Answered step by step

Verified Expert Solution

Question

1 Approved Answer

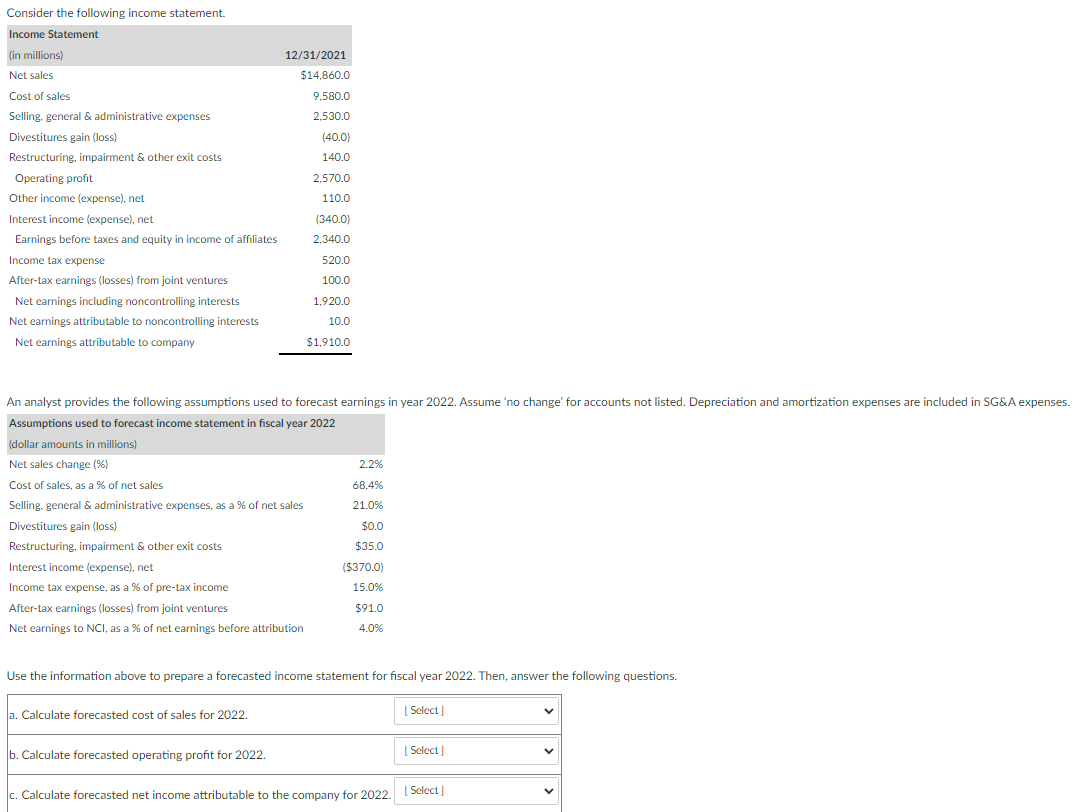

Consider the following income statement. Income Statement (in millions) Net sales Cost of sales Selling, general & administrative expenses Divestitures gain (loss) Restructuring, impairment

Consider the following income statement. Income Statement (in millions) Net sales Cost of sales Selling, general & administrative expenses Divestitures gain (loss) Restructuring, impairment & other exit costs Operating profit Other income (expense), net Interest income (expense), net Earnings before taxes and equity in income of affiliates Income tax expense After-tax earnings (losses) from joint ventures Net earnings including noncontrolling interests Net earnings attributable to noncontrolling interests Net earnings attributable to company 12/31/2021 $14,860.0 9,580.0 2,530.0 (40.0) 140.0 2,570.0 110.0 (340.0) 2,340.0 a. Calculate forecasted cost of sales for 2022. 520.0 100.0 1,920.0 10.0 An analyst provides the following assumptions used to forecast earnings in year 2022. Assume 'no change' for accounts not listed. Depreciation and amortization expenses are included in SG&A expenses. Assumptions used to forecast income statement in fiscal year 2022 (dollar amounts in millions) Net sales change (%) Cost of sales, as a % of net sales Selling, general & administrative expenses, as a % of net sales Divestitures gain (loss) Restructuring, impairment & other exit costs Interest income (expense), net Income tax expense, as a % of pre-tax income After-tax earnings (losses) from joint ventures Net earnings to NCI, as a % of net earnings before attribution b. Calculate forecasted operating profit for 2022. $1,910.0 2.2% 68.4% 21.0% Use the information above to prepare a forecasted income statement for fiscal year 2022. Then, answer the following questions. $0.0 $35.0 ($370.0) 15.0% $91.0 4.0% c. Calculate forecasted net income attributable to the company for 2022. [Select] [ Select] [Select]

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Assumptions Net sales change 22 Cost of sales as a of net sales 684 Selling general administrative e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started