Answered step by step

Verified Expert Solution

Question

1 Approved Answer

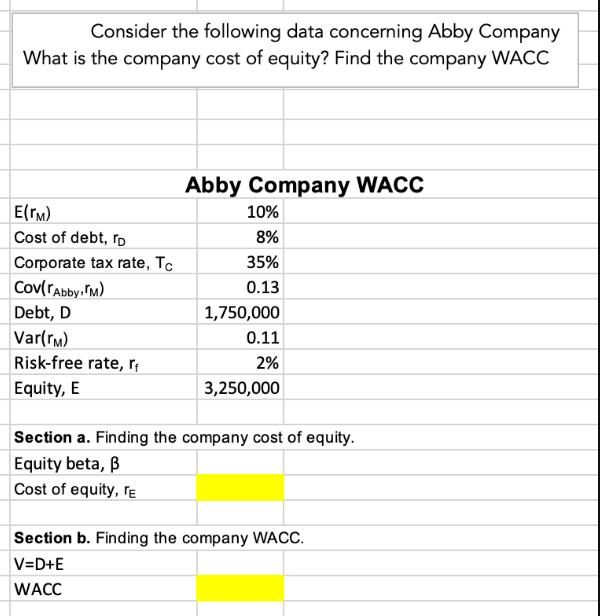

Consider the following data concerning Abby Company What is the company cost of equity? Find the company WACC E(TM) Cost of debt, ro Corporate

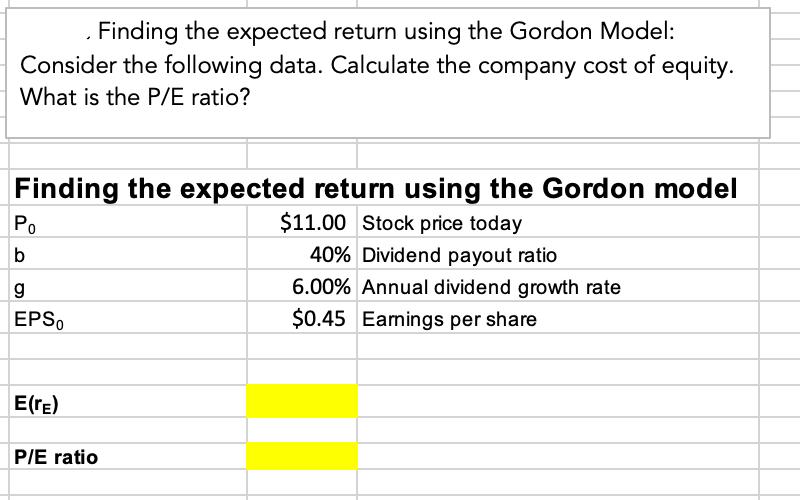

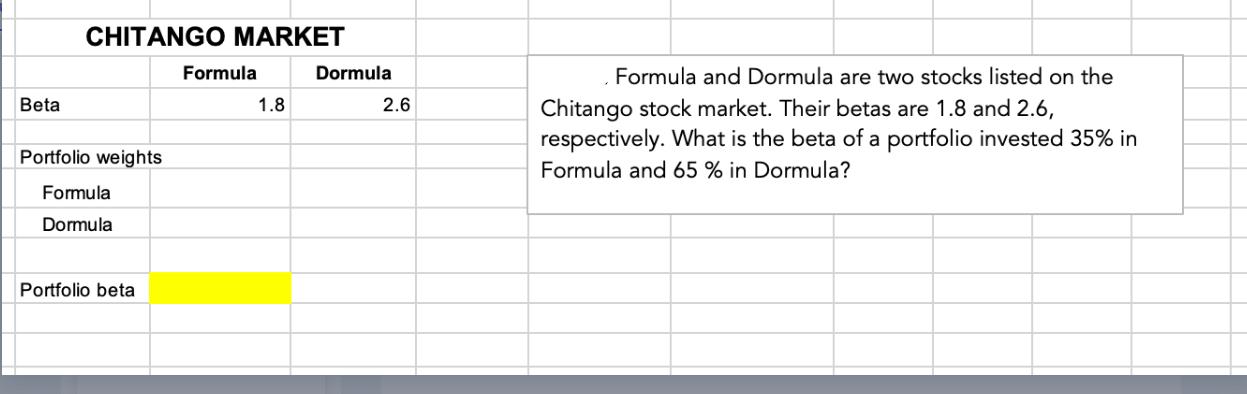

Consider the following data concerning Abby Company What is the company cost of equity? Find the company WACC E(TM) Cost of debt, ro Corporate tax rate, Tc Cov(FAbby M) Debt, D Var(M) Risk-free rate, r Equity, E Abby Company WACC 10% 8% 35% 0.13 1,750,000 0.11 2% 3,250,000 Section a. Finding the company cost of equity. Equity beta, B Cost of equity, E Section b. Finding the company WACC. V=D+E WACC Finding the expected return using the Gordon Model: Consider the following data. Calculate the company cost of equity. What is the P/E ratio? Finding the expected return using the Gordon model $11.00 Stock price today Po b g EPSO E(re) P/E ratio 40% Dividend payout ratio 6.00% Annual dividend growth rate $0.45 Earnings per share Beta CHITANGO MARKET Portfolio weights Formula Dormula Portfolio beta Formula 1.8 Dormula 2.6 Formula and Dormula are two stocks listed on the Chitango stock market. Their betas are 1.8 and 2.6, respectively. What is the beta of a portfolio invested 35% in Formula and 65 % in Dormula?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To find the companys cost of equity re we can use the Capital Asset Pricing Model CAPM formula re rf rm rf where rf riskfree rate equity beta rm expec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started