Answered step by step

Verified Expert Solution

Question

1 Approved Answer

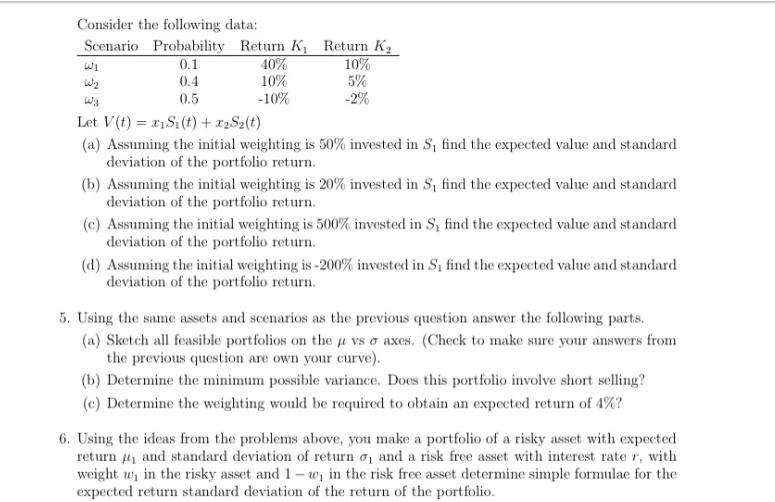

Consider the following data: Scenario Probability Return K Return K WI W2 0.1 0.4 40% 10% 10% 5% 0.5 -10% -2% Wa Let V(t)=xSi(t)

Consider the following data: Scenario Probability Return K Return K WI W2 0.1 0.4 40% 10% 10% 5% 0.5 -10% -2% Wa Let V(t)=xSi(t) + x2S2(t) (a) Assuming the initial weighting is 50% invested in S, find the expected value and standard deviation of the portfolio return. (b) Assuming the initial weighting is 20% invested in S find the expected value and standard deviation of the portfolio return. (c) Assuming the initial weighting is 500% invested in S, find the expected value and standard deviation of the portfolio return. (d) Assuming the initial weighting is -200% invested in S find the expected value and standard deviation of the portfolio return. 5. Using the same assets and scenarios as the previous question answer the following parts. (a) Sketch all feasible portfolios on the p vs axes. (Check to make sure your answers from the previous question are own your curve). (b) Determine the minimum possible variance. Does this portfolio involve short selling? (c) Determine the weighting would be required to obtain an expected return of 4%? 6. Using the ideas from the problems above, you make a portfolio of a risky asset with expected return and standard deviation of return , and a risk free asset with interest rate r, with weight w, in the risky asset and 1-w, in the risk free asset determine simple formulae for the expected return standard deviation of the return of the portfolio.

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the expected value and standard deviation of the portfolio return we need to consider the given probabilities returns and weights of the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started