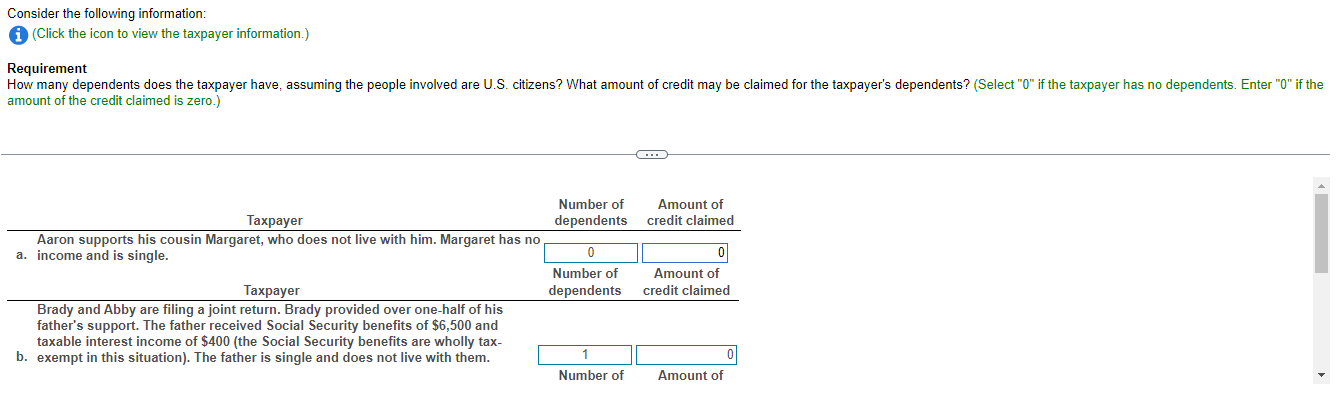

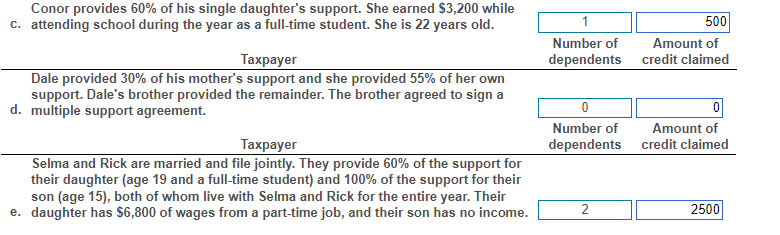

Consider the following information: (Click the icon to view the taxpayer information.) Requirement amount of the credit claimed is zero.) Conor provides 60% of his single daughter's support. She earned $3,200 while c. attending school during the year as a full-time student. She is 22 years old. \begin{tabular}{|c|c|} \hline 1 & 500 \\ \cline { 2 } Number of dependents & Amount of credit claimed \\ \hline \end{tabular} Dale provided 30% of his mother's support and she provided 55% of her own support. Dale's brother provided the remainder. The brother agreed to sign a d. multiple support agreement. \begin{tabular}{|c|c|} \hline 0 & 0 \\ \cline { 2 } Number of \\ dependents & Amount of credit claimed \\ \hline \end{tabular} Selma and Rick are married and file jointly. They provide 60% of the support for their daughter (age 19 and a full-time student) and 100% of the support for their son (age 15), both of whom live with Selma and Rick for the entire year. Their e. daughter has $6,800 of wages from a part-time job, and their son has no income. \begin{tabular}{|l|l|} \hline 2 & 2500 \\ \hline \end{tabular} Consider the following information: (Click the icon to view the taxpayer information.) Requirement amount of the credit claimed is zero.) Conor provides 60% of his single daughter's support. She earned $3,200 while c. attending school during the year as a full-time student. She is 22 years old. \begin{tabular}{|c|c|} \hline 1 & 500 \\ \cline { 2 } Number of dependents & Amount of credit claimed \\ \hline \end{tabular} Dale provided 30% of his mother's support and she provided 55% of her own support. Dale's brother provided the remainder. The brother agreed to sign a d. multiple support agreement. \begin{tabular}{|c|c|} \hline 0 & 0 \\ \cline { 2 } Number of \\ dependents & Amount of credit claimed \\ \hline \end{tabular} Selma and Rick are married and file jointly. They provide 60% of the support for their daughter (age 19 and a full-time student) and 100% of the support for their son (age 15), both of whom live with Selma and Rick for the entire year. Their e. daughter has $6,800 of wages from a part-time job, and their son has no income. \begin{tabular}{|l|l|} \hline 2 & 2500 \\ \hline \end{tabular}