Answered step by step

Verified Expert Solution

Question

1 Approved Answer

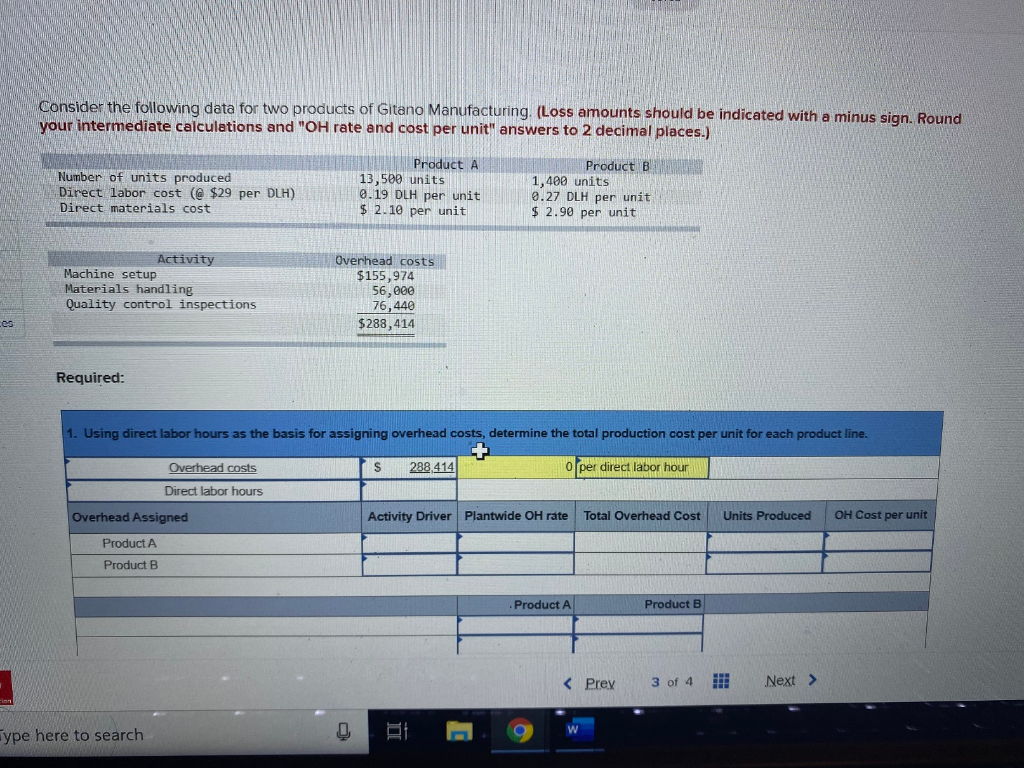

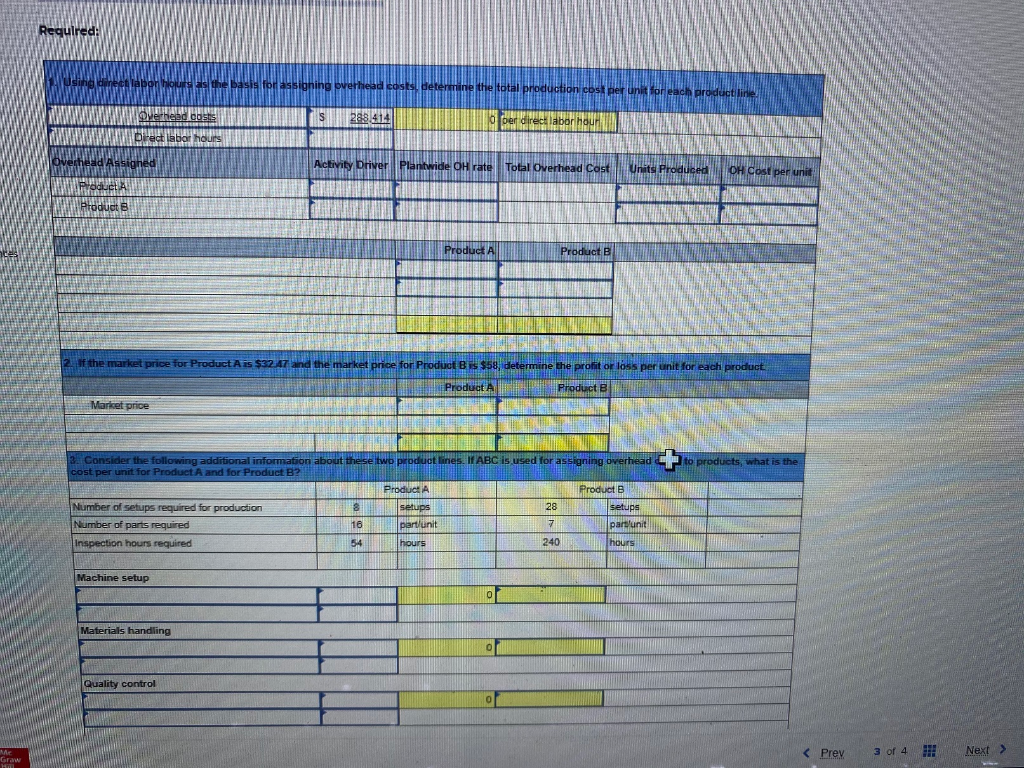

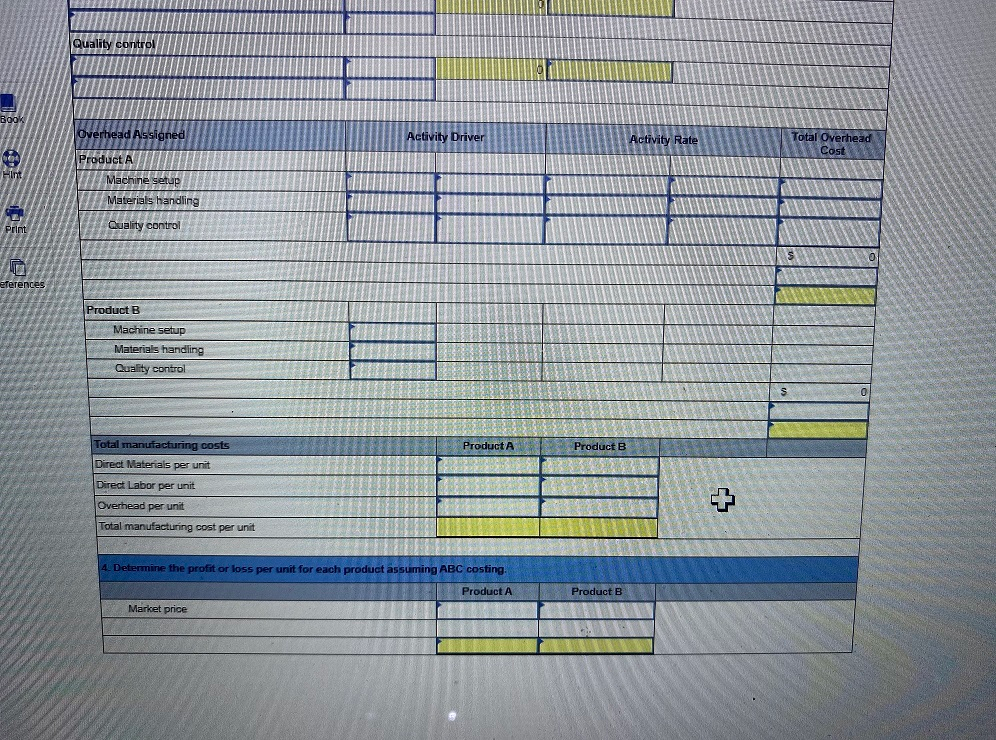

Consider the following data for two products of Gitano Manufacturing. (Loss amounts should be indicated with a minus sign. Round your intermediate calculations and OH

Consider the following data for two products of Gitano Manufacturing. (Loss amounts should be indicated with a minus sign. Round your intermediate calculations and "OH rate and cost per unit" answers to 2 decimal places.)

| Product A | Product B | |

| Number of units produced | 13,500 units | 1,400 units |

| Direct labor cost (@ $29 per DLH) | 0.19 DLH per unit | 0.27 DLH per unit |

| Direct materials cost | $ 2.10 per unit | $ 2.90 per unit |

| Activity | Overhead costs | |||

| Machine setup | $ | 155,974 | ||

| Materials handling | 56,000 | |||

| Quality control inspections | 76,440 | |||

| $ | 288,414 | |||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started