Question

Consider the following information for XYZCorp stock, which is non-dividend-paying. The interest rate is 2%. The stock moves on a binomial tree, with period length

-

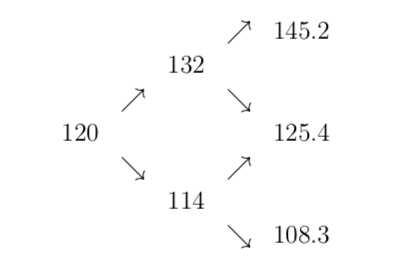

Consider the following information for XYZCorp stock, which is non-dividend-paying. The interest rate is 2%. The stock moves on a binomial tree, with period length h = 0.5 years, as

follows:

Calculate the price of a derivative which pays, in one years time, the stocks average price over the year (so the average is taken over three prices).

A customer comes to you wanting to buy a derivative whose payout is the stocks price at the end of the year minus its average price over the year. What is its (midmarket) price? (You shouldnt need to do too many calculations here.)

145.2 132 120 125.4 114 108.3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started