Answered step by step

Verified Expert Solution

Question

1 Approved Answer

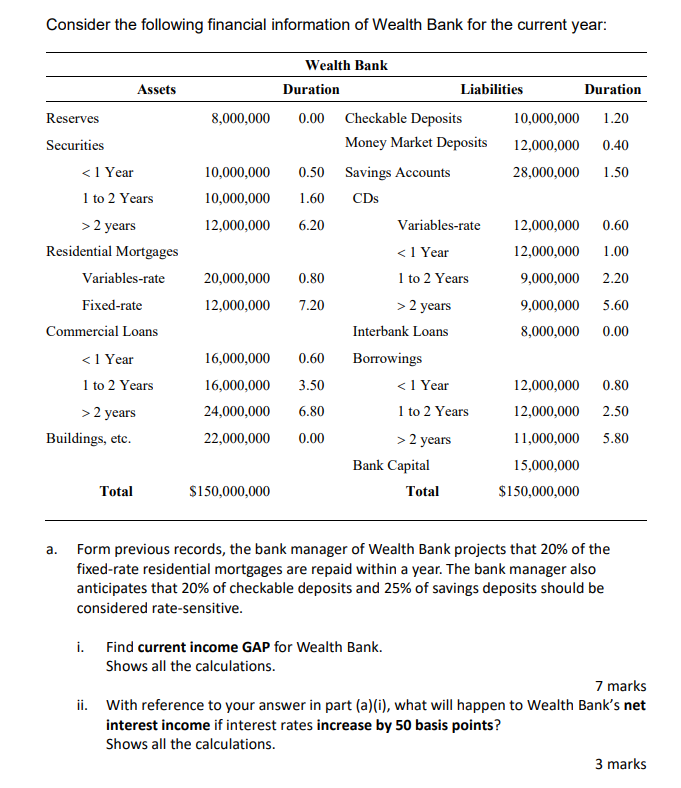

Consider the following financial information of Wealth Bank for the current year: a. Form previous records, the bank manager of Wealth Bank projects that 20%

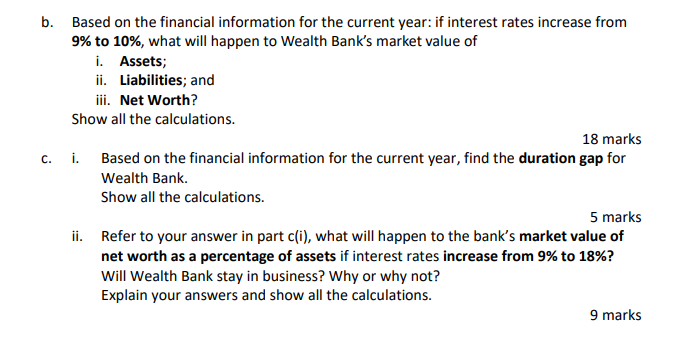

Consider the following financial information of Wealth Bank for the current year: a. Form previous records, the bank manager of Wealth Bank projects that 20% of the fixed-rate residential mortgages are repaid within a year. The bank manager also anticipates that 20% of checkable deposits and 25% of savings deposits should be considered rate-sensitive. i. Find current income GAP for Wealth Bank. Shows all the calculations. 7 marks ii. With reference to your answer in part (a)(i), what will happen to Wealth Bank's net interest income if interest rates increase by 50 basis points? Shows all the calculations. 3 marks b. Based on the financial information for the current year: if interest rates increase from 9% to 10%, what will happen to Wealth Bank's market value of i. Assets; ii. Liabilities; and iii. Net Worth? Show all the calculations. 18marks c. i. Based on the financial information for the current year, find the duration gap for Wealth Bank. Show all the calculations. 5marks ii. Refer to your answer in part c(i), what will happen to the bank's market value of net worth as a percentage of assets if interest rates increase from 9% to 18% ? Will Wealth Bank stay in business? Why or why not? Explain your answers and show all the calculations. Consider the following financial information of Wealth Bank for the current year: a. Form previous records, the bank manager of Wealth Bank projects that 20% of the fixed-rate residential mortgages are repaid within a year. The bank manager also anticipates that 20% of checkable deposits and 25% of savings deposits should be considered rate-sensitive. i. Find current income GAP for Wealth Bank. Shows all the calculations. 7 marks ii. With reference to your answer in part (a)(i), what will happen to Wealth Bank's net interest income if interest rates increase by 50 basis points? Shows all the calculations. 3 marks b. Based on the financial information for the current year: if interest rates increase from 9% to 10%, what will happen to Wealth Bank's market value of i. Assets; ii. Liabilities; and iii. Net Worth? Show all the calculations. 18marks c. i. Based on the financial information for the current year, find the duration gap for Wealth Bank. Show all the calculations. 5marks ii. Refer to your answer in part c(i), what will happen to the bank's market value of net worth as a percentage of assets if interest rates increase from 9% to 18% ? Will Wealth Bank stay in business? Why or why not? Explain your answers and show all the calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started