Answered step by step

Verified Expert Solution

Question

1 Approved Answer

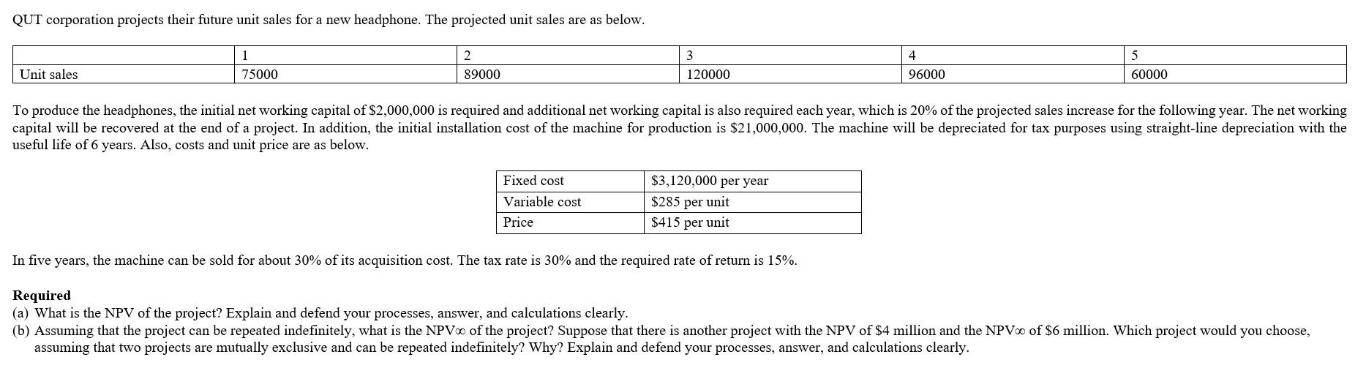

QUT corporation projects their future unit sales for a new headphone. The projected unit sales are as below. 1 75000 Unit sales 2 89000

QUT corporation projects their future unit sales for a new headphone. The projected unit sales are as below. 1 75000 Unit sales 2 89000 3 120000 Fixed cost Variable cost Price 4 96000 working To produce the headphones, the initial net working capital of $2,000,000 is required and additional net working capital is also required each year, which is 20% of the projected sales increase for the following year. The. capital will be recovered at the end of a project. In addition, the initial installation cost of the machine for production is $21,000,000. The machine will be depreciated for tax purposes using straight-line depreciation with the useful life of 6 years. Also, costs and unit price are as below. $3,120,000 per year $285 per unit $415 per unit 5 60000 In five years, the machine can be sold for about 30% of its acquisition cost. The tax rate is 30% and the required rate of return is 15%. Required (a) What is the NPV of the project? Explain and defend your processes, answer, and calculations clearly. (b) Assuming that the project can be repeated indefinitely, what is the NPV of the project? Suppose that there is another project with the NPV of $4 million and the NPV of $6 million. Which project would you choose, assuming that two projects are mutually exclusive and can be repeated indefinitely? Why? Explain and defend your processes, answer, and calculations clearly.

Step by Step Solution

★★★★★

3.54 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the NPV Net Present Value of the project we need to determine the cash flows associated with the project and discount them to their prese...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started