Question: Consider the following: EVA in absolute terms with EVA Chart EVA creation in terms of EVA Spread and EVA Spread chart EVA Ratios and Ratio

- Consider the following:

- EVA in absolute terms with EVA Chart

- EVA creation in terms of EVA Spread and EVA Spread chart

- EVA Ratios and Ratio chart

- Correlation of EVA per share and EPS with market price

- Compute EV and MVA and analyse value creation/destruction on these parameters. Risk free return=6.50%,Beta=0.779

| PROFIT & LOSS ACCOUNT OF HERO MOTOCORP (in Rs. Cr.) | MAR 19 | MAR 18 | MAR 17 | MAR 16 | MAR 15 | |

| 12 mths | 12 mths | 12 mths | 12 mths | 12 mths | ||

| INCOME | ||||||

| REVENUE FROM OPERATIONS [GROSS] | 33,124.53 | 32,230.84 | 30,540.67 | 30,618.09 | 29,235.64 | |

| Less: Excise/Sevice Tax/Other Levies | 0.00 | 641.33 | 2,371.13 | 2,258.18 | 1,717.64 | |

| REVENUE FROM OPERATIONS [NET] | 33,124.53 | 31,589.51 | 28,169.54 | 28,359.91 | 27,518.00 | |

| TOTAL OPERATING REVENUES | 33,650.54 | 32,230.49 | 28,500.46 | 28,599.30 | 27,585.30 | |

| Other Income | 691.25 | 525.82 | 522.43 | 391.12 | 492.74 | |

| TOTAL REVENUE | 34,341.79 | 32,756.31 | 29,022.89 | 28,990.42 | 28,078.04 | |

| EXPENSES | ||||||

| Cost Of Materials Consumed | 23,346.10 | 21,857.79 | 18,974.11 | 19,321.72 | 19,783.88 | |

| Operating And Direct Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Changes In Inventories Of FG,WIP And Stock-In Trade | -28.38 | -23.15 | 63.17 | -6.82 | -29.97 | |

| Employee Benefit Expenses | 1,730.24 | 1,540.13 | 1,396.01 | 1,319.56 | 1,172.87 | |

| Finance Costs | 8.60 | 6.25 | 6.05 | 2.15 | 11.09 | |

| Depreciation And Amortisation Expenses | 602.01 | 555.60 | 492.73 | 441.40 | 539.97 | |

| Other Expenses | 3,672.49 | 3,575.53 | 3,432.36 | 3,517.83 | 3,116.34 | |

| TOTAL EXPENSES | 29,331.06 | 27,512.15 | 24,364.43 | 24,595.84 | 24,594.18 | |

| PROFIT/LOSS BEFORE EXCEPTIONAL, EXTRAORDINARY ITEMS AND TAX | 5,010.73 | 5,244.16 | 4,658.46 | 4,394.58 | 3,483.86 | |

| Exceptional Items | 0.00 | 0.00 | 0.00 | 0.00 | -155.04 | |

| PROFIT/LOSS BEFORE TAX | 5,010.73 | 5,244.16 | 4,658.46 | 4,394.58 | 3,328.82 | |

| TAX EXPENSES-CONTINUED OPERATIONS | ||||||

| Current Tax | 1,601.02 | 1,446.95 | 1,082.08 | 960.88 | 898.91 | |

| Less: MAT Credit Entitlement | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Deferred Tax | 24.84 | 99.85 | 199.26 | 301.33 | 44.27 | |

| Tax For Earlier Years | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| TOTAL TAX EXPENSES | 1,625.86 | 1,546.80 | 1,281.34 | 1,262.21 | 943.18 | |

| PROFIT/LOSS AFTER TAX AND BEFORE EXTRAORDINARY ITEMS | 3,384.87 | 3,697.36 | 3,377.12 | 3,132.37 | 2,385.64 | |

| PROFIT/LOSS FROM CONTINUING OPERATIONS | 3,384.87 | 3,697.36 | 3,377.12 | 3,132.37 | 2,385.64 | |

| PROFIT/LOSS FOR THE PERIOD | 3,384.87 | 3,697.36 | 3,377.12 | 3,132.37 | 2,385.64 | |

| OTHER ADDITIONAL INFORMATION | ||||||

| EARNINGS PER SHARE | ||||||

| Basic EPS (Rs.) | 169.48 | 185.14 | 169.12 | 156.86 | 119.00 | |

| Diluted EPS (Rs.) | 169.47 | 185.13 | 169.12 | 156.86 | 119.00 | |

| VALUE OF IMPORTED AND INDIGENIOUS RAW MATERIALS STORES, SPARES AND LOOSE TOOLS | ||||||

| Imported Raw Materials | 0.00 | 0.00 | 0.00 | 972.56 | 14.33 | |

| Indigenous Raw Materials | 0.00 | 0.00 | 0.00 | 18,434.78 | 16.22 | |

| STORES, SPARES AND LOOSE TOOLS | ||||||

| Imported Stores And Spares | 0.00 | 0.00 | 0.00 | 7.78 | 7.23 | |

| Indigenous Stores And Spares | 0.00 | 0.00 | 0.00 | 34.38 | 35.32 | |

| DIVIDEND AND DIVIDEND PERCENTAGE | ||||||

| Equity Share Dividend | 1,897.35 | 1,697.50 | 1,737.34 | 1,437.75 | 1,198.12 | |

| Tax On Dividend | 390.01 | 345.57 | 353.69 | 292.69 | 223.76 | |

| Equity Dividend Rate (%) | 4,350.00 | 4,750.00 | 4,250.00 | 3,600.00 | 3,000.00 |

