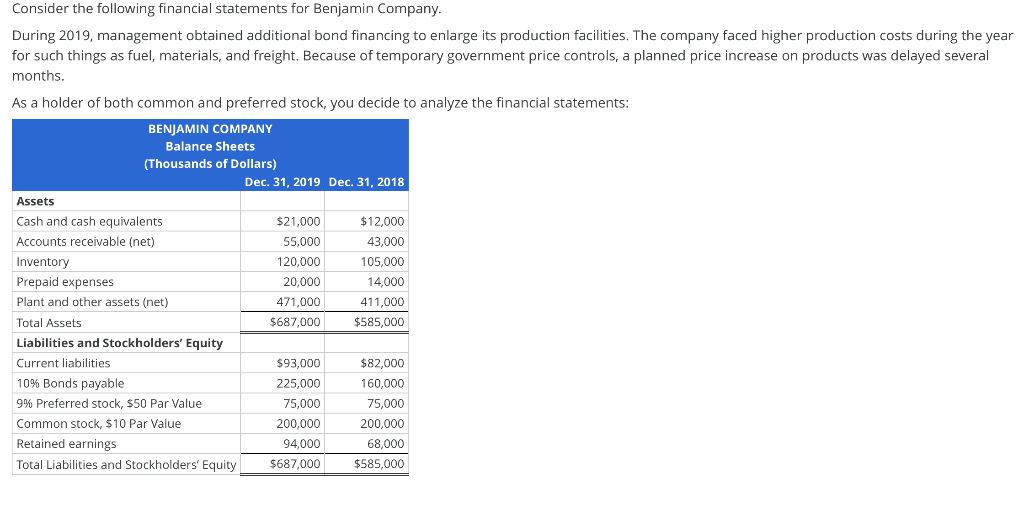

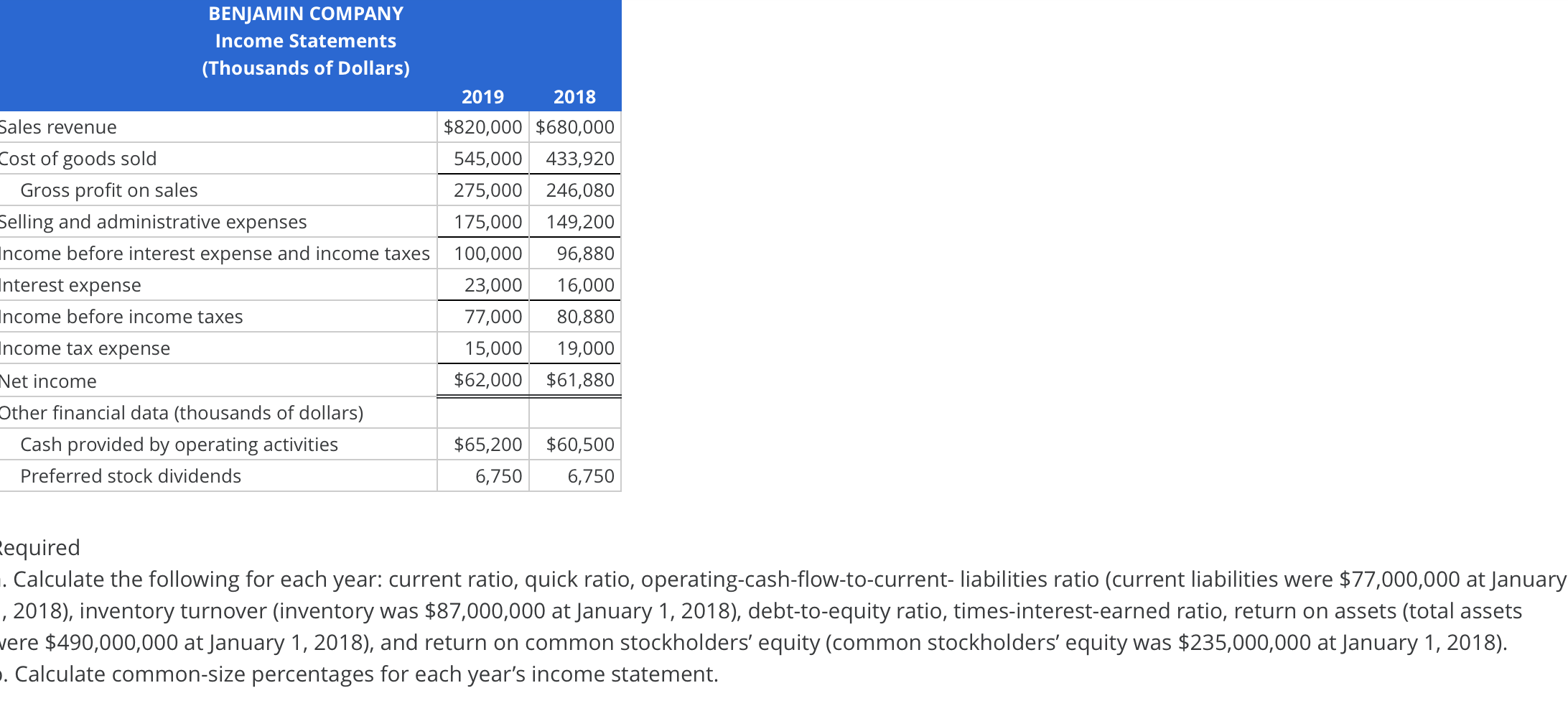

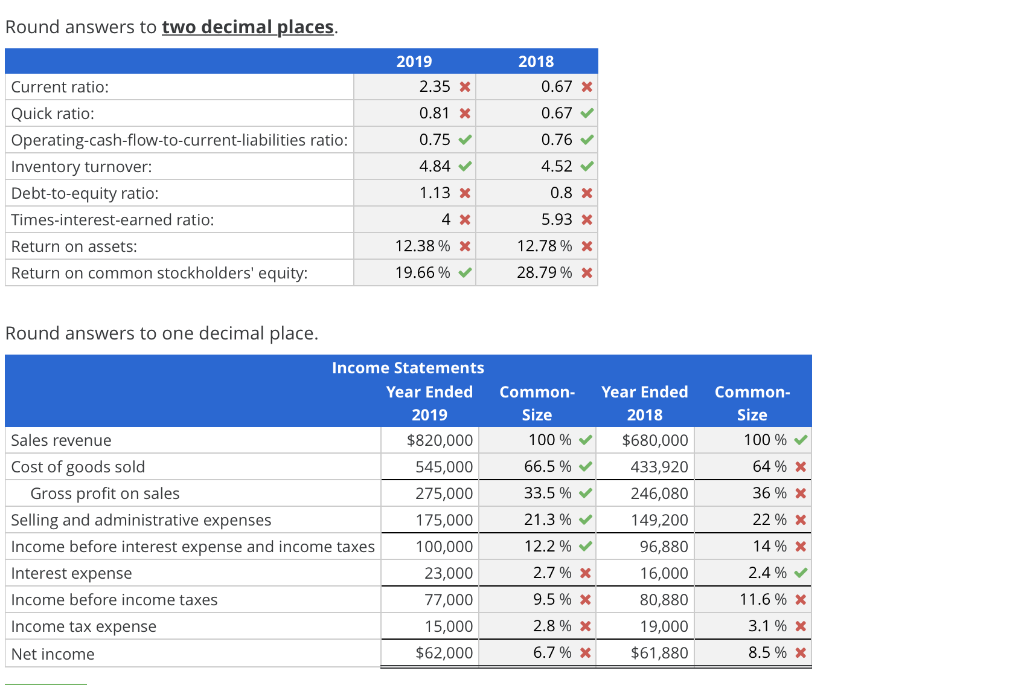

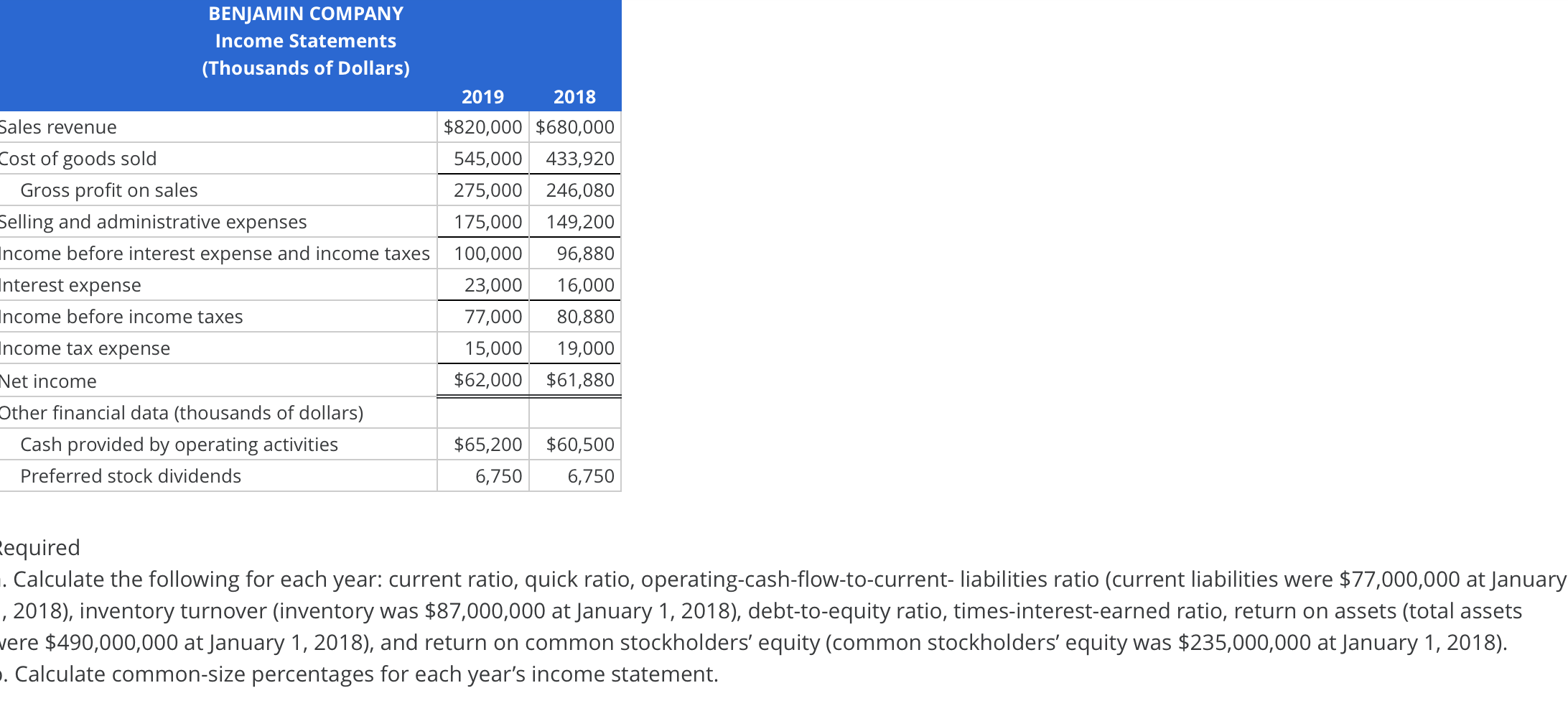

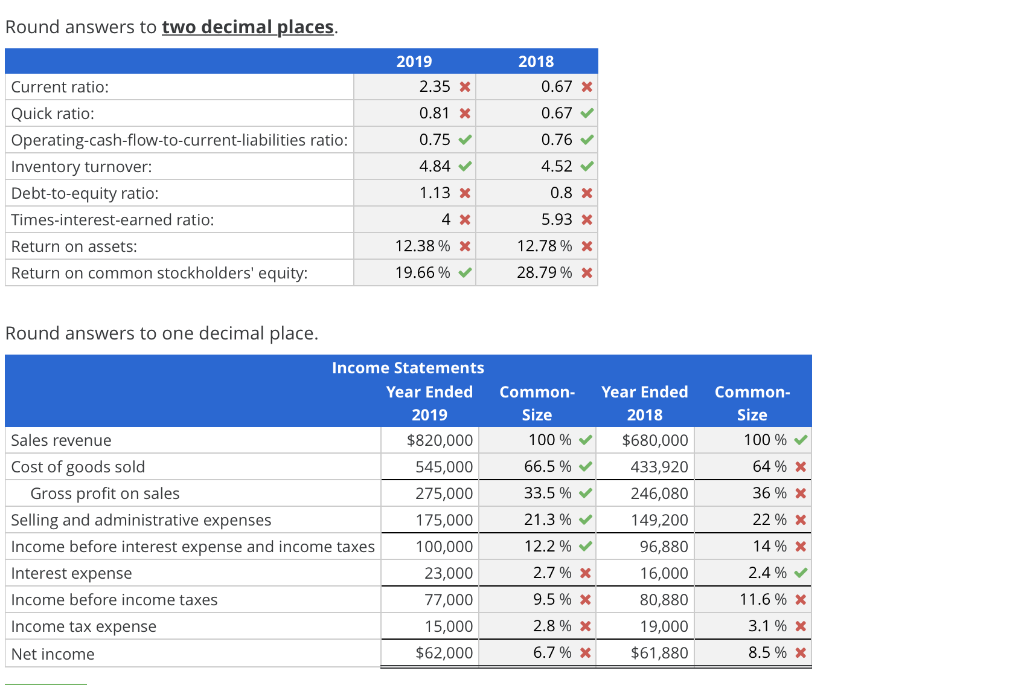

Consider the following financial statements for Benjamin Company During 2019, management obtained additional bond financing to enlarge its production facilities. The company faced higher production costs during the year for such things as fuel, materials, and freight. Because of temporary government price controls, a planned price increase on products was delayed several months. As a holder of both common and preferred stock, you decide to analyze the financial statements: BENJAMIN COMPANY Balance Sheets (Thousands of Dollars) Dec. 31, 2019 Dec. 31, 2018 Assets Cash and cash equivalents $21,000 $12,000 Accounts