Answered step by step

Verified Expert Solution

Question

1 Approved Answer

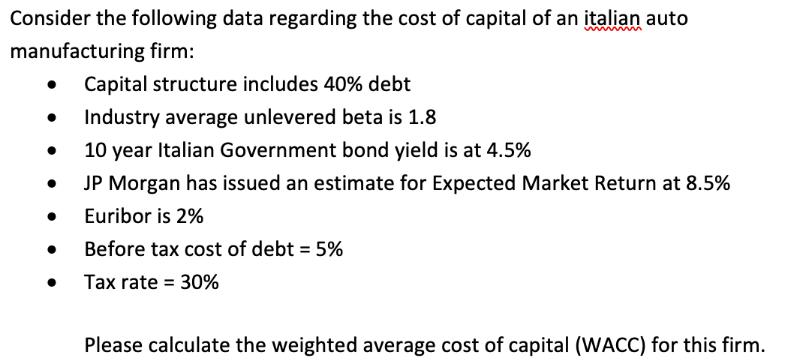

Consider the following data regarding the cost of capital of an italian auto manufacturing firm: Capital structure includes 40% debt Industry average unlevered beta

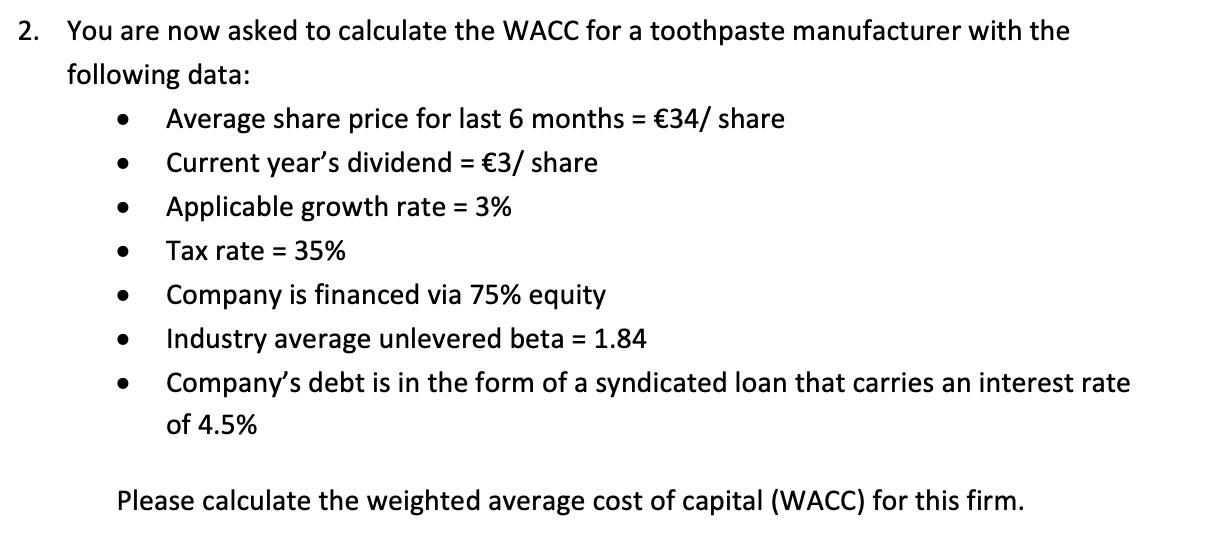

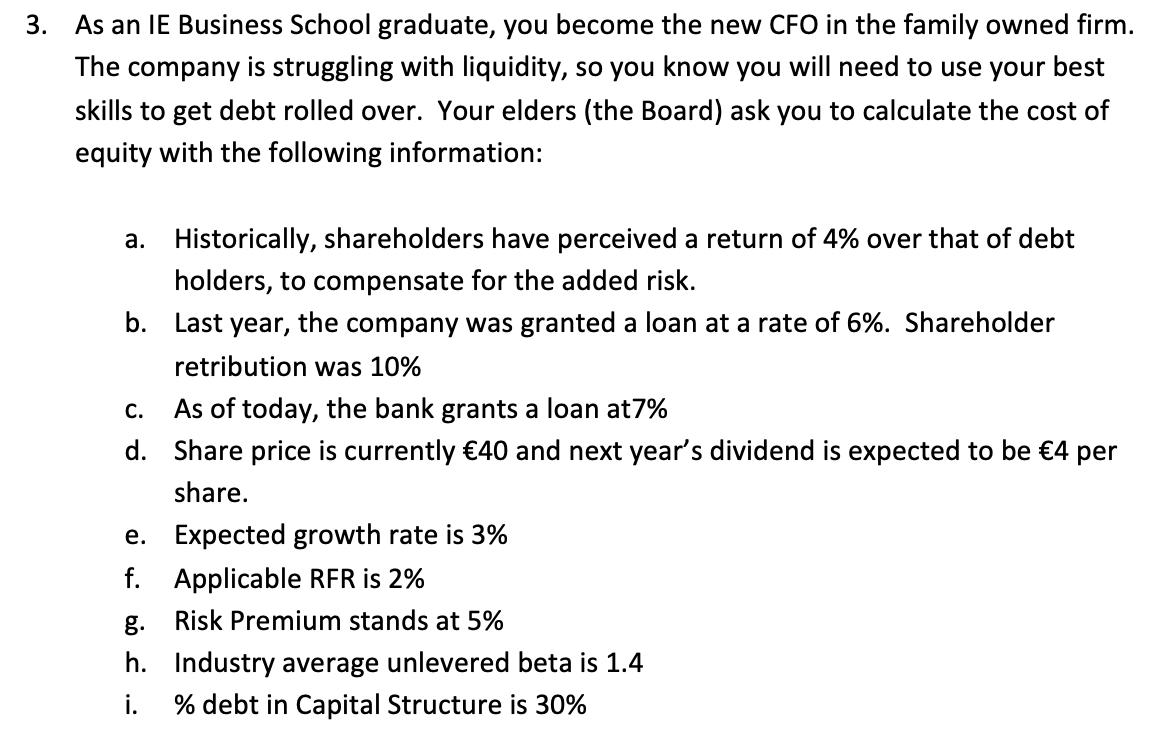

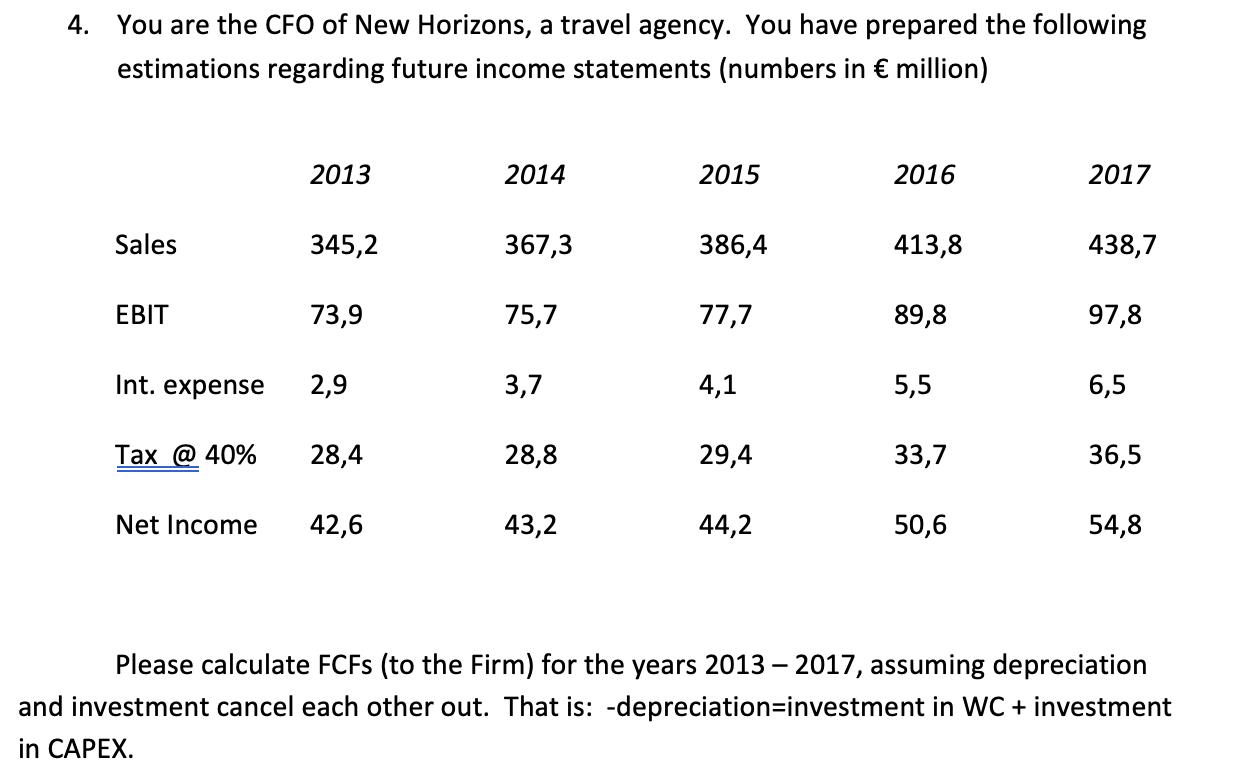

Consider the following data regarding the cost of capital of an italian auto manufacturing firm: Capital structure includes 40% debt Industry average unlevered beta is 1.8 10 year Italian Government bond yield is at 4.5% JP Morgan has issued an estimate for Expected Market Return at 8.5% Euribor is 2% Before tax cost of debt = 5% Tax rate = 30% Please calculate the weighted average cost of capital (WACC) for this firm. 2. You are now asked to calculate the WACC for a toothpaste manufacturer with the following data: Average share price for last 6 