of $1,081.04 and a yield to maturity of 6%. What's the bond's coupon rate? You must show all your calculations. We have collected the following information from NFF Corporation: The firm has 650 million in interest-bearing debt on its books, on which it pays 25 million in annual interest expenses. The average maturity of the debt is 6 years. The bond rating for the firm is A-, and the default spread over the risk- free rate is 3%. The average unlevered beta for other shipping firms is 0.80. The risk-free rate is 4.2% and the market risk premium is 4.47%. The marginal tax rate is 35%. The revenue of the firm is $280 million, the costs of goods sold are $15 million, and depreciation is $2.5 million. Capital expenditure equals depreciation and the expected change in the company's NWC is zero. Free Cash Flow is expected to grow at a 3% rate for the coming 5 years and 2% afterwards. There are 200 million shares outstanding, trading at 10 a share in the stock market. Given your valuation of the company, would you buy NFF Corporation shares in the stock market? You must show all your calculations. NFF's comparables A, B, C, and D have the following characteristics: Company A Company B Company C Company D Debt 0 200 100 500 Equity 2.000 500 900 1.000 Excess Cash 30 20 20 10 EBIT 240 70 90 180 EV 1.970 680 980 1.490 EV/EBIT 8,21 9,71 10,89 8,28 Which of the five companies would be a better investment and why? NFF Corp. has no excess cash.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Youve provided two images which contain multiple sets of information along with distinct financial questions Lets handle them one by one From the firs...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started