receivable (net) 55,000 43,000 120,000 Inventory 105,000 Prepaid expenses 20,000 14,000 Plant and other assets (net) 471,000 411,000 $687,000 $585,000 Total Assets Liabilities and Stockholders' Equity Current liabilities $82,000 $93,000 10% Bonds payable 225,000 160,000 9% Preferred stock, $50 Par Value 75,000 75,000 200,000 Common stock, $10 Par Value 200,000 Retained earnings 94,000 68,000 Total Liabilities and Stockholders' Equity $687,000 $585,000 BENJAMIN COMPANY Income Statements (Thousands of Dollars) 2018 2019 Sales revenue $820,000 $680,000 Cost of goods sold 545,000 433,920 Gross profit on sales 275,000 246,080 Selling and administrative expenses 175,000 149,200 Income before interest expense and income taxes 96,880 100,000 Interest expense. 23,000 16,000 Income before income taxes 77,000 80,880 Income tax expense 15,000 19,000 $62,000 $61,880 Net income Other financial data (thousands of dollars) $65,200 $60,500 Cash provided by operating activities Preferred stock dividends 6,750 6,750 tequired . Calculate the following for each year: current ratio, quick ratio, operating-cash-flow-to-current- liabilities ratio (current liabilities were $77,000,000 at January ,2018), inventory turnover (inventory was $87,000,000 at January 1, 2018), debt-to-equity ratio, times-interest-earned ratio, return on assets (total assets vere $490,000,000 at January 1, 2018), and return on common stockholders' equity (common stockholders' equity was $235,000,000 at January 1, 2018) . Calculate common-size percentages for each year's income statement. Round answers to two decimal places. 2019 2018 Current ratio 2.35 0.67 0.81 Quick ratio: 0.67 Operating-cash-flow-to-current-liabilities ratio: 0.75 0.76 4.84 4.52 Inventory turnover: Debt-to-equity ratio: 1.13 0,8 Times-interest-earned ratio 5.93 4 * 12.38 % 12.78% Return on assets: 28.79 %x Return on common stockholders' equity: 19.66% Round answers to one decimal place. Income Statements Year Ended Year Ended Common- Common- 2019 Size 2018 Size 100% Sales revenue $820,000 100% $680,000 545,000 66.5% Cost of goods sold 64 % * 433,920 Gross profit on sales 246,080 36 % x 275,000 33.5% 21.3 % Selling and administrative expenses 22 % x 175,000 149,200 14% Income before interest expense and income taxes 100,000 12.2% 96,880 2.7 % Interest expense 2.4% 23,000 16,000 11.6% Income before income taxes 9.5% 77,000 80,880 Income tax expense 15,000 2.8% 19,000 3.1 % x 6.7 % 8.5% $61,880 $62,000 Net income