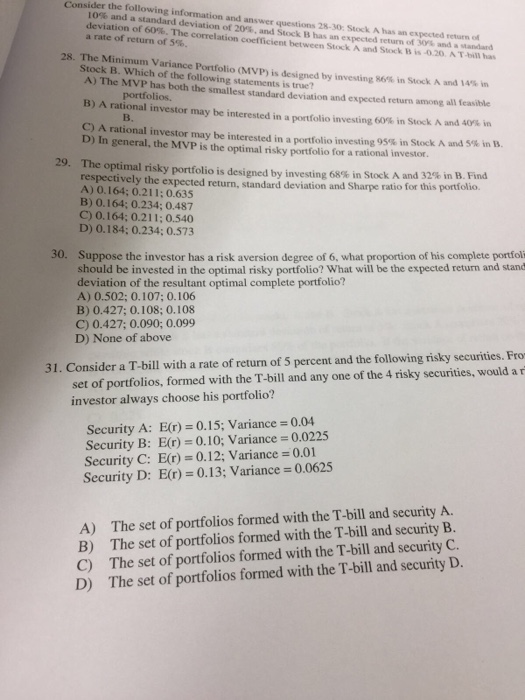

Consider the following information and answer questions 28-30: Stock A has an expected return of 10% and standard deviation of 20%, and Stock B has an expected return of 30% and a standard deviation of 60%. The correlation coefficient between Stock A and stock B is -0.20 A T-bill has rate of return of 5%. The Minimum Portfolio (MVP) is designed by investing 86% in Stock. A and 14% in Stock B. Which of the following statements is true? A) The MVP has both the smallest standard deviation and expected return among all feasible portfolios. B) A rational investor may be interested in a portfolio investing 60% in Stock A and 40% in B. C) A rational investor may be interested in a portfolio investing 95% in Stock A and 5% in B. D) In general, the MVP is risky portfolio for a rational investor. The 29. risky is designed by investing 68% Stock A and 32% in B. Find respectively the expected return, standard deviation and Sharpe ratio for this portfolio A) 0.164; 0.21 0.635 B) 0.164; 0.234; 0.487 C) 0.164; 0.211; 0.540 D) 0.184: 0.234: 0.573 Suppose the investor has a risk aversion degree of 6, what proportion complete portfolio should be in the risky portfolio? What will be the expected return and stand deviation of of the resultant optimal complete portfolio? A) 0.502; 0.107: 0.106 B) 0.427: 0.108: 0.108 C) 0.427; 0.090; 0.099 D) None of above Consider a T-bill with a rate of 5 percent and the following risky securities. Fro of return set of portfolios, formed with the T-bill and any one of the 4 risky securities, would a investor always choose his portfolio? Security A: E(r) = 0.15; Variance = 0.04 Security B: E(r) = 0.10, Variance = 0.0225 Security C: E(r) = 0.12; Variance = 0.01 Security D: E(r) = 0.13; Variance = 0.0625 A) The set of portfolios formed with the T-bill and security A. B) The set of portfolios formed with the T-bill and security B. C) The set of portfolios formed with the T-bill and security C. D) The set of portfolios formed with the T bill and security D. Consider the following information and answer questions 28-30: Stock A has an expected return of 10% and standard deviation of 20%, and Stock B has an expected return of 30% and a standard deviation of 60%. The correlation coefficient between Stock A and stock B is -0.20 A T-bill has rate of return of 5%. The Minimum Portfolio (MVP) is designed by investing 86% in Stock. A and 14% in Stock B. Which of the following statements is true? A) The MVP has both the smallest standard deviation and expected return among all feasible portfolios. B) A rational investor may be interested in a portfolio investing 60% in Stock A and 40% in B. C) A rational investor may be interested in a portfolio investing 95% in Stock A and 5% in B. D) In general, the MVP is risky portfolio for a rational investor. The 29. risky is designed by investing 68% Stock A and 32% in B. Find respectively the expected return, standard deviation and Sharpe ratio for this portfolio A) 0.164; 0.21 0.635 B) 0.164; 0.234; 0.487 C) 0.164; 0.211; 0.540 D) 0.184: 0.234: 0.573 Suppose the investor has a risk aversion degree of 6, what proportion complete portfolio should be in the risky portfolio? What will be the expected return and stand deviation of of the resultant optimal complete portfolio? A) 0.502; 0.107: 0.106 B) 0.427: 0.108: 0.108 C) 0.427; 0.090; 0.099 D) None of above Consider a T-bill with a rate of 5 percent and the following risky securities. Fro of return set of portfolios, formed with the T-bill and any one of the 4 risky securities, would a investor always choose his portfolio? Security A: E(r) = 0.15; Variance = 0.04 Security B: E(r) = 0.10, Variance = 0.0225 Security C: E(r) = 0.12; Variance = 0.01 Security D: E(r) = 0.13; Variance = 0.0625 A) The set of portfolios formed with the T-bill and security A. B) The set of portfolios formed with the T-bill and security B. C) The set of portfolios formed with the T-bill and security C. D) The set of portfolios formed with the T bill and security D