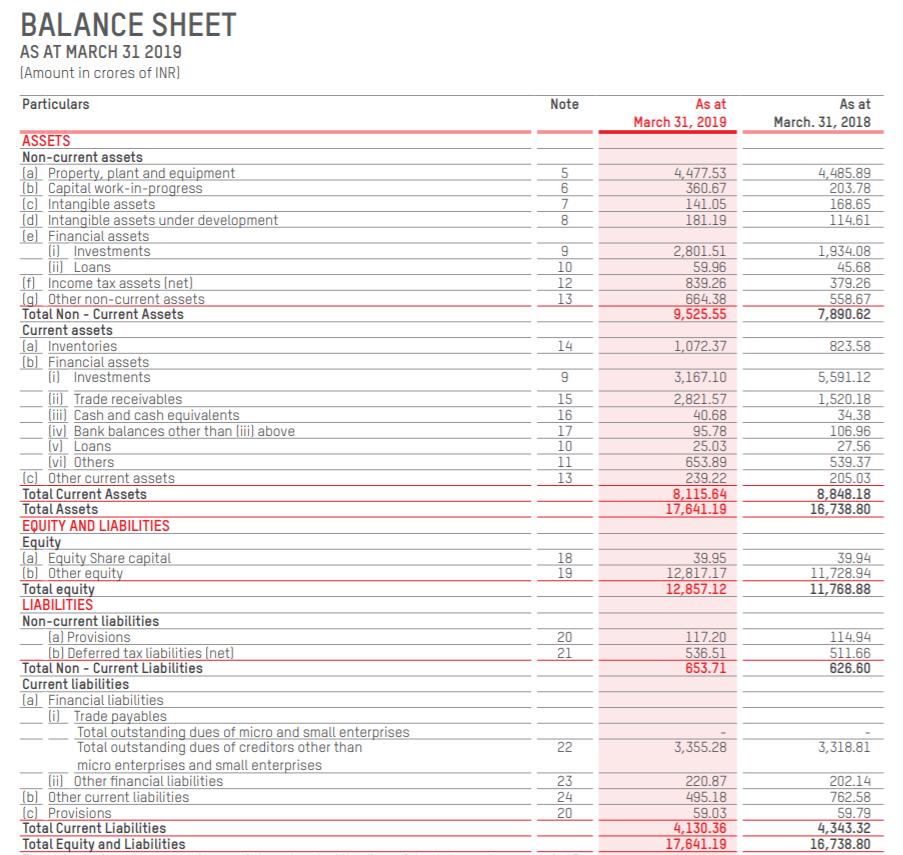

BALANCE SHEET AS AT MARCH 31 2019 [Amount in crores of INR) Particulars ASSETS Non-current assets (al Property, plant and equipment [b] Capital work-in-progress (c) Intangible assets [d] Intangible assets under development lel Financial assets [i] Investments (ii) Loans [f] Income tax assets [net) (g) Other non-current assets Total Non-Current Assets Current assets (a) Inventories [b] Financial assets [i] Investments [ii] Trade receivables (iii) Cash and cash equivalents [iv] Bank balances other than [iii] above (v) Loans [vil Others (c) Other current assets Total Current Assets Total Assets EQUITY AND LIABILITIES Equity (a) Equity Share capital [b] Other equity Total equity LIABILITIES Non-current liabilities (a) Provisions [b] Deferred tax liabilities (net) Total Non-Current Liabilities Current liabilities [a] Financial liabilities (i) Trade payables Total outstanding dues of micro and small enterprises Total outstanding dues of creditors other than micro enterprises and small enterprises [ii] Other financial liabilities (b) Other current liabilities (c) Provisions Total Current Liabilities Total Equity and Liabilities Note S678923 5 10 12 13 14 9 5700155 16 10 11 13 HE colml 18 19 20 21 22 23 24 20 As at March 31, 2019 4,477.53 360.67 141.05 181.19 2,801.51 59.96 839.26 664.38 9,525.55 1,072.37 3,167.10 2,821.57 40.68 95.78 25.03 653.89 239.22 8,115.64 17,641.19 39.95 12,817.17 12,857.12 117.20 536.51 653.71 3,355.28 220.87 495.18 59.03 4,130.36 17,641.19 As at March. 31, 2018 4,485.89 203.78 168.65 114.61 1,934.08 45.68 379.26 558.67 7,890.62 823.58 5,591.12 1,520.18 34.38 106.96 27.56 539.37 205.03 8,848.18 16,738.80 39.94 11,728.94 11,768.88 114.94 511.66 626.60 3,318.81 202.14 762.58 59.79 4,343.32 16,738.80

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

EVA stands for Economic Value Added which is a measure of financial performance calculated by subtracting the cost of capital from the net operating p... View full answer

Get step-by-step solutions from verified subject matter experts