Question

Consider the following information and prepare a bank reconciliation, along with any resulting journal entries, for TJ Company, an online retailer that specializes in digital

Consider the following information and prepare a bank reconciliation, along with any resulting journal entries, for TJ Company, an online retailer that specializes in digital device accessories, at April 30, 2020.

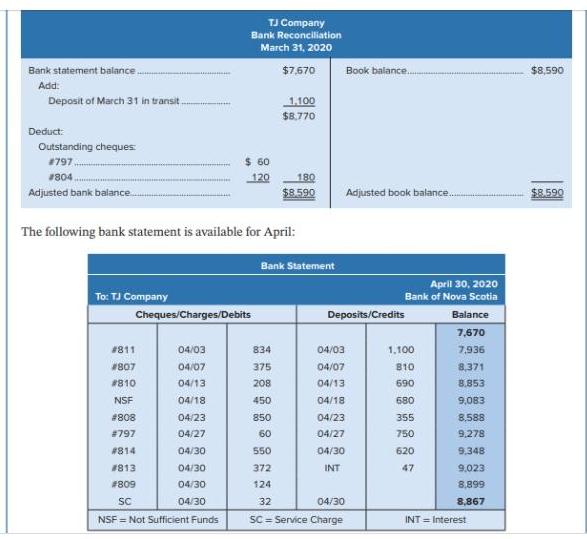

Analysis Component: Assume that you are the owner of TJ Company and have just read an online article about employee accounting fraud. As a result, you have decided to review the bank reconciliation prepared for April 30. You notice that cheque #808 for $850 is not included with the cancelled cheques that are returned by the bank with the bank statement. Your office is small and is managed by one employee, Brent Wicker. When questioned, Brent cannot locate the missing cheque. What do you do, if anything? Explain. The bank reconciliation prepared by TJ Company on March 31, 2020 as follows:

Bank statement balance.. Add: Deposit of March 31 in transit. Deduct: Outstanding cheques #797. #804. Adjusted bank balance To: TJ Company TJ Company Bank Reconciliation March 31, 2020 $7,670 #811 #807 #810 NSF #808 #797 #814 #813 #809 SC NSF = Not Sufficient Funds 04/03 04/07 04/13 04/18 04/23 04/27 04/30 04/30 04/30 04/30 $ 60 120 The following bank statement is available for April: Cheques/Charges/Debits 1.100 $8,770 834 375 208 450 850 60 550 180 $8.590 Bank Statement 372 124 32 Book balance. Adjusted book balance.. 04/03 04/07 04/13 04/18 04/23 04/27 04/30 INT 04/30 SC Service Charge Deposits/Credits April 30, 2020 Bank of Nova Scotia 1,100 810 690 680 355 750 620 47 Balance 7,670 7,936 8,371 8.853 9,083 8,588 9,278 9.348 9,023 8,899 8,867 INT= Interest $8,590 $8.590

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Step 11 TJ Company Bank Reconciliation Particulars Bank Statement balance Add Deposit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started