Answered step by step

Verified Expert Solution

Question

1 Approved Answer

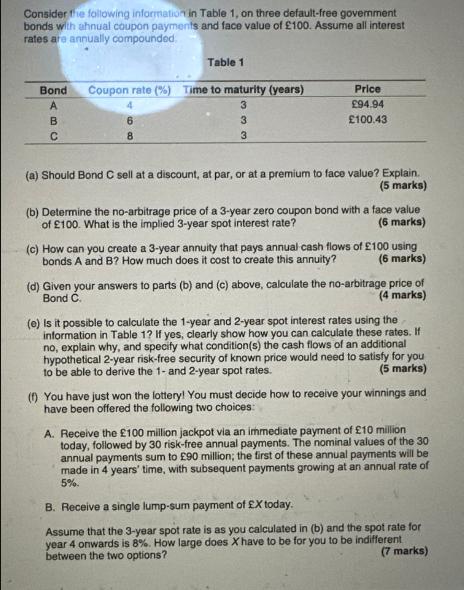

Consider the following information in Table 1, on three default-free goverment bonds with annual coupon payments and face value of 100. Assume all interest

Consider the following information in Table 1, on three default-free goverment bonds with annual coupon payments and face value of 100. Assume all interest rates are annually compounded Bond ABC Table 1 Coupon rate (%) Time to maturity (years) 3 4 6 8 3 3 Price 94.94 100.43 (a) Should Bond C sell at a discount, at par, or at a premium to face value? Explain. (5 marks) (b) Determine the no-arbitrage price of a 3-year zero coupon bond with a face value of 100. What is the implied 3-year spot interest rate? (6 marks) (c) How can you create a 3-year annuity that pays annual cash flows of 100 using bonds A and B? How much does it cost to create this annuity? (6 marks) (d) Given your answers to parts (b) and (c) above, calculate the no-arbitrage price of (4 marks) Bond C. (e) Is it possible to calculate the 1-year and 2-year spot interest rates using the information in Table 1? If yes, clearly show how you can calculate these rates. If no, explain why, and specify what condition(s) the cash flows of an additional hypothetical 2-year risk-free security of known price would need to satisfy for you to be able to derive the 1- and 2-year spot rates. (5 marks) (1) You have just won the lottery! You must decide how to receive your winnings and have been offered the following two choices: A. Receive the 100 million jackpot via an immediate payment of 10 million today, followed by 30 risk-free annual payments. The nominal values of the 30 annual payments sum to 90 million; the first of these annual payments will be made in 4 years' time, with subsequent payments growing at an annual rate of 5%. B. Receive a single lump-sum payment of EX today. Assume that the 3-year spot rate is as you calculated in (b) and the spot rate for year 4 onwards is 8%. How large does X have to be for you to be indifferent between the two options? (7 marks)

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Bond C should sell at par to face value A bond sells at a discount when its price is below the face value and it sells at a premium when its price i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started