Question

Consider the following futures prices for Brazilian reals. BRAZILIAN REALS (CME); 100,000 REALS, $ PER REALS Assume the U.S. risk-free rate is 4.25%(continuously compounded rate)

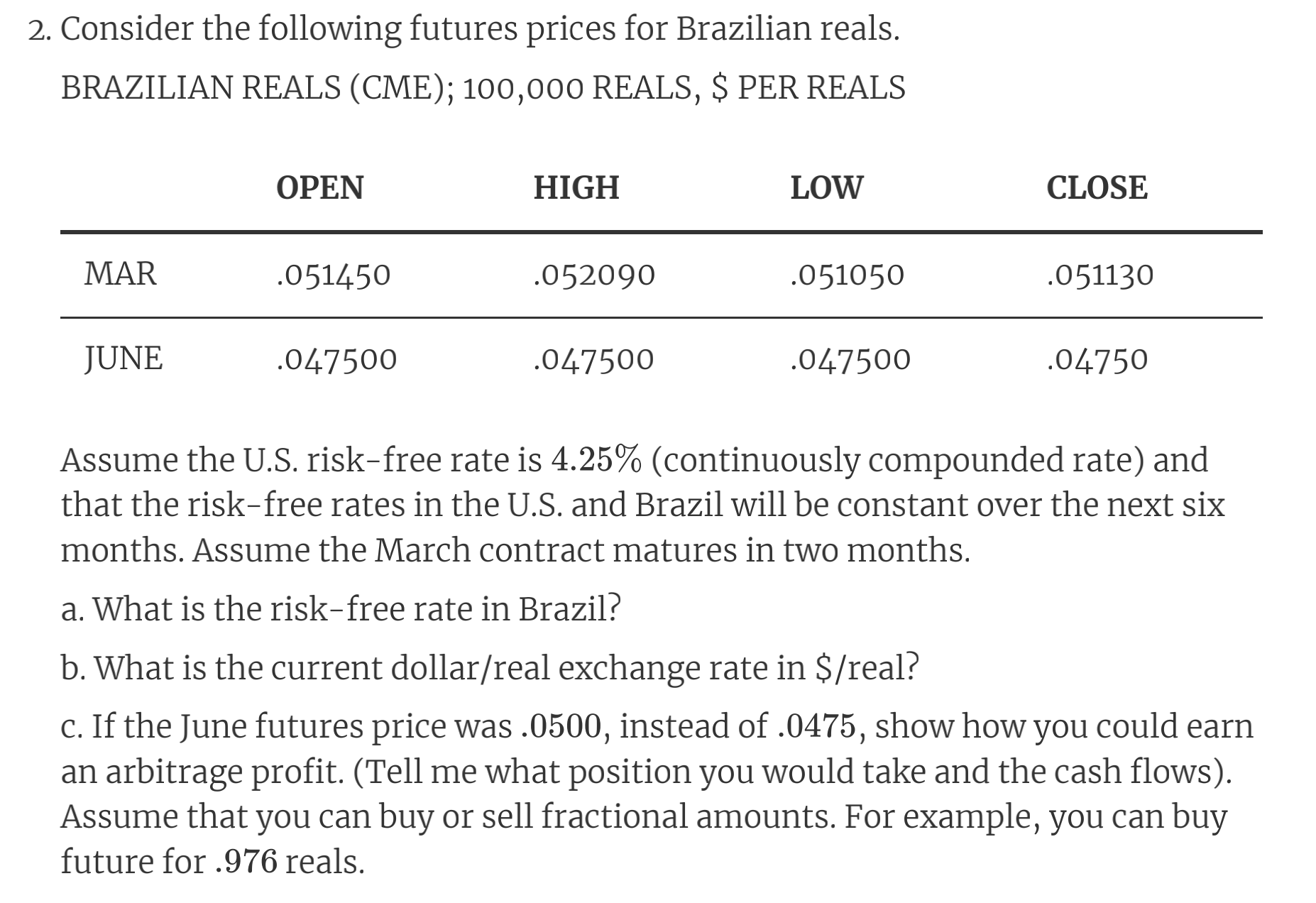

Consider the following futures prices for Brazilian reals. BRAZILIAN REALS (CME); 100,000 REALS, $ PER REALS

Assume the U.S. risk-free rate is 4.25%(continuously compounded rate) and

that the risk-free rates in the U.S. and Brazil will be constant over the next six

months. Assume the March contract matures in two months.

a. What is the risk-free rate in Brazil?

b. What is the current dollar/real exchange rate in $/real?

c. If the June futures price was 0.500, instead of 0.0475, show how you could earn

an arbitrage profit. (Tell me what position you would take and the cash flows).

Assume that you can buy or sell fractional amounts. For example, you can buy

future for 0.976 reals.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started