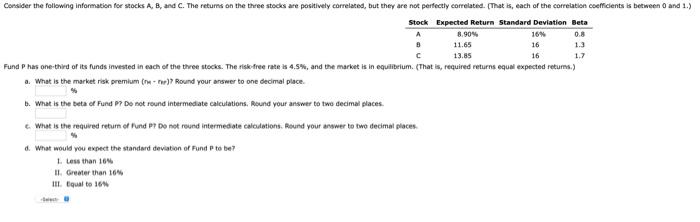

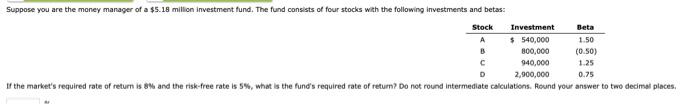

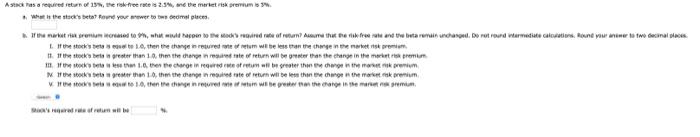

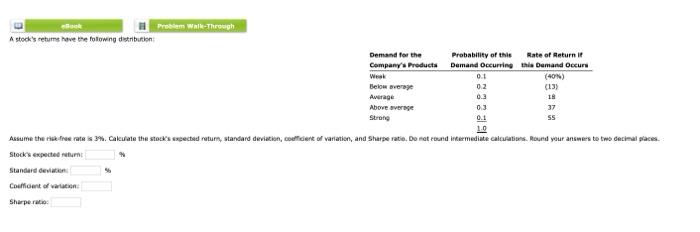

Consider the following information for stocks A, B, and C. The returns on the three stocks are positively correlated, but they are not perfectly correlated. (That is, each of the correlation coefficients is between 0 and 1.) Stock Expected Return Standard Deviation Beta 16% 0.8 16 1.3 11.65 13.85 C 16 1.7 Fund P has one-third of its funds invested in each of the three stocks. The risk-free rate is 4.5%, and the market is in equilibrium. (That is, required returns equal expected returns.) a. What is the market risk premium (ne-ree)? Round your answer to one decimal place. b. What is the beta of Fund P? Do not round intermediate calculations. Round your answer to two decimal places. c. What is the required return of Fund P? Do not round intermediate calculations. Round your answer to two decimal places. d. What would you expect the standard deviation of Fund P to be? 1. Less than 16% II. Greater than 16% 111. Equal to 16% 8.90% Suppose you are the money manager of a $5.18 million investment fund. The fund consists of four stocks with the following investments and betas: Stock A B C D Investment $ 540,000 800,000 940,000 2,900,000 Beta 1.50 (0.50) 1.25 0.75 If the market's required rate of return is 8% and the risk-free rate is 5%, what is the fund's required rate of return? Do not round intermediate calculations. Round your answer to two decimal places. Astack as required return of 15%, the risk-free rate is 2.3%, and the market risk premium is 3%. What is the stock's beta? Round your answer to two decimal places. If the market premium increased to 9%, what would happen to the stock's required rate of return? Assume that the free rate and the beta remain unchanged. Do not round intermediate calculations. Round your answer to two decimal places L. If the stock's bet is easel to 10, then the change in required rate of return will be less than the change in the market is premi 11. If the stock's bets in greater than 1.0, then the change in required rate of return will be greater than the change in the market risk prem If the stocks beta is less than 1.0, then the change in required rate of retum will be greater than the change in the makers premium If the stock's bets If the stocks beta greater than 10, then the change in required rate of return will be less than the change in the market risk premium equal to 1.0, then the change in required rate of retum wil be greater than the change in the market nok premium S's required of will be Book A stock's returns have the following distribution Problem Walk-Through Demand for the Company's Products Weak Below average Average Above average Strong Probability of this Demand Occurring Rate of Return if this Demand Occurs 0.1 0.2 0.3 0.3 0.1 1.0 Assume the rise free rate is 39%. Calculate the stock's expected return, standard deviation, coefficient of variation, and Sharpe ratio. Do not round intermediate calculations. Round your answers to two decimal places. Stock's expected return Standard deviation Coefficient of variation: Sharpe ratio (40%) (13) 18 37 55