Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following end of year financial information that a financial analyst has forecasted for White plc. for the next five years from 2021 to

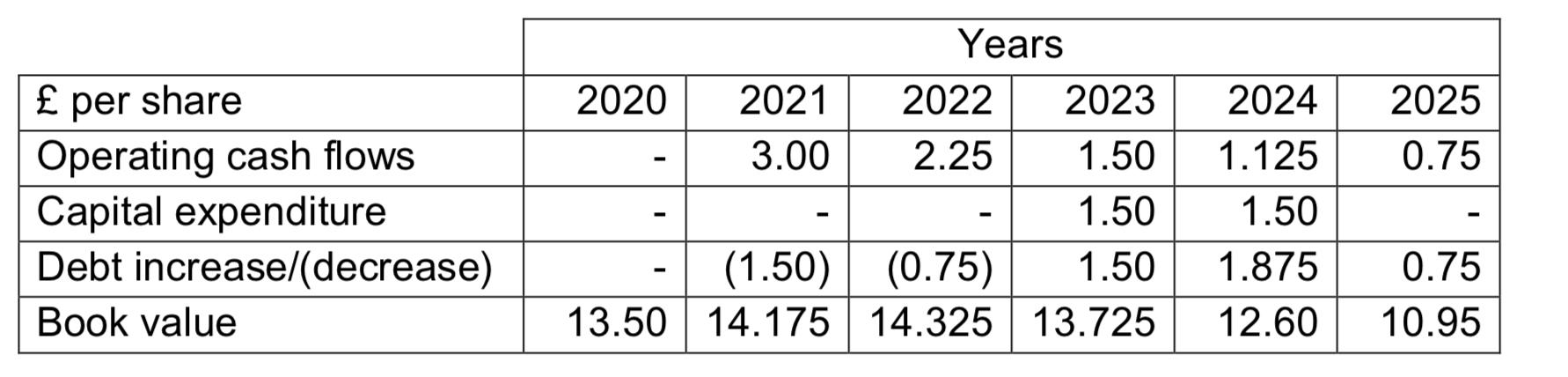

Consider the following end of year financial information that a financial analyst has forecasted for White plc. for the next five years from 2021 to 2025.

i. Assuming a cost of capital of 10% per year, estimate the share price? At the end of 2020 using free cash flow to equity (FCFE) method?

ii. Are White plc's shares over- or under-valued if they are currently trading at £12.00 per share? Would you recommend a buy, sell, or hold, and why?

per share Operating cash flows Capital expenditure Debt increase/(decrease) Book value Years 2022 2023 2024 2.25 1.50 1.125 1.50 1.50 (1.50) (0.75) 1.50 1.875 0.75 13.50 14.175 14.325 13.725 12.60 10.95 2020 2021 3.00 - 2025 0.75

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To estimate the share price using the Free Cash Flow to Equity FCFE method we need to calculate the present value of the estimated future FCFE for eac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started