Answered step by step

Verified Expert Solution

Question

1 Approved Answer

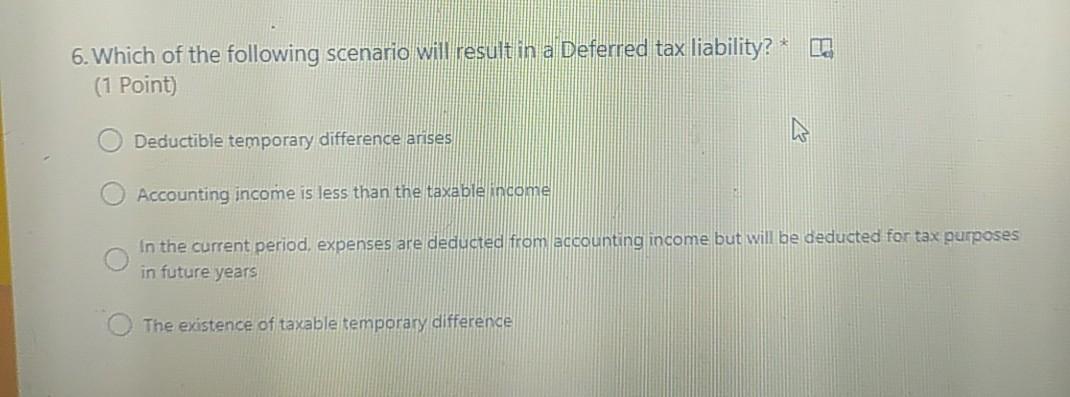

please answer all the questions immediately thankyou 6. Which of the following scenario will result in a Deferred tax liability? (1 Point) Deductible temporary difference

please answer all the questions immediately thankyou

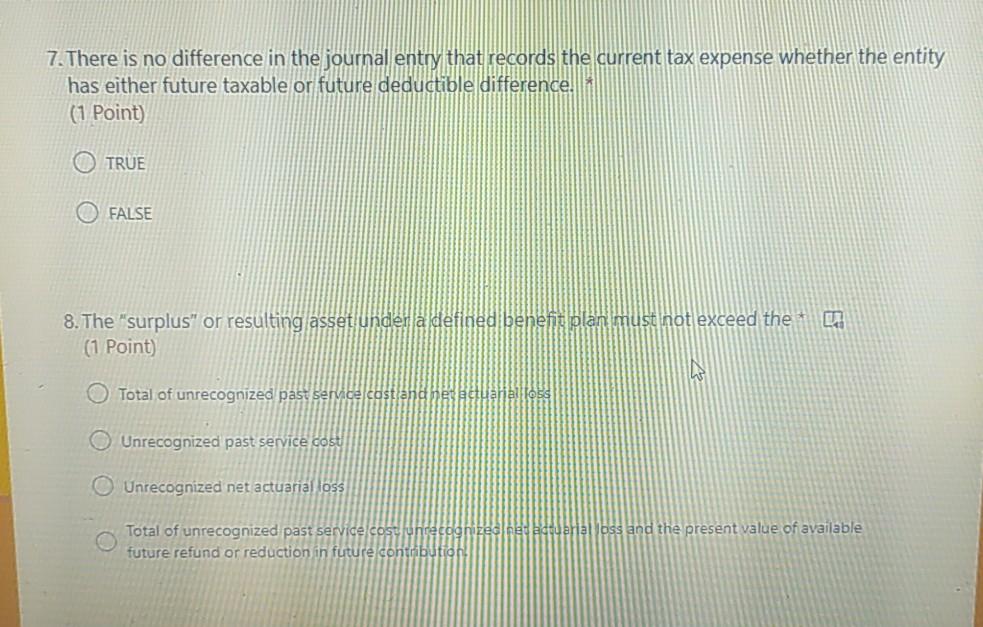

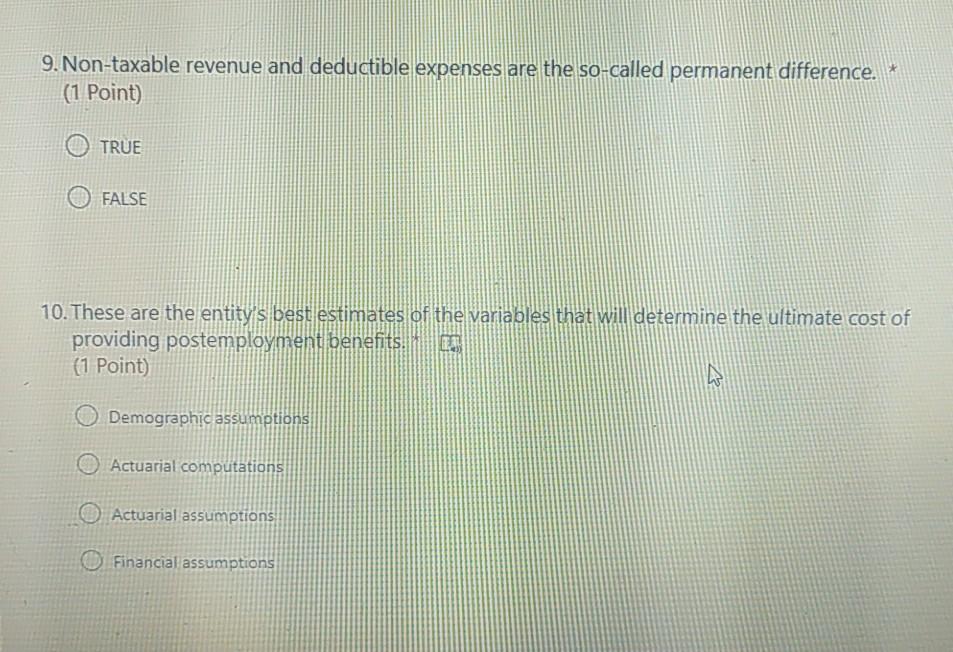

6. Which of the following scenario will result in a Deferred tax liability? (1 Point) Deductible temporary difference arises Accounting income is less than the taxable income In the current period, expenses are deducted from accounting income but will be deducted for tax purposes in future years The existence of taxable temporary difference 7.There is no difference in the journal entry that records the current tax expense whether the entity has either future taxable or future deductible difference. (1 Point) TRUE FALSE 8. The "surplus" or resulting asset under a defined benefit plan must not exceed the (1 Point) Total of unrecognized past service castian 0 Unrecognized past service cost O Unrecognized net actuarial loss Uloss and the present value of available Total of unrecognized past service future refund or reduction in future 9. Non-taxable revenue and deductible expenses are the so-called permanent difference. * (1 Point) TRUE FALSE 10. These are the entity's best estimates of the variables that will determine the ultimate cost of providing postemployment benefits. 09:33 (1 Point) Demographic assumptions Actuarial computations Actuarial assumptions Financial assumptionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started