months = 34/ share Current year's dividend = 3/ share Applicable growth rate = 3% Tax rate = 35% Company is financed via 75% equity Industry average unlevered beta = 1.84 Company's debt is in the form of a syndicated loan that carries an interest rate of 4.5% Please calculate the weighted average cost of capital (WACC) for this firm. 3. As an IE Business School graduate, you become the new CFO in the family owned firm. The company is struggling with liquidity, so you know you will need to use your best skills to get debt rolled over. Your elders (the Board) ask you to calculate the cost of equity with the following information: a. Historically, shareholders have perceived a return of 4% over that of debt holders, to compensate for the added risk. b. Last year, the company was granted a loan at a rate of 6%. Shareholder retribution was 10% C. As of today, the bank grants a loan at 7% d. Share price is currently 40 and next year's dividend is expected to be 4 per share. Expected growth rate is 3% e. f. Applicable RFR is 2% g. Risk Premium stands at 5% h. Industry average unlevered beta is 1.4 i. % debt in Capital Structure is 30% 4. You are the CFO of New Horizons, a travel agency. You have prepared the following estimations regarding future income statements (numbers in million) Sales EBIT Int. expense Tax @ 40% 2013 345,2 73,9 2,9 28,4 Net Income 42,6 2014 367,3 75,7 3,7 28,8 43,2 2015 386,4 77,7 4,1 29,4 44,2 2016 413,8 89,8 5,5 33,7 50,6 2017 438,7 97,8 6,5 36,5 54,8 Please calculate FCFs (to the Firm) for the years 2013-2017, assuming depreciation and investment cancel each other out. That is: -depreciation-investment in WC + investment in CAPEX.

Step by Step Solution

★★★★★

3.39 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Here are the calculations for the questions 1 Auto manufacturing firm WACC Cost of debt before tax 5 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started