Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a hedge fund maximizing the expected return subject to not exceeding standard devia- tion of 11%. You do not have access to

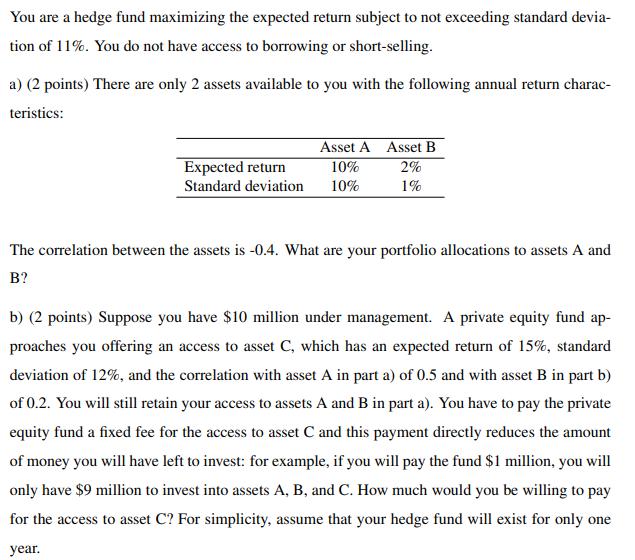

You are a hedge fund maximizing the expected return subject to not exceeding standard devia- tion of 11%. You do not have access to borrowing or short-selling. a) (2 points) There are only 2 assets available to you with the following annual return charac- teristics: Asset A Asset B Expected return 10% 2% Standard deviation 10% 1% The correlation between the assets is -0.4. What are your portfolio allocations to assets A and B? b) (2 points) Suppose you have $10 million under management. A private equity fund ap- proaches you offering an access to asset C, which has an expected return of 15%, standard deviation of 12%, and the correlation with asset A in part a) of 0.5 and with asset B in part b) of 0.2. You will still retain your access to assets A and B in part a). You have to pay the private equity fund a fixed fee for the access to asset C and this payment directly reduces the amount of money you will have left to invest: for example, if you will pay the fund $1 million, you will only have $9 million to invest into assets A, B, and C. How much would you be willing to pay for the access to asset C? For simplicity, assume that your hedge fund will exist for only one year.

Step by Step Solution

★★★★★

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

a Given Expected returns A10 B2 Standard deviations A10 B1 Correlation between A and B ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started