Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following information about a company known as Gazal Agricultural Ltd The Australian Stock Exchange (ASX) code for this company is 'GAZ'. GAZ is

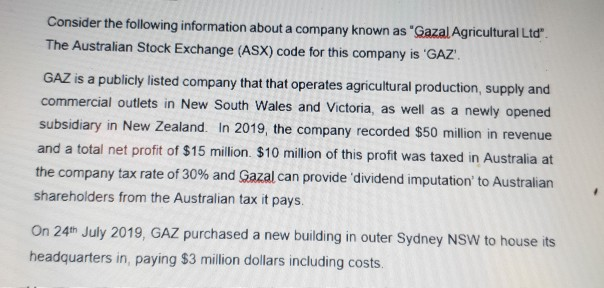

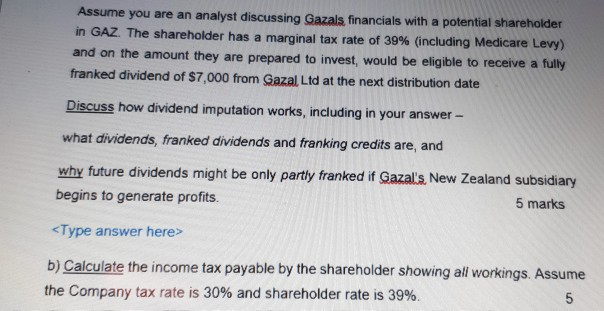

Consider the following information about a company known as "Gazal Agricultural Ltd The Australian Stock Exchange (ASX) code for this company is 'GAZ'. GAZ is a publicly listed company that that operates agricultural production, supply and commercial outlets in New South Wales and Victoria, as well as a newly opened subsidiary in New Zealand. In 2019, the company recorded $50 million in revenue and a total net profit of $15 million $10 million of this profit was taxed in Australia at the company tax rate of 30% and Gazal can provide 'dividend imputation to Australian shareholders from the Australian tax it pays. On 24th July 2019, GAZ purchased a new building in outer Sydney NSW to house its headquarters in, paying $3 million dollars including costs. Assume you are an analyst discussing Gazals financials with a potential shareholder in GAZ. The shareholder has a marginal tax rate of 39% (including Medicare Levy) and on the amount they are prepared to invest, would be eligible to receive a fully franked dividend of $7,000 from Gazal Ltd at the next distribution date Discuss how dividend imputation works, including in your answer - what dividends, franked dividends and franking credits are, and why future dividends might be only partly franked if Gazal's New Zealand subsidiary begins to generate profits. 5 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started