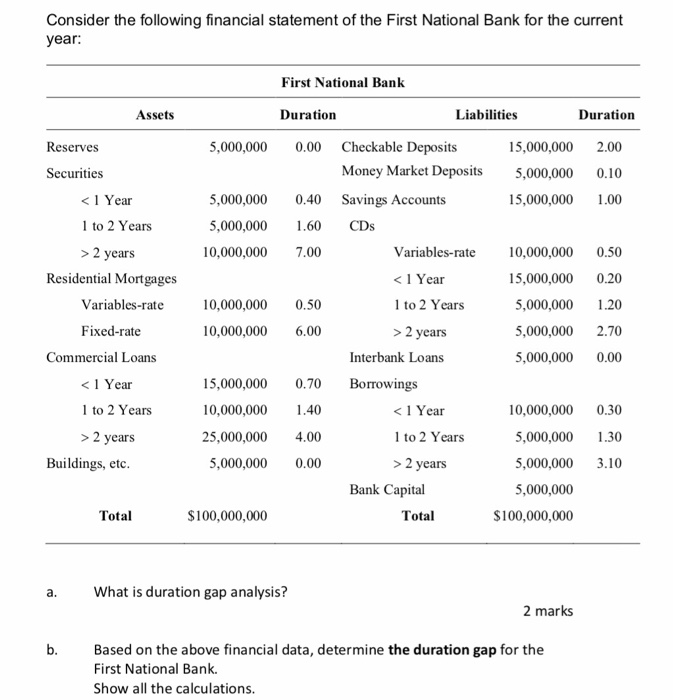

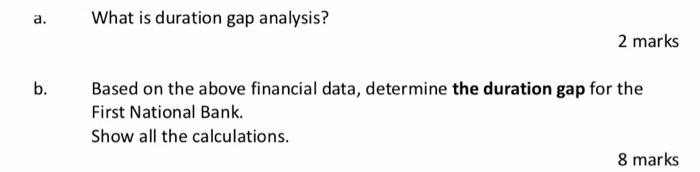

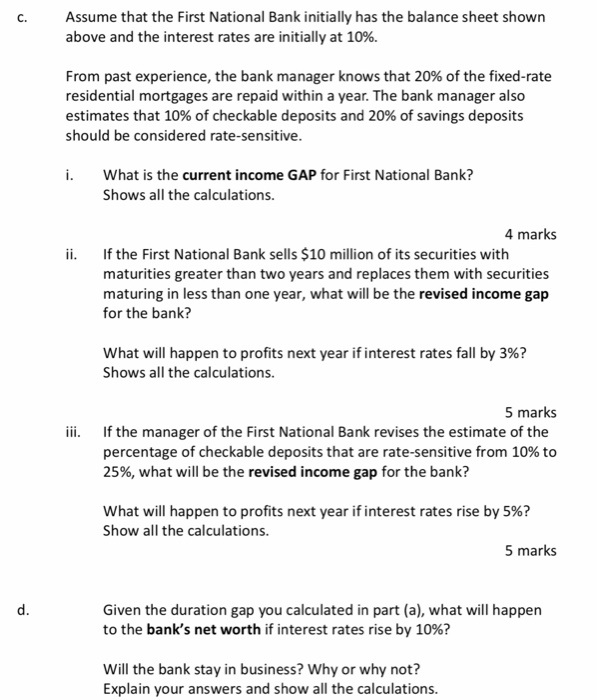

Consider the following financial statement of the First National Bank for the current year: First National Bank Assets Duration Liabilities Duration 5,000,000 0.00 Reserves Securities Checkable Deposits Money Market Deposits Savings Accounts CDs 15,000,000 5,000,000 15,000,000 2.00 0.10 1.00 2 years Residential Mortgages Variables-rate Fixed-rate Commercial Loans 10,000,000 10,000,000 0.50 6.00 10,000,000 15,000,000 5,000,000 5,000,000 5,000,000 0.50 0.20 1.20 2.70 0.00 1 to 2 Years > 2 years Interbank Loans Borrowings 2 years Buildings, etc. 4.00 0.00 1.30 3.10 > 2 years Bank Capital Total 5,000,000 5,000,000 5,000,000 $100,000,000 Total $100,000,000 What is duration gap analysis? 2 marks Based on the above financial data, determine the duration gap for the First National Bank. Show all the calculations. a. What is duration gap analysis? 2 marks Based on the above financial data, determine the duration gap for the First National Bank. Show all the calculations. 8 marks Assume that the First National Bank initially has the balance sheet shown above and the interest rates are initially at 10%. From past experience, the bank manager knows that 20% of the fixed-rate residential mortgages are repaid within a year. The bank manager also estimates that 10% of checkable deposits and 20% of savings deposits should be considered rate-sensitive. i. What is the current income GAP for First National Bank? Shows all the calculations. ii. 4 marks If the First National Bank sells $10 million of its securities with maturities greater than two years and replaces them with securities maturing in less than one year, what will be the revised income gap for the bank? What will happen to profits next year if interest rates fall by 3%? Shows all the calculations. 5 marks If the manager of the First National Bank revises the estimate of the percentage of checkable deposits that are rate-sensitive from 10% to 25%, what will be the revised income gap for the bank? What will happen to profits next year if interest rates rise by 5%? Show all the calculations. 5 marks Given the duration gap you calculated in part (a), what will happen to the bank's net worth if interest rates rise by 10%? Will the bank stay in business? Why or why not? Explain your answers and show all the calculations. Consider the following financial statement of the First National Bank for the current year: First National Bank Assets Duration Liabilities Duration 5,000,000 0.00 Reserves Securities Checkable Deposits Money Market Deposits Savings Accounts CDs 15,000,000 5,000,000 15,000,000 2.00 0.10 1.00 2 years Residential Mortgages Variables-rate Fixed-rate Commercial Loans 10,000,000 10,000,000 0.50 6.00 10,000,000 15,000,000 5,000,000 5,000,000 5,000,000 0.50 0.20 1.20 2.70 0.00 1 to 2 Years > 2 years Interbank Loans Borrowings 2 years Buildings, etc. 4.00 0.00 1.30 3.10 > 2 years Bank Capital Total 5,000,000 5,000,000 5,000,000 $100,000,000 Total $100,000,000 What is duration gap analysis? 2 marks Based on the above financial data, determine the duration gap for the First National Bank. Show all the calculations. a. What is duration gap analysis? 2 marks Based on the above financial data, determine the duration gap for the First National Bank. Show all the calculations. 8 marks Assume that the First National Bank initially has the balance sheet shown above and the interest rates are initially at 10%. From past experience, the bank manager knows that 20% of the fixed-rate residential mortgages are repaid within a year. The bank manager also estimates that 10% of checkable deposits and 20% of savings deposits should be considered rate-sensitive. i. What is the current income GAP for First National Bank? Shows all the calculations. ii. 4 marks If the First National Bank sells $10 million of its securities with maturities greater than two years and replaces them with securities maturing in less than one year, what will be the revised income gap for the bank? What will happen to profits next year if interest rates fall by 3%? Shows all the calculations. 5 marks If the manager of the First National Bank revises the estimate of the percentage of checkable deposits that are rate-sensitive from 10% to 25%, what will be the revised income gap for the bank? What will happen to profits next year if interest rates rise by 5%? Show all the calculations. 5 marks Given the duration gap you calculated in part (a), what will happen to the bank's net worth if interest rates rise by 10%? Will the bank stay in business? Why or why not? Explain your answers and show all the calculations