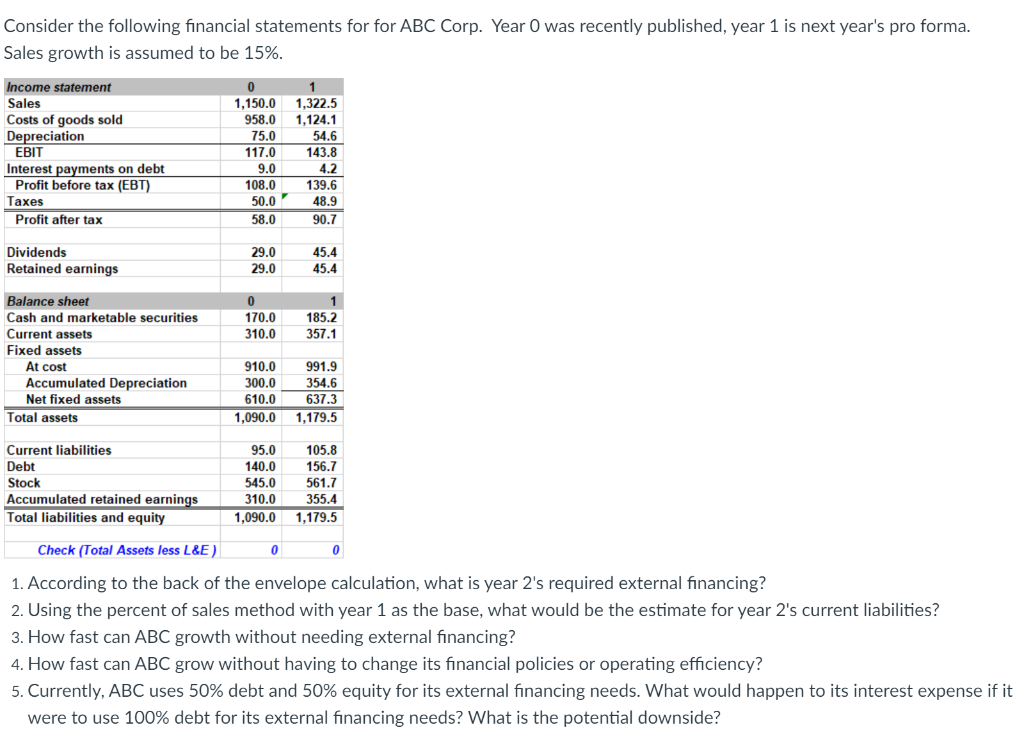

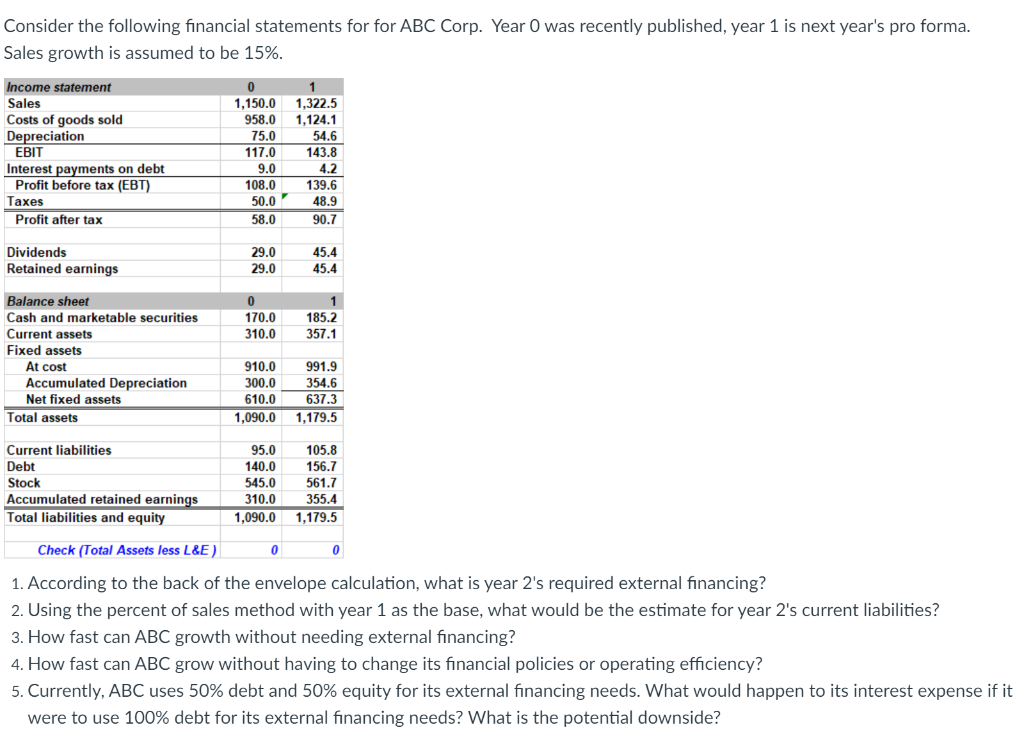

Consider the following financial statements for for ABC Corp. Year 0 was recently published, year 1 is next year's pro forma. Sales growth is assumed to be 15%. 1,150.0 958.0 75.0 Income statement Sales Costs of goods sold Depreciation EBIT Interest payments on debt Profit before tax (EBT) Taxes Profit after tax 117.0 1 1,322.5 1,124.1 54.6 143.8 4.2 139.6 48.9 90.7 9.0 108.0 50.0 58.0 Dividends Retained earnings 29.0 29.0 45.4 45.4 0 170.0 310.0 1 185.2 357.1 Balance sheet Cash and marketable securities Current assets Fixed assets At cost Accumulated Depreciation Net fixed assets Total assets 910.0 300.0 610.0 1,090.0 991.9 354.6 637.3 1,179.5 Current liabilities Debt Stock Accumulated retained earnings Total liabilities and equity 95.0 140.0 545.0 310.0 1,090.0 105.8 156.7 561.7 355.4 1,179.5 Check (Total Assets less L&E) 0 0 1. According to the back of the envelope calculation, what is year 2's required external financing? 2. Using the percent of sales method with year 1 as the base, what would be the estimate for year 2's current liabilities? 3. How fast can ABC growth without needing external financing? 4. How fast can ABC grow without having to change its financial policies or operating efficiency? 