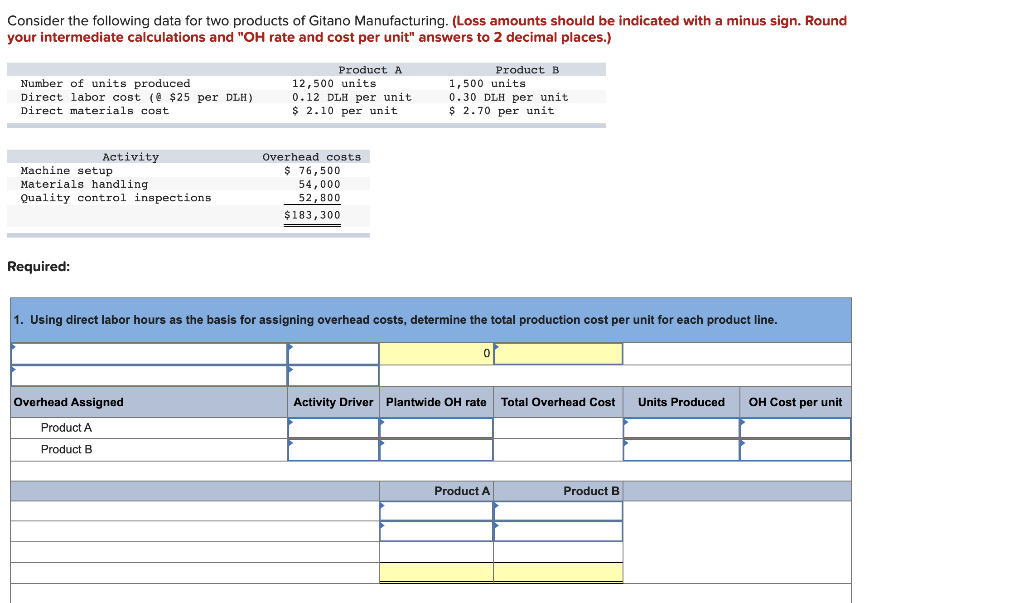

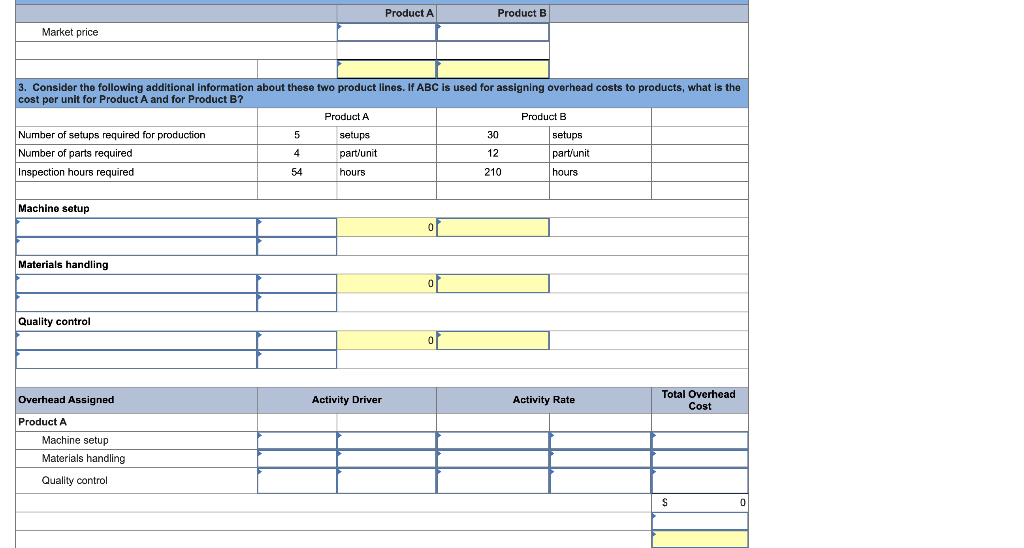

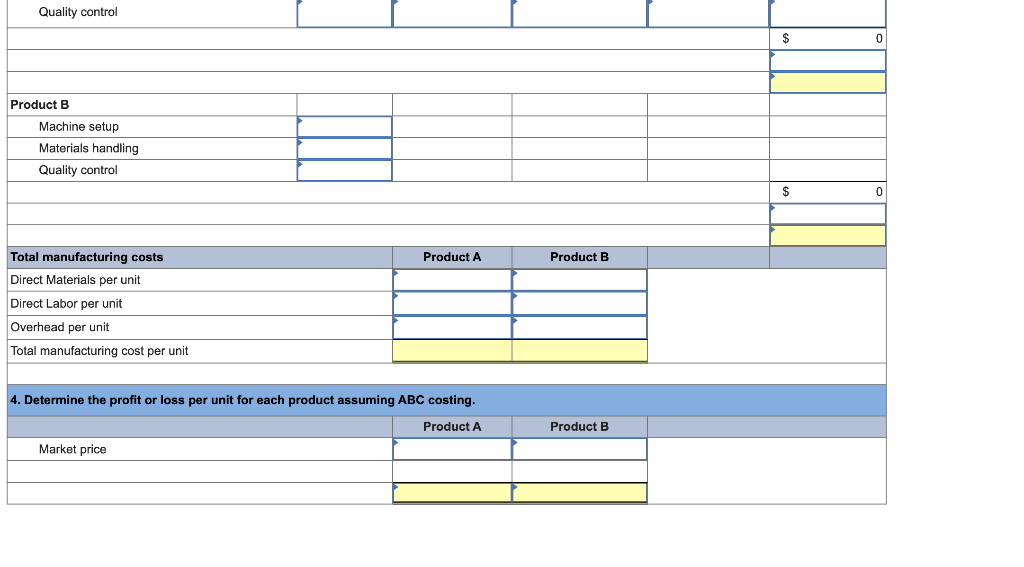

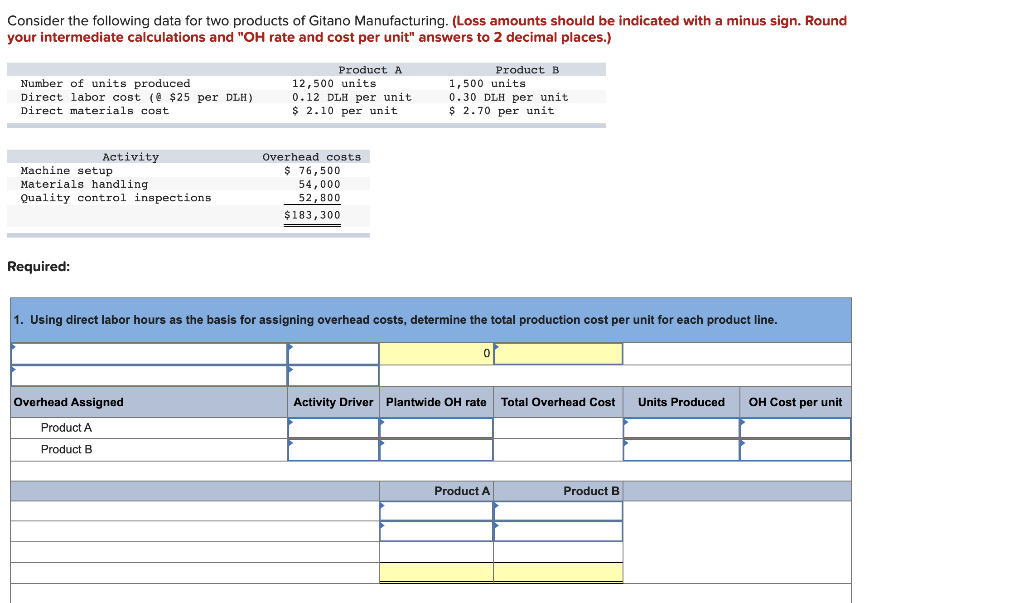

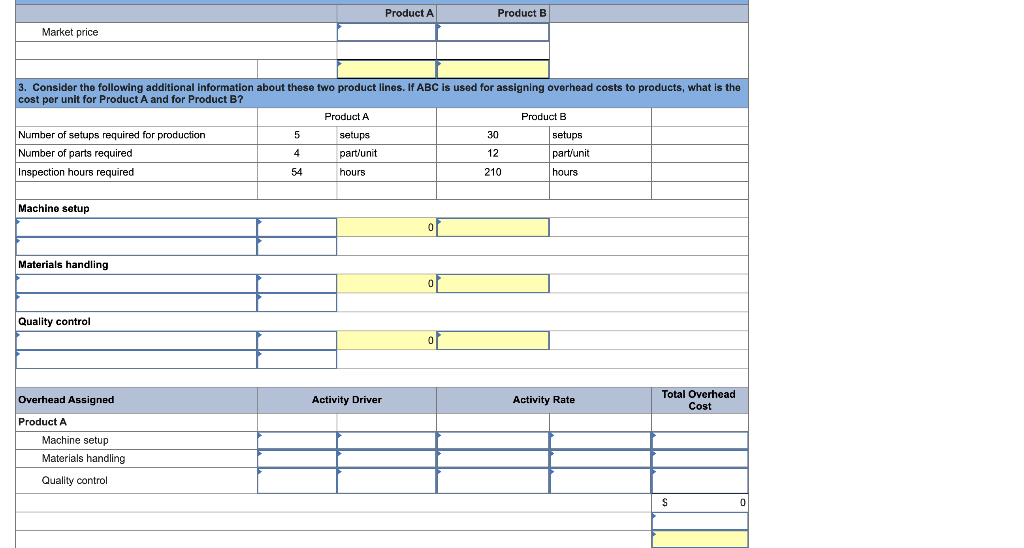

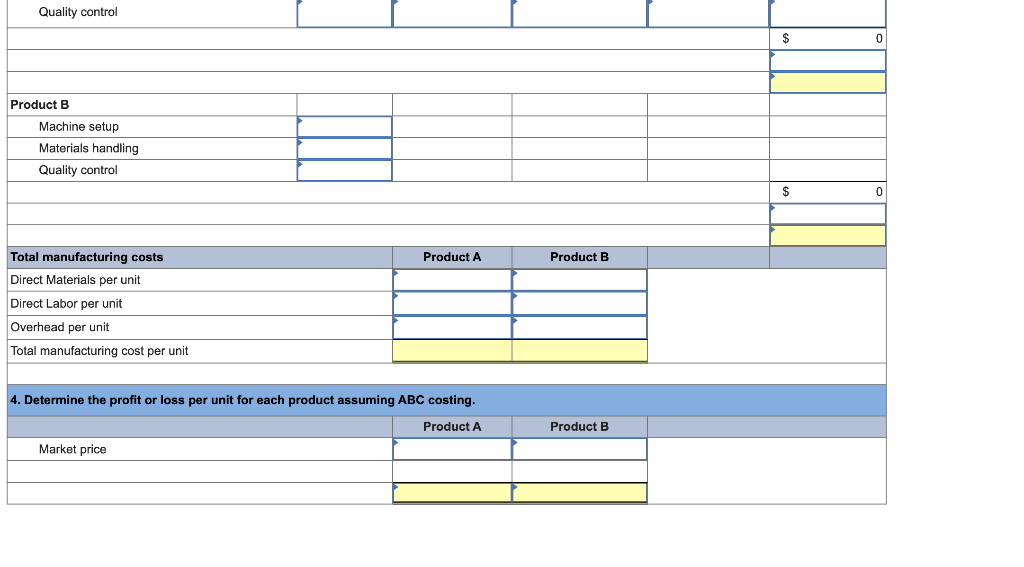

Consider the following data for two products of Gitano Manufacturing. (Loss amounts should be indicated with a minus sign. Round your intermediate calculations and "OH rate and cost per unit" answers to 2 decimal places.) Number of units produced Direct labor cost (@ $25 per DLH) Direct materials cost Product A 12,500 units 0.12 DLH per unit $ 2.10 per unit Product B 1,500 units 0.30 DLH per unit $ 2.70 per unit Activity Machine setup Materials handling Quality control inspections Overhead costs $ 76,500 54,000 52,800 $183, 300 Required: 1. Using direct labor hours as the basis for assigning overhead costs, determine the total production cost per unit for each product line. Overhead Assigned Activity Driver Plantwide OH rate Total Overhead Cost Units Produced OH Cost per unit Product A Product B Product A Product B Product A Product B Market price 3. Consider the following additional information about these two product lines. If ABC is used for assigning overhead costs to