Answered step by step

Verified Expert Solution

Question

1 Approved Answer

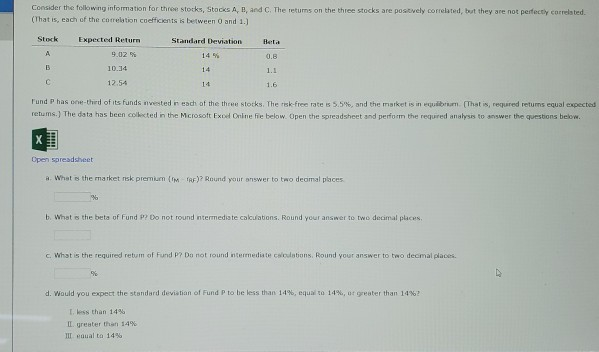

Consider the following information for three stocks, Stocks A, B, and C. The returns on the three stocks are positively correlated, but they are not

Consider the following information for three stocks, Stocks A, B, and C. The returns on the three stocks are positively correlated, but they are not perfectly correlated (That is, each of the correlation coefficients is between 0 and 1.) Stock Beta Standard Deviation 14 % A 0.8 Expected Return 9.02% 10.34 12.54 14 1.1 14 1.6 Fund P has one-third of its funds vested in each of the three stocks. The risk-free rates 5.5, and the market is in equilibrium (That is required returns equal expected retums.) The data has been collected in the Mcrosoft Exod Online fie below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet . What the market risk premium (RF)? Round your answer to two decimal places b. What is the beta of Fund P? Do not found ntermediate calculations. Round your answer to two decimal places. c. What is the required retum of Fund P? Do not found intermediate calculations, Round your answer to two decmal places % d. Would you expect the standard deviation of Fund P to be less than 14%, equal to 14%, or greater than 14%? 1. less than 14% II greater than 14% TIL noual to 14%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started