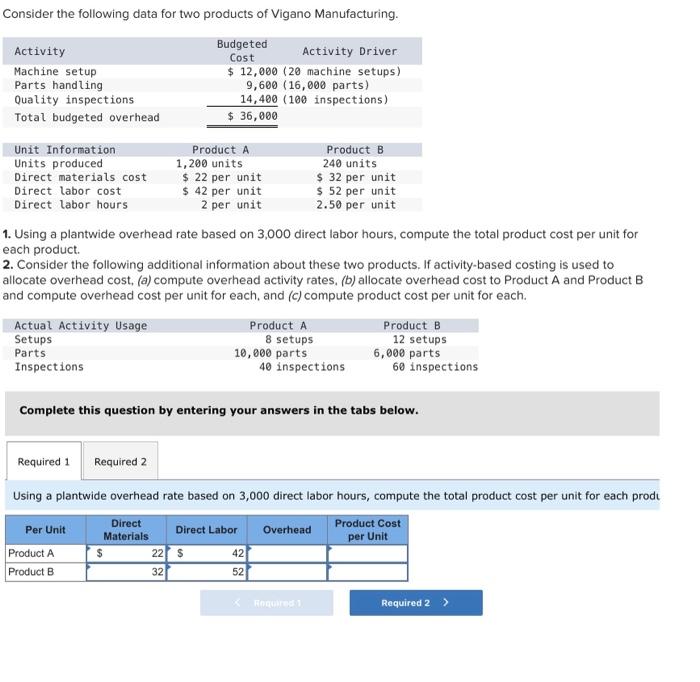

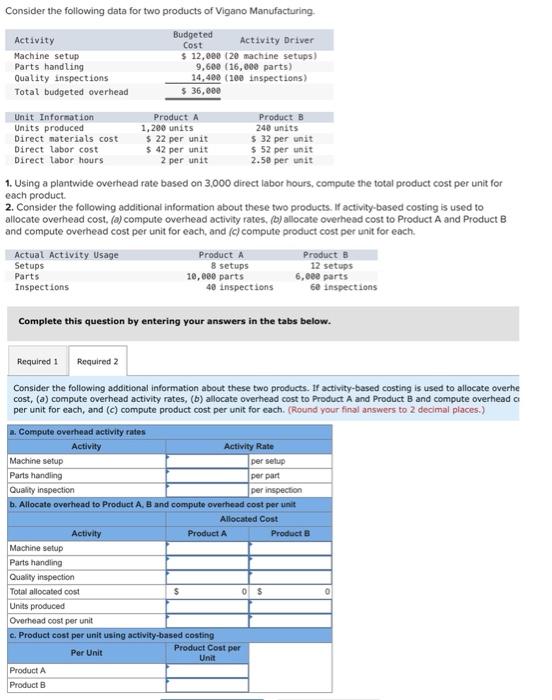

Consider the following data for two products of Vigano Manufacturing. Activity Budgeted Activity Driver Cost Machine setup $ 12,000 (20 machine setups) Parts handling 9,600 (16,000 parts) Quality inspections 14,400 (100 inspections) Total budgeted overhead 36,000 Unit Information Product A Product B Units produced 1,200 units 240 units Direct materials cost $ 22 per unit $ 32 per unit Direct labor cost $ 42 per unit $ 52 per unit Direct labor hours 2 per unit 2.50 per unit 1. Using a plantwide overhead rate based on 3,000 direct labor hours, compute the total product cost per unit for each product. 2. Consider the following additional information about these two products. If activity-based costing is used to allocate overhead cost, (a) compute overhead activity rates, (b) allocate overhead cost to Product A and Product B and compute overhead cost per unit for each, and (c) compute product cost per unit for each. Actual Activity Usage Product A Product B Setups 8 setups 12 setups Parts 10,000 parts 6,000 parts Inspections 40 inspections 60 inspections Complete this question by entering your answers in the tabs below. Required 1 Required 2 Using a plantwide overhead rate based on 3,000 direct labor hours, compute the total product cost per unit for each produ Per Unit Direct Materials Direct Labor Overhead Product Cost per Unit Product A $ 225 Product B 327 42 52 Required 2 > Consider the following data for two products of Vigano Manufacturing Budgeted Activity Cost Activity Driver Machine setup $ 12,000 (20 machine setups) Parts handling 9,600 (16,000 parts) Quality inspections 14,400 (100 inspections) Total budgeted overhead $ 36,000 Unit Information Product A Product B Units produced 1,200 units 240 units Direct materials cost $ 22 per unit $ 32 per unit Direct labor cost $ 42 per unit $ 52 per unit Direct labor hours 2 per unit 2.58 per unit 1. Using a plantwice overhead rate based on 3,000 direct labor hours, compute the total product cost per unit for each product 2. Consider the following additional information about these two products. If activity-based costing is used to allocate overhead cost. (a) compute overhead activity rates, (b) allocate overhead cost to Product A and Product B and compute overhead cost per unit for each, and (c) compute product cost per unit for each Actual Activity Usage Product A Products Setups 8 setups 12 setups Parts 10,000 parts 6,eee parts Inspections 40 inspections 6e inspections Complete this question by entering your answers in the tabs below. Required 1 Required 2 Consider the following additional information about these two products. If activity-based costing is used to allocate overhe cost, (a) compute overhead activity rates, (b) allocate overhead cost to Product A and Product B and compute overhead a per unit for each, and (c) compute product cost per unit for each. (Round your final answers to 2 decimal places.) . Compute overhead activity rates Activity Activity Rate Machine setup per setup Parts handling per part Quality inspection per inspection b. Allocate overhead to Product A, B and compute overhead cost per unit Allocated Cost Activity Product A Product Machine setup Parts handling Quality inspection Total allocated cost $ 0 $ Units produced Overhead cost per unit c. Product cost per unit using activity-based costing Product Cost per Per Unit Unit Product A Product B