Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following economy with three dates (t=0, 1, 2). A firm needs to raise $100 to finance a project at t=0. At t=2,

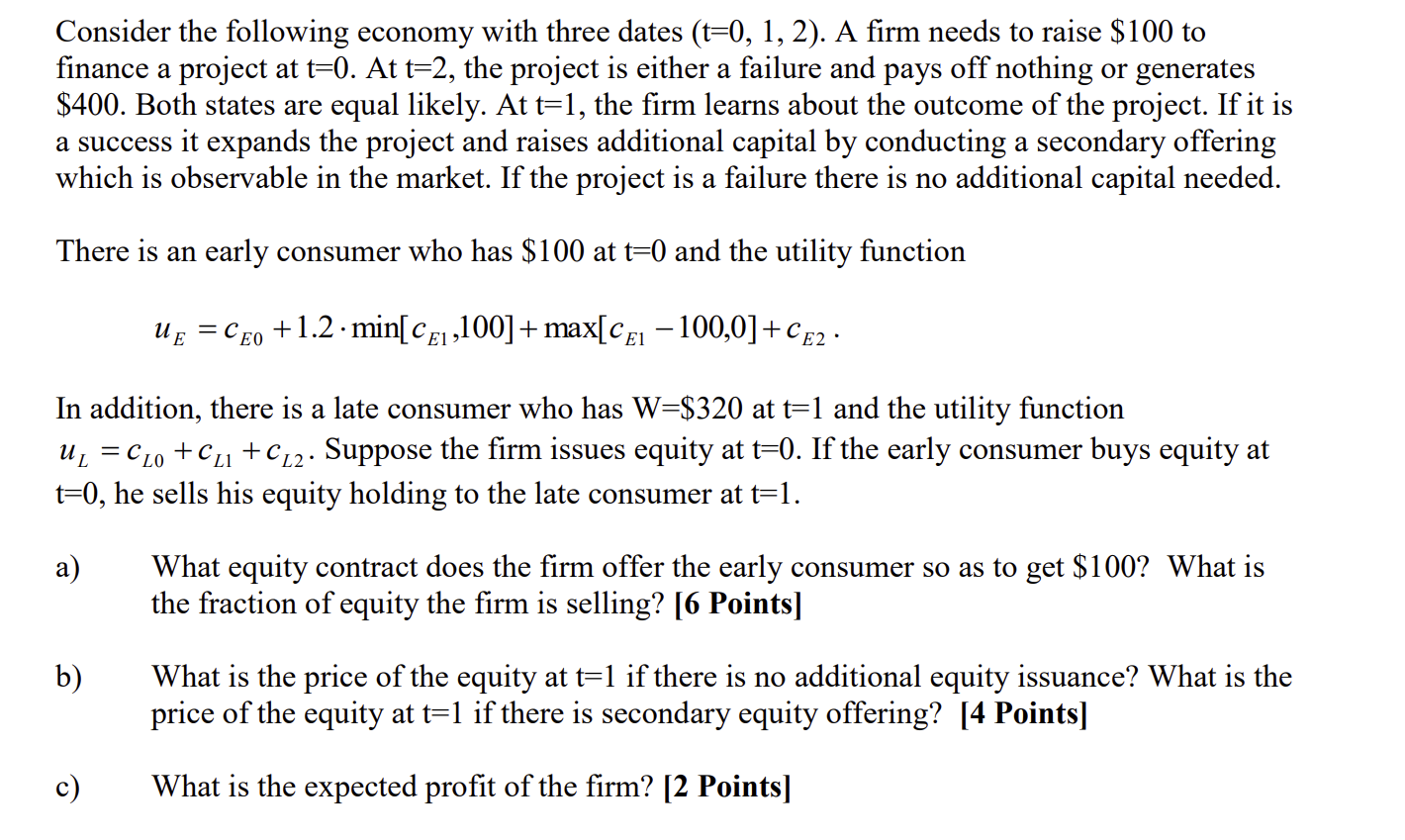

Consider the following economy with three dates (t=0, 1, 2). A firm needs to raise $100 to finance a project at t=0. At t=2, the project is either a failure and pays off nothing or generates $400. Both states are equal likely. At t=1, the firm learns about the outcome of the project. If it is a success it expands the project and raises additional capital by conducting a secondary offering which is observable in the market. If the project is a failure there is no additional capital needed. There is an early consumer who has $100 at t=0 and the utility function UE = CEO +1.2.min[CE,100] + max[CE1 -100,0]+CE2. In addition, there is a late consumer who has W=$320 at t=1 and the utility function U = C0 + C +C2. Suppose the firm issues equity at t=0. If the early consumer buys equity at t=0, he sells his equity holding to the late consumer at t=1. a) b) What equity contract does the firm offer the early consumer so as to get $100? What is the fraction of equity the firm is selling? [6 Points] What is the price of the equity at t=1 if there is no additional equity issuance? What is the price of the equity at t=1 if there is secondary equity offering? [4 Points] What is the expected profit of the firm? [2 Points]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To raise 100 the firm can offer the early consumer equity with a payoff structure that ensures the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started