products, what is the cost per unit for Product A and for Product B? Product A Product B Number of setups required for production 5 setups 30 setups Number of parts required 4 part/unit 12 part/unit Inspection hours required 54 hours 210 hours Machine setup Materials handling Quality control Overhead Assigned Activity Driver Activity Rate Total Overhead Cost Product A Machine setup Materials handling Quality control Quality control Product B Machine setup Materials handling Quality control Product A Product B Total manufacturing costs Direct Materials per unit Direct Labor per unit Overhead per unit Total manufacturing cost per unit 4. Determine the profit or loss per unit for each product assuming ABC costing. Product Market price Product B Consider the following data for two products of Gitano Manufacturing. (Loss amounts should be indicated with a minus sign. Round your intermediate calculations and "OH rate and cost per unit" answers to 2 decimal places.) Number of units produced Direct labor cost (@ $25 per DLH) Direct materials cost Product A 12,500 units 0.12 DLH per unit $ 2.10 per unit Product B 1,500 units 0.30 DLH per unit $ 2.70 per unit Activity Machine setup Materials handling Quality control inspections Overhead costs $ 76,500 54,000 52,800 $183, 300 Required: 1. Using direct labor hours as the basis for assigning overhead costs, determine the total production cost per unit for each product line. Overhead Assigned Activity Driver Plantwide OH rate Total Overhead Cost Units Produced OH Cost per unit Product A Product B Product A Product B Product A Product B Market price 3. Consider the following additional information about these two product lines. If ABC is used for assigning overhead costs to products, what is the cost per unit for Product A and for Product B? Product A Product B Number of setups required for production 5 setups 30 setups Number of parts required 4 part/unit 12 part/unit Inspection hours required 54 hours 210 hours Machine setup Materials handling Quality control Overhead Assigned Activity Driver Activity Rate Total Overhead Cost Product A Machine setup Materials handling Quality control Quality control Product B Machine setup Materials handling Quality control Product A Product B Total manufacturing costs Direct Materials per unit Direct Labor per unit Overhead per unit Total manufacturing cost per unit 4. Determine the profit or loss per unit for each product assuming ABC costing. Product Market price Product B