Answered step by step

Verified Expert Solution

Question

1 Approved Answer

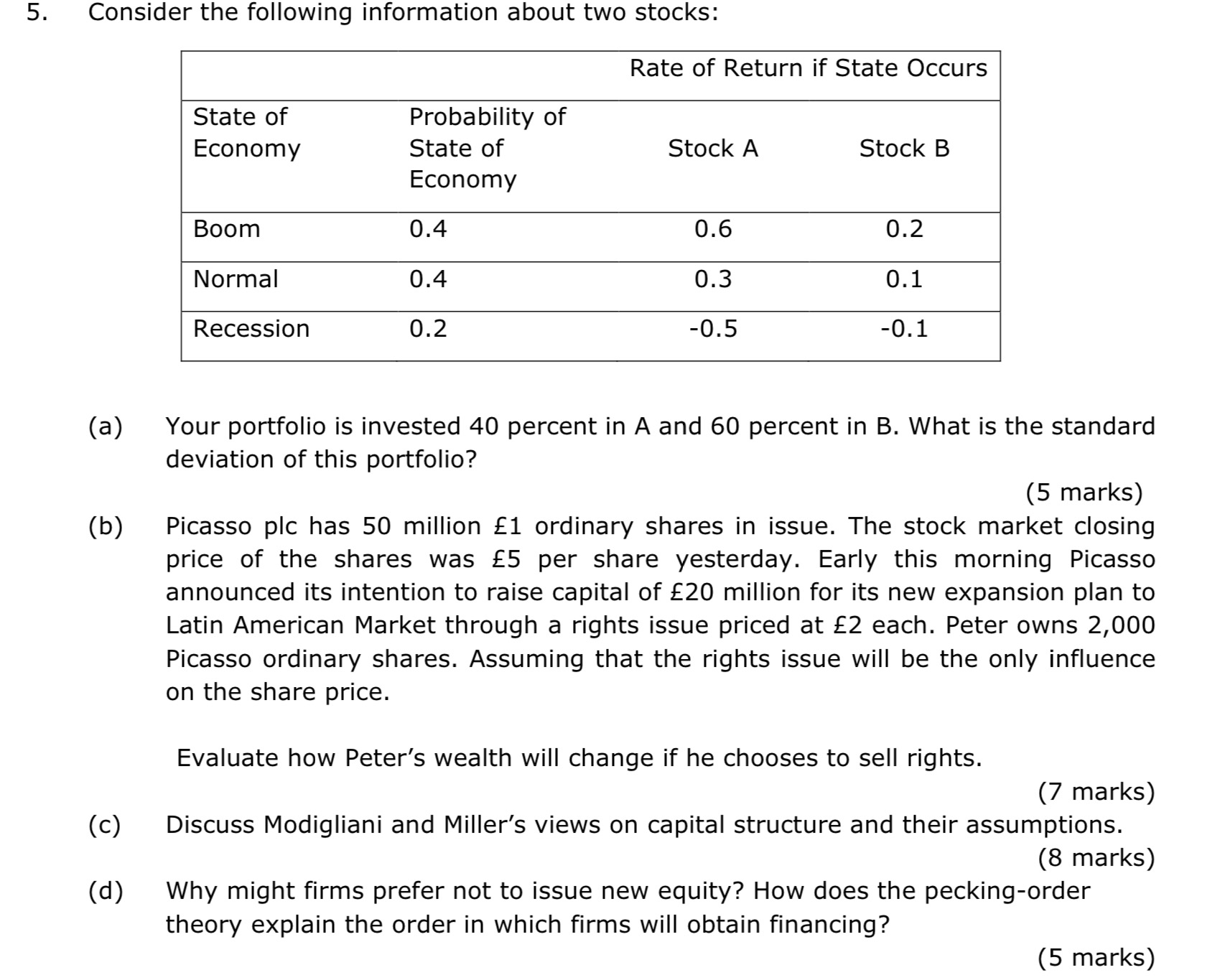

Consider the following information about two stocks: ( a ) Your portfolio is invested 4 0 percent in A and 6 0 percent in B

Consider the following information about two stocks:

a Your portfolio is invested percent in A and percent in What is the standard

deviation of this portfolio?

marks

b Picasso plc has million ordinary shares in issue. The stock market closing

price of the shares was per share yesterday. Early this morning Picasso

announced its intention to raise capital of million for its new expansion plan to

Latin American Market through a rights issue priced at each. Peter owns

Picasso ordinary shares. Assuming that the rights issue will be the only influence

on the share price.

Evaluate how Peter's wealth will change if he chooses to sell rights.

marks

c Discuss Modigliani and Miller's views on capital structure and their assumptions.

marks

d Why might firms prefer not to issue new equity? How does the peckingorder

theory explain the order in which firms will obtain financing?

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started