Answered step by step

Verified Expert Solution

Question

1 Approved Answer

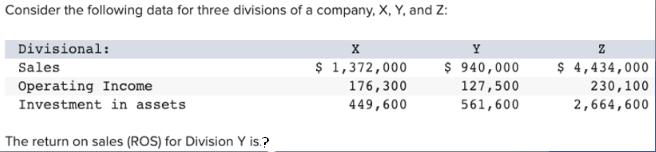

Consider the following data for three divisions of a company, X, Y, and Z: Divisional: Sales Operating Income Investment in assets The return on

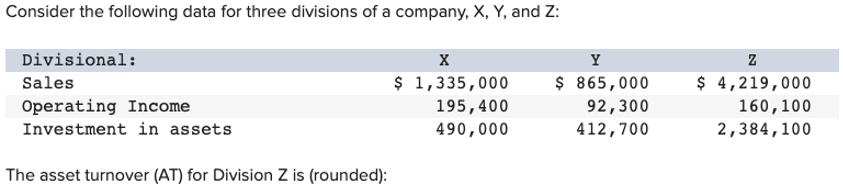

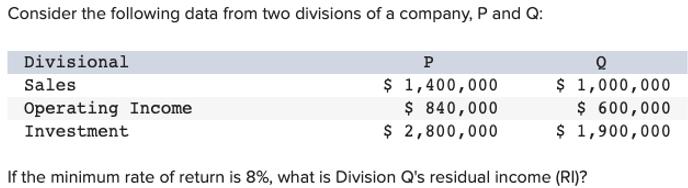

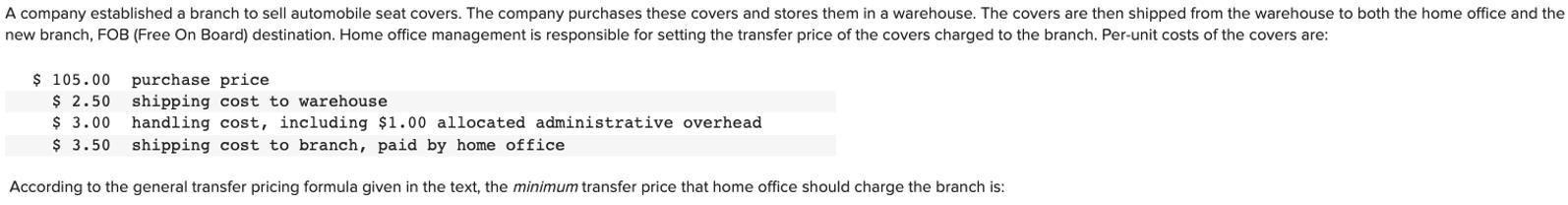

Consider the following data for three divisions of a company, X, Y, and Z: Divisional: Sales Operating Income Investment in assets The return on sales (ROS) for Division Y is.? X $ 1,372,000 176,300 449,600 Y $ 940,000 127,500 561,600 Z $ 4,434,000 230,100 2,664,600 Consider the following data for three divisions of a company, X, Y, and Z: Divisional: Sales Operating Income Investment in assets The asset turnover (AT) for Division Z is (rounded): X $ 1,335,000 195,400 490,000 Y $ 865,000 92,300 412,700 Z $ 4,219,000 160,100 2,384,100 Consider the following data from two divisions of a company, P and Q: Divisional Sales Operating Income Investment Q $ 1,000,000 $ 600,000 $ 1,900,000 P $ 1,400,000 $ 840,000 $ 2,800,000 If the minimum rate of return is 8%, what is Division Q's residual income (RI)? A company established a branch to sell automobile seat covers. The company purchases these covers and stores them in a warehouse. The covers are then shipped from the warehouse to both the home office and the new branch, FOB (Free On Board) destination. Home office management is responsible for setting the transfer price of the covers charged to the branch. Per-unit costs of the covers are: $ 105.00 purchase price shipping cost to warehouse handling cost, including $1.00 allocated administrative overhead $ 2.50 $ 3.00 $ 3.50 shipping cost to branch, paid by home office According to the general transfer pricing formula given in the text, the minimum transfer price that home office should charge the branch is:

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate the return on sales ROS for Division Y Given the data for Division Y Operating Income Y ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started