Answered step by step

Verified Expert Solution

Question

1 Approved Answer

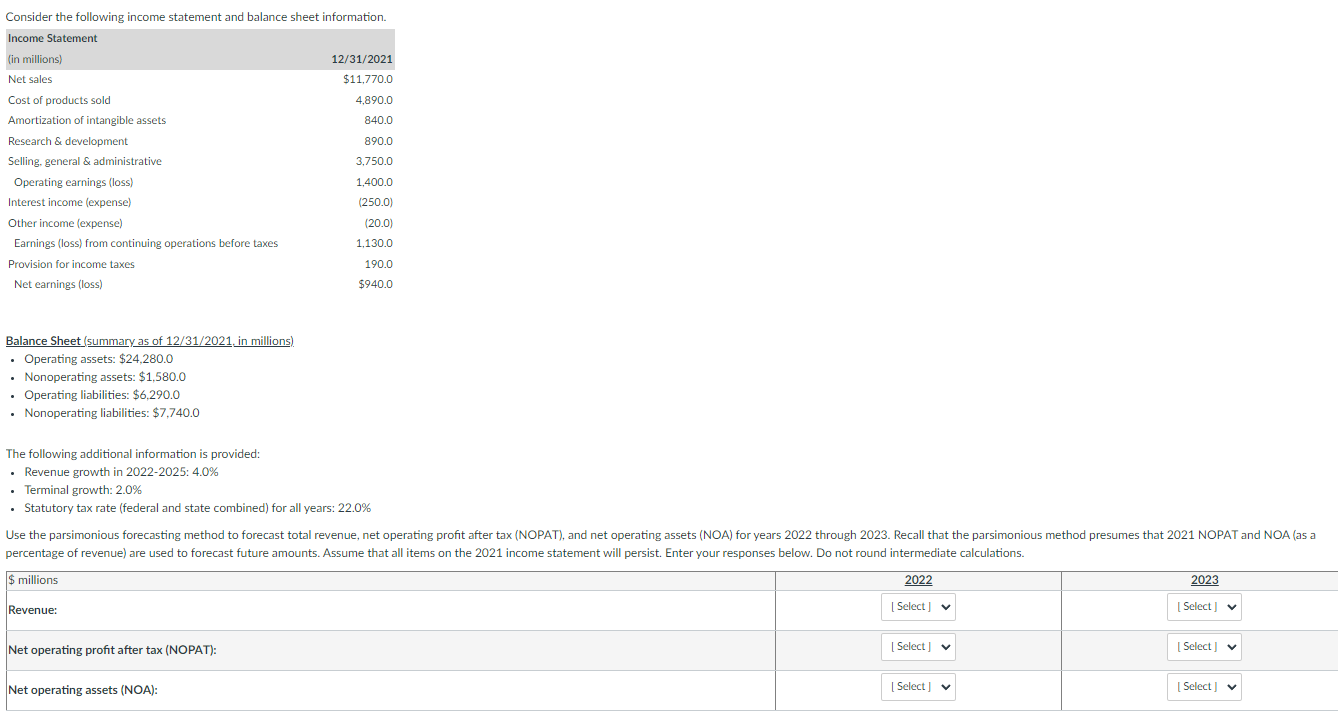

Consider the following income statement and balance sheet information. Income Statement (in millions) Net sales Cost of products sold Amortization of intangible assets Research

Consider the following income statement and balance sheet information. Income Statement (in millions) Net sales Cost of products sold Amortization of intangible assets Research & development Selling, general & administrative Operating earnings (loss) Interest income (expense) Other income (expense) Earnings (loss) from continuing operations before taxes Provision for income taxes Net earnings (loss) Balance Sheet (summary as of 12/31/2021, in millions) Operating assets: $24,280.0 Nonoperating assets: $1,580.0 Operating liabilities: $6,290.0 . Nonoperating liabilities: $7,740.0 The following additional information is provided: Revenue growth in 2022-2025: 4.0% . Terminal growth: 2.0% Statutory tax rate (federal and state combined) for all years: 22.0% Revenue: 12/31/2021 $11,770.0 4,890.0 840.0 890.0 3,750.0 1,400.0 (250.0) (20.0) 1,130.0 Use the parsimonious forecasting method to forecast total revenue, net operating profit after tax (NOPAT), and net operating assets (NOA) for years 2022 through 2023. Recall that the parsimonious method presumes that 2021 NOPAT and NOA (as a percentage of revenue) are used to forecast future amounts. Assume that all items on the 2021 income statement will persist. Enter your responses below. Do not round intermediate calculations. $ millions 2022 [Select] Net operating profit after tax (NOPAT): 190.0 $940.0 Net operating assets (NOA): [Select] [Select] 2023 [Select] [Select] [Select]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculate the forecasted revenue NOPAT and NOA for 2022 and 2023 Lets calculate Step 1 NOPAT Percent...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started