Question

Consider the following divisional performance report prepared for TSI Services: TSI Services is a consulting business that operates from a rented office in an inner

- Consider the following divisional performance report prepared for TSI Services:

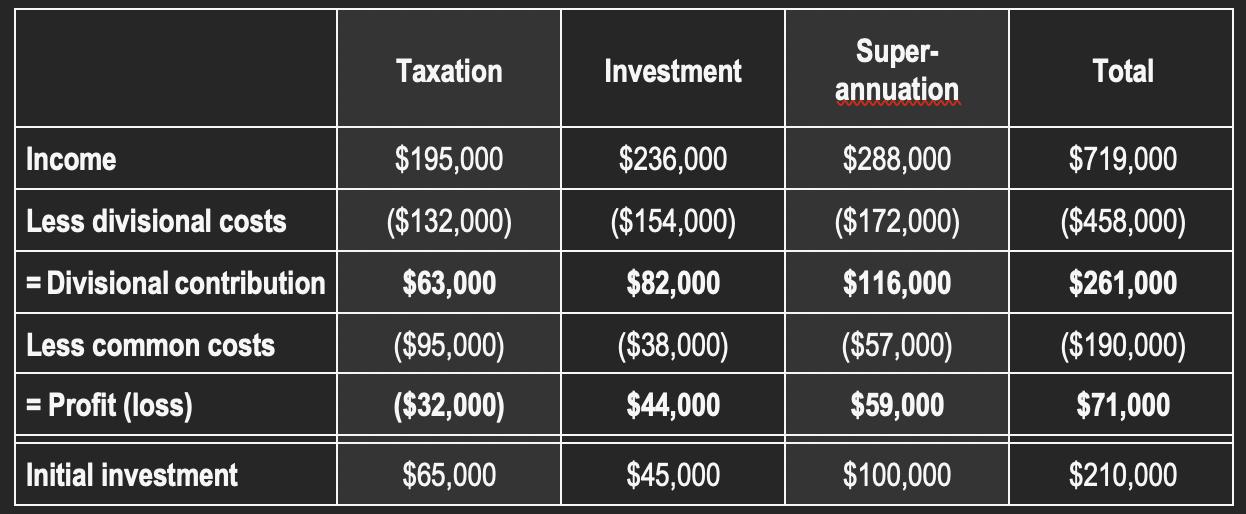

TSI Services is a consulting business that operates from a rented office in an inner suburb. Offering taxation, superannuation and insurance advice, the office has a main reception area (servicing all departments) with remaining floor space allocated to the three departments. Clients are able to book online for taxation services, but all other bookings are made through reception.

- Calculate the ROI for each division and for the business as a whole.

- Calculate the residual income (RI) for each division and for the business as a whole (assuming a required rate of return of 30% per annum).

- Would you recommend that any divisions be closed down? Explain why or why not.

You have just learned that common costs have been allocated to divisions based on floor space occupied. Does this information affect your answer to part (c)?

If any division is closed, common costs remain the same and assume no change to investment. Consider the impact of closing the taxation division on: (i)Total income (ii)Total divisional costs (iii) Total common costs (iv)Total profit . Comment on whether the division should remain open based on both financial and non-financial reasons.

Income Less divisional costs = Divisional contribution Less common costs = Profit (loss) Initial investment Taxation $195,000 ($132,000) $63,000 ($95,000) ($32,000) $65,000 Investment $236,000 ($154,000) $82,000 ($38,000) $44,000 $45,000 Super- annuation $288,000 ($172,000) $116,000 ($57,000) $59,000 $100,000 Total $719,000 ($458,000) $261,000 ($190,000) $71,000 $210,000

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Particulars Taxation Investment Superannuation Total Income A 195000 236000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started