Answered step by step

Verified Expert Solution

Question

1 Approved Answer

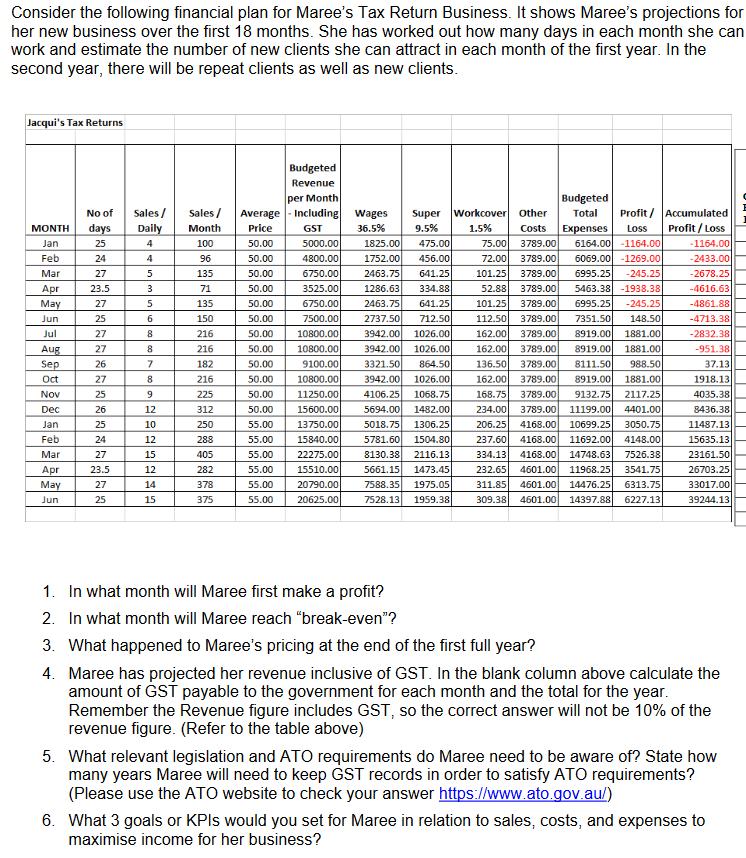

Consider the following financial plan for Maree's Tax Return Business. It shows Maree's projections for her new business over the first 18 months. She

Consider the following financial plan for Maree's Tax Return Business. It shows Maree's projections for her new business over the first 18 months. She has worked out how many days in each month she can work and estimate the number of new clients she can attract in each month of the first year. In the second year, there will be repeat clients as well as new clients. Jacqui's Tax Returns MONTH days Jan Feb 25 Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun No of Sales/ CNCNNCGCNNNNNNN 24 23.5 23.5 Sales / Average Daily Month Price 50.00 4 100 96 50.00 4 5 3 5 6 8 00002: 9 12 10 12 15 12 14 15 135 71 135 150 216 216 182 Budgeted Revenue per Month - Including GST 5000.00 4800.00 50.00 6750.00 50.00 3525.00 50.00 50.00 50.00 50.00 50.00 50.00 50.00 6750.00 7500.00 10800.00 10800.00 9100.00 10800.00 11250.00 15600.00 13750.00 55.00 15840.00 55.00 22275.00 55.00 15510.00 55.00 20790.00 55.00 20625.00 50.00 55.00 216 225 312 250 288 405 282 378 375 Super Workcover Other 9.5% 1.5% Wages 36.5% 1825.00 475.00 1752.00 456.00 2463.75 641.25 1286.63 334.88 2463.75 641.25 2737.50 712.50 3942.00 1026.00 3942.00 1026.00 3321.50 864.50 3942.00 1026.00 4106.25 1068.75 5694.00 1482.00 5018.75 1306.25 5781.60 1504.80 8130.38 2116.13 5661.15 1473.45 7588.35 1975.05 7528.13 1959.38 Budgeted Total Profit/ Accumulated Costs Expenses Loss Profit/Loss 75.00 3789.00 6164.00 1164.00 72.00 3789.00 6069.00 -1269.00 101.25 3789.00 6995.25 -245.25 52.88 3789.00 5463.38 -1938.38 101.25 3789.00 6995.25 -245.25 112.50 3789.00 7351.50 148.50 162.00 3789.00 8919.00 1881.00 162.00 3789.00 8919.00 1881.00 136.50 3789.00 8111.50 988.50 162.00 3789.00 8919.00 1881.00 168.75 3789.00 9132.75 2117.25 234.00 3789.00 11199.00 4401.00 206.25 4168.00 10699.25 3050.75 237.60 4168.00 11692.00 4148.00 334.13 4168.00 14748.63 7526.38 232.65 4601.00 11968.25 3541.75 311.85 4601.00 14476.25 6313.75 309.38 4601.00 14397.88 6227.13 -1164.00 -2433.00 -2678.25 -4616.63 -4861.88 -4713.38 -2832.38 -951.38 37.13 1918.13 4035.38 8436.38 11487.13 15635.13 23161.50 26703.25 33017.00 39244.13 1. In what month will Maree first make a profit? 2. In what month will Maree reach "break-even"? 3. What happened to Maree's pricing at the end of the first full year? 4. Maree has projected her revenue inclusive of GST. In the blank column above calculate the amount of GST payable to the government for each month and the total for the year. Remember the Revenue figure includes GST, so the correct answer will not be 10% of the revenue figure. (Refer to the table above) 5. What relevant legislation and ATO requirements do Maree need to be aware of? State how many years Maree will need to keep GST records in order to satisfy ATO requirements? (Please use the ATO website to check your answer https://www.ato.gov.au/) 6. What 3 goals or KPIs would you set for Maree in relation to sales, costs, and expenses to maximise income for her business?

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Maree will first make a profit in the month of October This is the first month where the profitloss column shows a positive value 2 Maree will reach breakeven in the month of March Breakeven refers ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started