Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Smith is an unlevered firm and expects to generate $140 in earnings before interest and taxes in perpetuity. The corporate tax rate is 20%

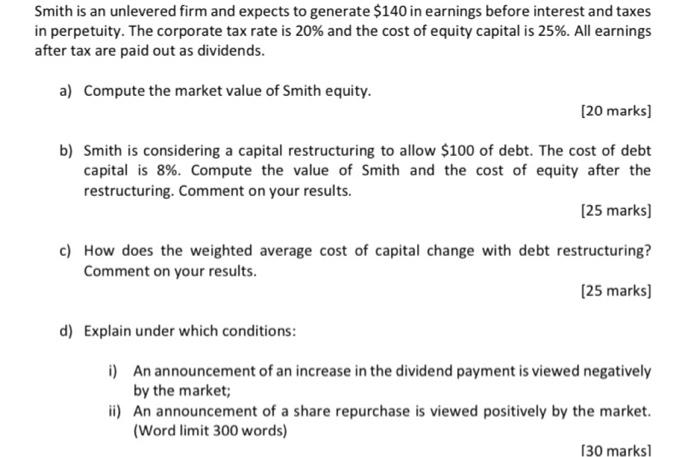

Smith is an unlevered firm and expects to generate $140 in earnings before interest and taxes in perpetuity. The corporate tax rate is 20% and the cost of equity capital is 25%. All earnings after tax are paid out as dividends. a) Compute the market value of Smith equity. [20 marks] b) Smith is considering a capital restructuring to allow $100 of debt. The cost of debt capital is 8%. Compute the value of Smith and the cost of equity after the restructuring. Comment on your results. [25 marks] c) How does the weighted average cost of capital change with debt restructuring? Comment on your results. [25 marks] d) Explain under which conditions: i) An announcement of an increase in the dividend payment is viewed negatively by the market; ii) An announcement of a share repurchase is viewed positively by the market. (Word limit 300 words) [30 marks]

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a To compute the market value of Smith equity we need to use the perpetuity formula and the given information Earnings before interest and taxes EBIT 140 Tax rate 20 Cost of equity capital 25 First we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started