Question

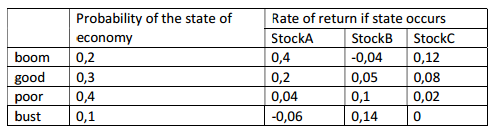

Consider the following information and answer the questions. a. Calculate the expected return of each stock. b. Calculate the variance and standard deviation of each

Consider the following information and answer the questions.

a. Calculate the expected return of each stock.

b. Calculate the variance and standard deviation of each stock.

c. Calculate the expected return of the portfolio (Portfolio1) consisting 40% of stock A, 40% of stock B and 20% of stock C.

d. Calculate the variance and standard deviation of this portfolio.

e. Consider an alternative portfolio (Portfolio2) 40% of stock A, 20% of stock B, 10% of stock C and 30% in the risk-free asset. Risk-free asset expected return is 2%. What is this portfolios expected return, variance, and standard deviation?

f. Based on CAPM calculate each stock beta if market risk premium is 5%.

g. Which stock has the lowest systematic risk? Which stock has the lowest total risk? Which stock is safest? Explain.

h. What is the beta of the Portfolio1 and Portfolio2?

Probability of the state of Rate of return if state occurs Stock A StockB Stock C economy -0,04 012 0,4 boom 0,2 good 03 0,05 0,2 0,08 poor 0,4 0,04 0,1 0,02 0 0,14 bust 0,1 -0,06Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started