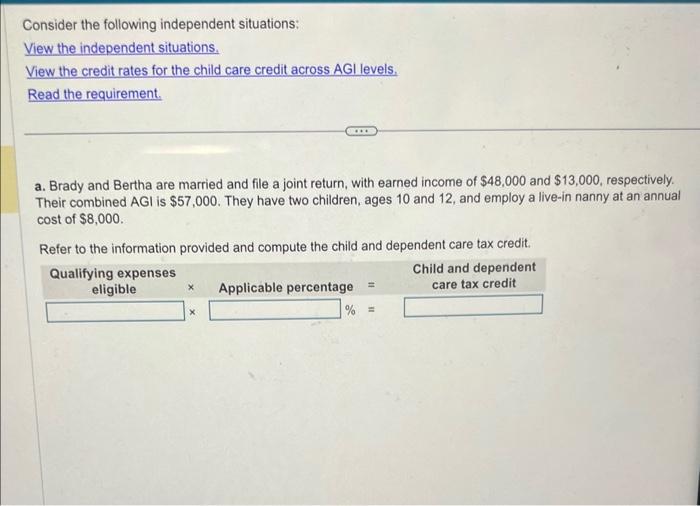

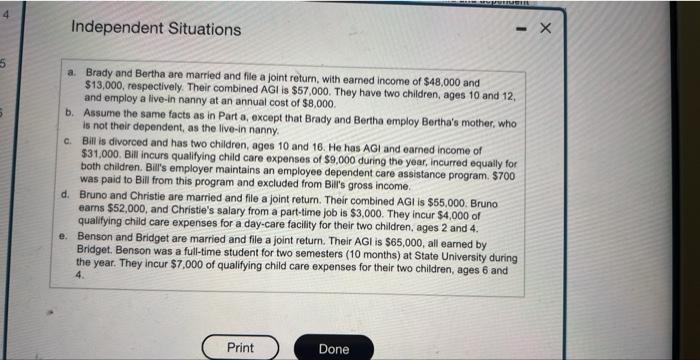

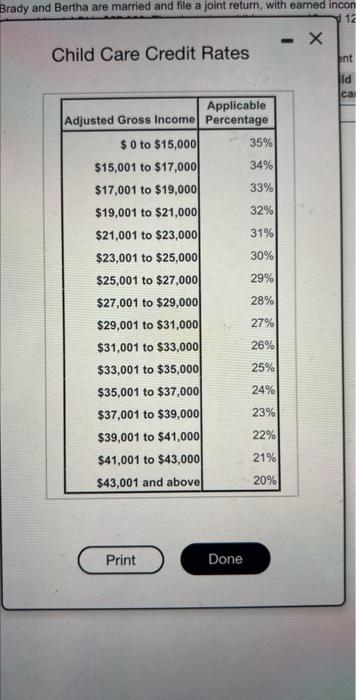

Consider the following independent situations: View the independent situations. View the credit rates for the child care credit across AGI levels. Read the requirement. a. Brady and Bertha are married and file a joint return, with earned income of $48,000 and $13,000, respectively. Their combined AGI is $57,000. They have two children, ages 10 and 12 , and employ a live-in nanny at an annual cost of $8,000. Refer to the information provided and compute the child and dependent care tax credit. Independent Situations a. Brady and Bertha are married and fle a joint return, with eamed income of $48,000 and $13,000, respectively. Their combined AGI is $57,000. They have two children, ages 10 and 12 , and employ a live-in nanny at an annual cost of $8,000. b. Assume the same facts as in Part a, except that Brady and Bertha employ Bertha's mother, who is not their dependent, as the live-in nanny. c. Bill is divorced and has two children, ages 10 and 16. He has AGI and earned income of $31,000. Bill incurs qualifying child care expenses of $9,000 during the year, incurred equally for both children. Bili's employer maintains an employee dependent care assistance program. $700 was paid to Bill from this program and excluded from Bill's gross income. d. Bruno and Christie are married and file a joint return. Their combined AGI is $55.000. Bruno earns $52,000, and Christie's salary from a part-time job is $3,000. They incur $4,000 of qualifying child care expenses for a day-care facility for their two children, ages 2 and 4 . e. Benson and Bridget are married and file a joint return. Their AGI is $65,000, all earned by Bridget. Benson was a full-time student for two semesters ( 10 months) at State University during the year. They incur $7,000 of qualifying child care expenses for their two children, ages 6 and 4. Child Care Credit Rates Requirement For each of the independert situations, determine the amount of the child and dependent care tax credit. (Assume that both taxpayers are employed and the year is 2022.) Consider the following independent situations: View the independent situations. View the credit rates for the child care credit across AGI levels. Read the requirement. a. Brady and Bertha are married and file a joint return, with earned income of $48,000 and $13,000, respectively. Their combined AGI is $57,000. They have two children, ages 10 and 12 , and employ a live-in nanny at an annual cost of $8,000. Refer to the information provided and compute the child and dependent care tax credit. Independent Situations a. Brady and Bertha are married and fle a joint return, with eamed income of $48,000 and $13,000, respectively. Their combined AGI is $57,000. They have two children, ages 10 and 12 , and employ a live-in nanny at an annual cost of $8,000. b. Assume the same facts as in Part a, except that Brady and Bertha employ Bertha's mother, who is not their dependent, as the live-in nanny. c. Bill is divorced and has two children, ages 10 and 16. He has AGI and earned income of $31,000. Bill incurs qualifying child care expenses of $9,000 during the year, incurred equally for both children. Bili's employer maintains an employee dependent care assistance program. $700 was paid to Bill from this program and excluded from Bill's gross income. d. Bruno and Christie are married and file a joint return. Their combined AGI is $55.000. Bruno earns $52,000, and Christie's salary from a part-time job is $3,000. They incur $4,000 of qualifying child care expenses for a day-care facility for their two children, ages 2 and 4 . e. Benson and Bridget are married and file a joint return. Their AGI is $65,000, all earned by Bridget. Benson was a full-time student for two semesters ( 10 months) at State University during the year. They incur $7,000 of qualifying child care expenses for their two children, ages 6 and 4. Child Care Credit Rates Requirement For each of the independert situations, determine the amount of the child and dependent care tax credit. (Assume that both taxpayers are employed and the year is 2022.)