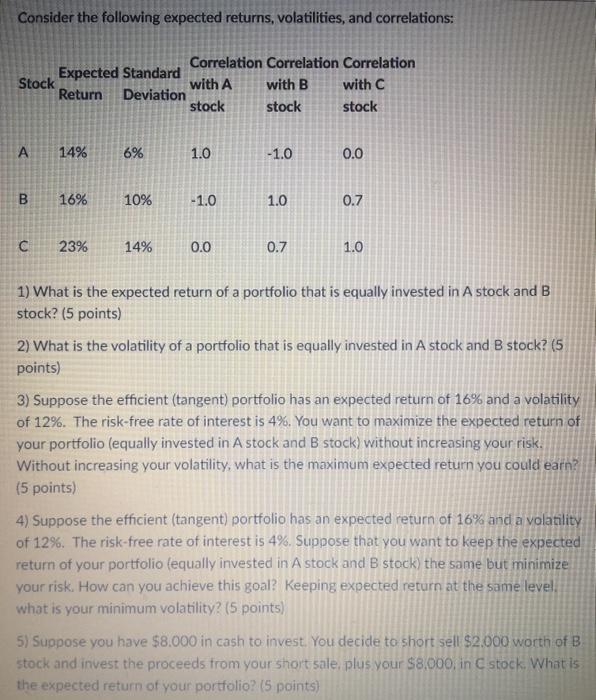

Consider the following expected returns, volatilities, and correlations: Correlation Correlation Correlation Expected Standard Stock with A with B with C Return Deviation stock stock stock A 14% 6% 1.0 -1.0 0.0 B 16% 10% - 1.0 1.0 0.7 C 23% 14% 0.0 0.7 1.0 1) What is the expected return of a portfolio that is equally invested in A stock and B stock? (5 points) 2) What is the volatility of a portfolio that is equally invested in A stock and B stock? (5 points) 3) Suppose the efficient (tangent) portfolio has an expected return of 16% and a volatility of 12%. The risk-free rate of interest is 4%. You want to maximize the expected return of your portfolio (equally invested in A stock and B stock) without increasing your risk. Without increasing your volatility, what is the maximum expected return you could earn? (5 points) 4) Suppose the efficient (tangent) portfolio has an expected return of 16% and a volatility of 12%. The risk-free rate of interest is 4%. Suppose that you want to keep the expected return of your portfolio (equally invested in A stock and B stock) the same but minimize your risk. How can you achieve this goal? Keeping expected return at the same level what is your minimum volatility? (5 points) 5) Suppose you have $8.000 in cash to invest. You decide to short sell $2.000 worth of B stock and invest the proceeds from your short sale, plus your $8.000, in C stock. What is the expected return of your portfolio? (5 points) Consider the following expected returns, volatilities, and correlations: Correlation Correlation Correlation Expected Standard Stock with A with B with C Return Deviation stock stock stock A 14% 6% 1.0 -1.0 0.0 B 16% 10% - 1.0 1.0 0.7 C 23% 14% 0.0 0.7 1.0 1) What is the expected return of a portfolio that is equally invested in A stock and B stock? (5 points) 2) What is the volatility of a portfolio that is equally invested in A stock and B stock? (5 points) 3) Suppose the efficient (tangent) portfolio has an expected return of 16% and a volatility of 12%. The risk-free rate of interest is 4%. You want to maximize the expected return of your portfolio (equally invested in A stock and B stock) without increasing your risk. Without increasing your volatility, what is the maximum expected return you could earn? (5 points) 4) Suppose the efficient (tangent) portfolio has an expected return of 16% and a volatility of 12%. The risk-free rate of interest is 4%. Suppose that you want to keep the expected return of your portfolio (equally invested in A stock and B stock) the same but minimize your risk. How can you achieve this goal? Keeping expected return at the same level what is your minimum volatility? (5 points) 5) Suppose you have $8.000 in cash to invest. You decide to short sell $2.000 worth of B stock and invest the proceeds from your short sale, plus your $8.000, in C stock. What is the expected return of your portfolio? (5 points)