Answered step by step

Verified Expert Solution

Question

1 Approved Answer

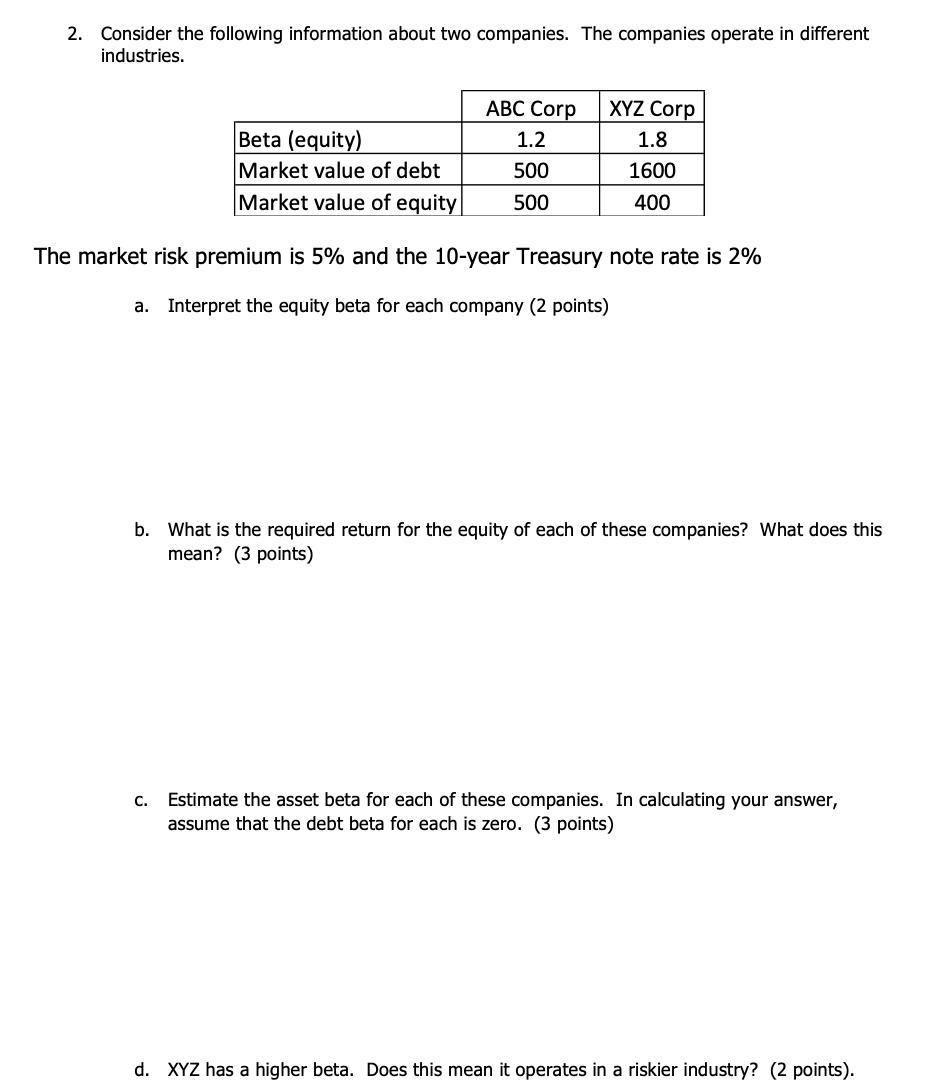

2. Consider the following information about two companies. The companies operate in different industries. ABC Corp Beta (equity) 1.2 Market value of debt 500

2. Consider the following information about two companies. The companies operate in different industries. ABC Corp Beta (equity) 1.2 Market value of debt 500 Market value of equity 500 XYZ Corp 1.8 1600 400 The market risk premium is 5% and the 10-year Treasury note rate is 2% a. Interpret the equity beta for each company (2 points) C. b. What is the required return for the equity of each of these companies? What does this mean? (3 points) Estimate the asset beta for each of these companies. In calculating your answer, assume that the debt beta for each is zero. (3 points) d. XYZ has a higher beta. Does this mean it operates in a riskier industry? (2 points).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Equity Beta for ABC is 12 while Equity Beta for XYZ is 18 This means that the stock of XYZ is much ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d8a7b7c7f7_176573.pdf

180 KBs PDF File

635d8a7b7c7f7_176573.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started