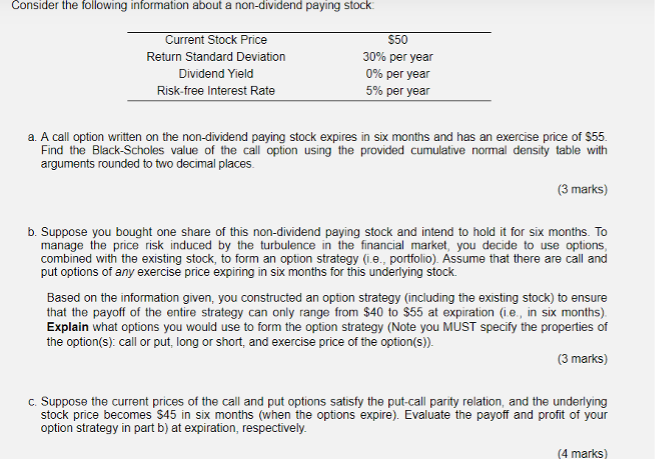

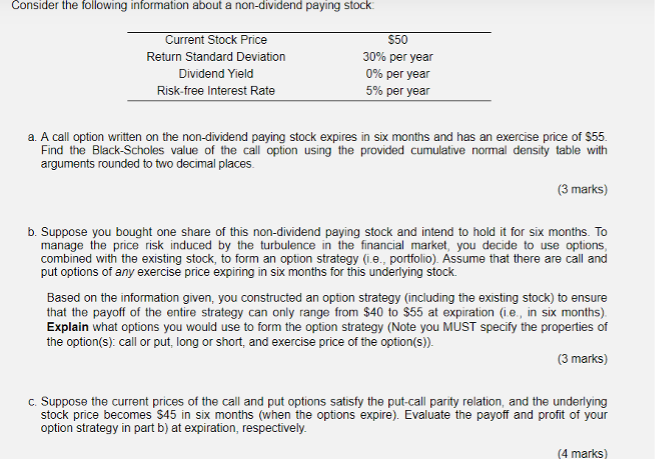

Consider the following information about a non-dividend paying stock Current Stock Price Return Standard Deviation Dividend Yield Risk-free Interest Rate $50 30% per year 0% per year 5% per year a. A call option written on the non-dividend paying stock expires in six months and has an exercise price of $55. Find the Black-Scholes value of the call option using the provided cumulative normal density table with arguments rounded to two decimal places (3 marks) b. Suppose you bought one share of this non-dividend paying stock and intend to hold it for six months. To manage the price risk induced by the turbulence in the financial market, you decide to use options, combined with the existing stock, to form an option strategy (.e., portfolio). Assume that there are call and put options of any exercise price expiring in six months for this underlying stock. Based on the information given, you constructed an option strategy (including the existing stock) to ensure that the payoff of the entire strategy can only range from $40 to $55 at expiration (ie, in six months) Explain what options you would use to form the option strategy (Note you MUST specify the properties of the option(s): call or put, long or short, and exercise price of the option(s)) (3 marks) Suppose the current prices of the call and put options satisfy the put-call parity relation, and the underlying stock price becomes S45 in six months (when the options expire). Evaluate the payoff and profit of your option strategy in part b) at expiration, respectively. (4 marks) Consider the following information about a non-dividend paying stock Current Stock Price Return Standard Deviation Dividend Yield Risk-free Interest Rate $50 30% per year 0% per year 5% per year a. A call option written on the non-dividend paying stock expires in six months and has an exercise price of $55. Find the Black-Scholes value of the call option using the provided cumulative normal density table with arguments rounded to two decimal places (3 marks) b. Suppose you bought one share of this non-dividend paying stock and intend to hold it for six months. To manage the price risk induced by the turbulence in the financial market, you decide to use options, combined with the existing stock, to form an option strategy (.e., portfolio). Assume that there are call and put options of any exercise price expiring in six months for this underlying stock. Based on the information given, you constructed an option strategy (including the existing stock) to ensure that the payoff of the entire strategy can only range from $40 to $55 at expiration (ie, in six months) Explain what options you would use to form the option strategy (Note you MUST specify the properties of the option(s): call or put, long or short, and exercise price of the option(s)) (3 marks) Suppose the current prices of the call and put options satisfy the put-call parity relation, and the underlying stock price becomes S45 in six months (when the options expire). Evaluate the payoff and profit of your option strategy in part b) at expiration, respectively. (4 marks)