Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following financial information about a new machine a company is planning to buy: The machine costs $250,000 and will be used for 4

Consider the following financial information about a new machine a company is planning to buy:

- The machine costs $250,000 and will be used for 4 years.

- The machine will be depreciated using MACRS 7-year class property.

- At the end of the project life, the machine will be sold at $102,000.

- The firm will invest $69,000 in working capital (fully recoverable at the end of the project life).

- The expected revenues are $150,000 in year 1, and they increase $20,000 every year thereafter (i.e., every year the revenues are $20,000 more than in the previous year).

- Operating and maintenance costs are $50,000 annually.

- The firm will ask for a loan to finance 30% of the machine cost at an interest rate of 8%. The firm is required to repay the loan with 4 equal annual payments.

- The firms tax rate is 40%.

- The firms MARR is 10%.

With the above information, compute the present worth for this project. Is this a good investment? Why? Explain your answer clearly.

Show all your calculations and explain every step. Always use factor notation.

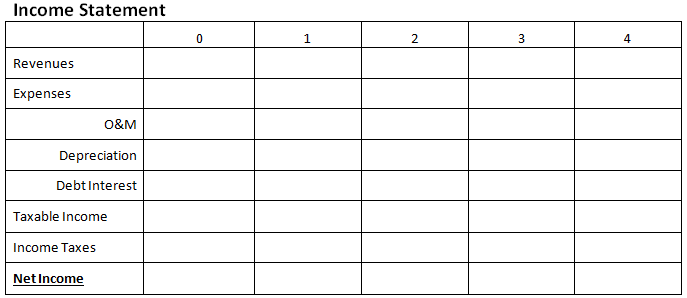

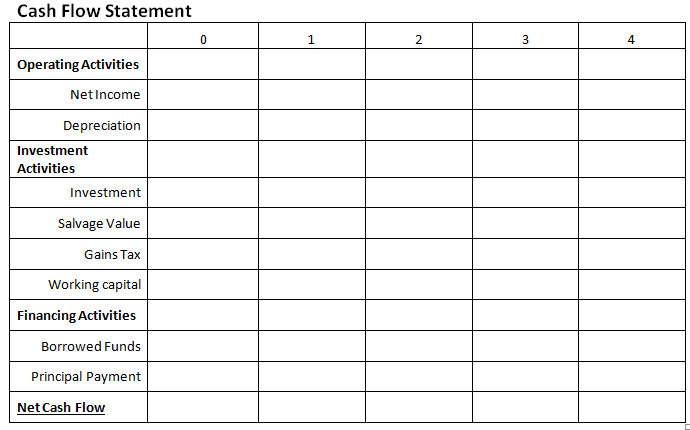

Complete the income and cash flow statements

.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started