Answered step by step

Verified Expert Solution

Question

1 Approved Answer

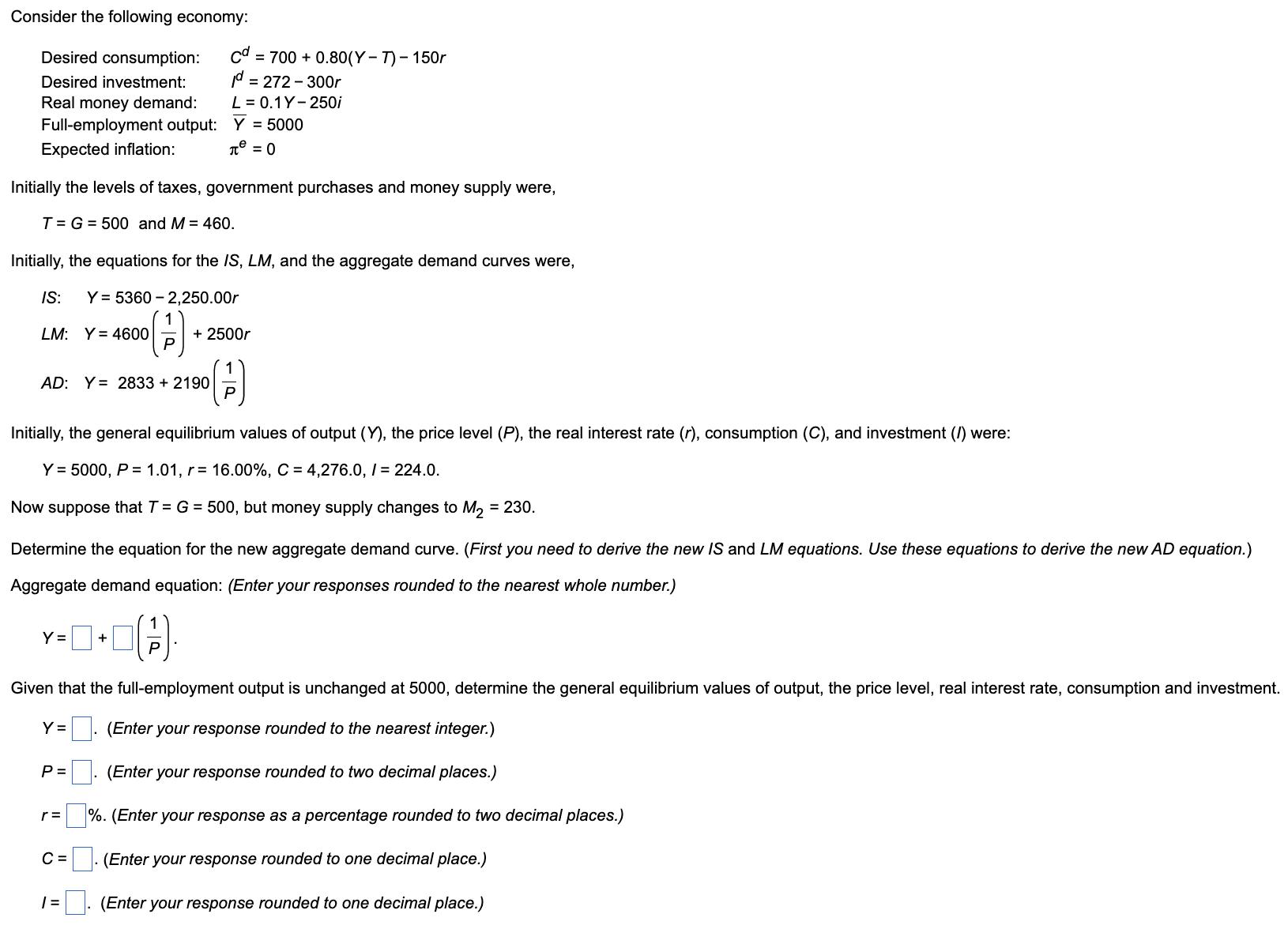

Consider the following economy: Desired consumption: Desired investment: Real money demand: Full-employment output: Expected inflation: Initially the levels of taxes, government purchases and money

Consider the following economy: Desired consumption: Desired investment: Real money demand: Full-employment output: Expected inflation: Initially the levels of taxes, government purchases and money supply were, T= G = 500 and M = 460. Initially, the equations for the IS, LM, and the aggregate demand curves were, IS: Y = 5360 -2,250.00r 1 LM: AD: Y= 2833 + 2190 Y = + Y = Initially, the general equilibrium values of output (Y), the price level (P), the real interest rate (r), consumption (C), and investment (/) were: Y = 5000, P = 1.01, r= 16.00%, C = 4,276.0, 1 = 224.0. Now suppose that T = G = 500, but money supply changes to M = 230. Determine the equation for the new aggregate demand curve. (First you need to derive the new IS and LM equations. Use these equations to derive the new AD equation.) Aggregate demand equation: (Enter your responses rounded to the nearest whole number.) A Given that the full-employment output is unchanged at 5000, determine the general equilibrium values of output, the price level, real interest rate, consumption and investment. (Enter your response rounded to the nearest integer.) (Enter your response rounded to two decimal places.) %. (Enter your response as a percentage rounded to two decimal places.) (Enter your response rounded to one decimal place.) (Enter your response rounded to one decimal place.) P = Y = 4600 r= C= cd= 700+ 0.80(Y-T)- 150r d=272-300r L = 0.1 Y 250i Y = 5000 T = 0 1 = + 2500r (A)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started