5. Currently, ABC uses 50% debt and 50% equity for its external financing needs. What would happen to its interest expense if it were to use 100% debt for its external financing needs? What is the potential downside? Consider the following financial statements for for ABC Corp. Year 0 was recently published, year 1 is next year's pro forma. Sales growth is assumed to be 15%. 1,150.0 958.0 75.0 Income statement Sales Costs of goods sold Depreciation EBIT Interest payments on debt Profit before tax (EBT) Taxes Profit after tax 117.0 1 1,322.5 1,124.1 54.6 143.8 4.2 139.6 48.9 90.7 9.0 108.0 50.0 58.0 Dividends Retained earnings 29.0 29.0 45.4 45.4 0 170.0 310.0 1 185.2 357.1 Balance sheet Cash and marketable securities Current assets Fixed assets At cost Accumulated Depreciation Net fixed assets Total assets 910.0 300.0 610.0 1,090.0 991.9 354.6 637.3 1,179.5 Current liabilities Debt Stock Accumulated retained earnings Total liabilities and equity 95.0 140.0 545.0 310.0 1,090.0 105.8 156.7 561.7 355.4 1,179.5 Check (Total Assets less L&E) 0 0 1. According to the back of the envelope calculation, what is year 2's required external financing? 2. Using the percent of sales method with year 1 as the base, what would be the estimate for year 2's current liabilities? 3. How fast can ABC growth without needing external financing? 4. How fast can ABC grow without having to change its financial policies or operating efficiency? 5. Currently, ABC uses 50% debt and 50% equity for its external financing needs. What would happen to its interest expense if it were to use 100% debt for its external financing needs? What is the potential downside