Answered step by step

Verified Expert Solution

Question

1 Approved Answer

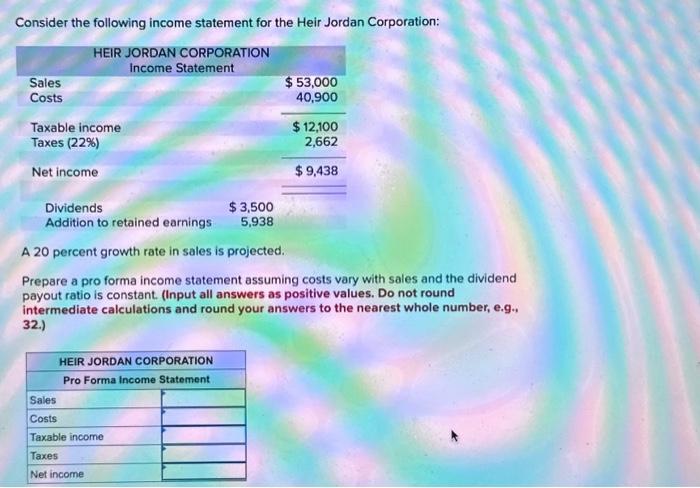

Consider the following income statement for the Heir Jordan Corporation: HEIR JORDAN CORPORATION Income Statement Sales Costs Taxable income Taxes (22%) Net income Dividends

Consider the following income statement for the Heir Jordan Corporation: HEIR JORDAN CORPORATION Income Statement Sales Costs Taxable income Taxes (22%) Net income Dividends $ 53,000 40,900 $12,100 2,662 $9,438 $3,500 5,938 Addition to retained earnings A 20 percent growth rate in sales is projected. Prepare a pro forma income statement assuming costs vary with sales and the dividend payout ratio is constant. (Input all answers as positive values. Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) HEIR JORDAN CORPORATION Pro Forma Income Statement Sales Costs Taxable income Taxes Net income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started