Answered step by step

Verified Expert Solution

Question

1 Approved Answer

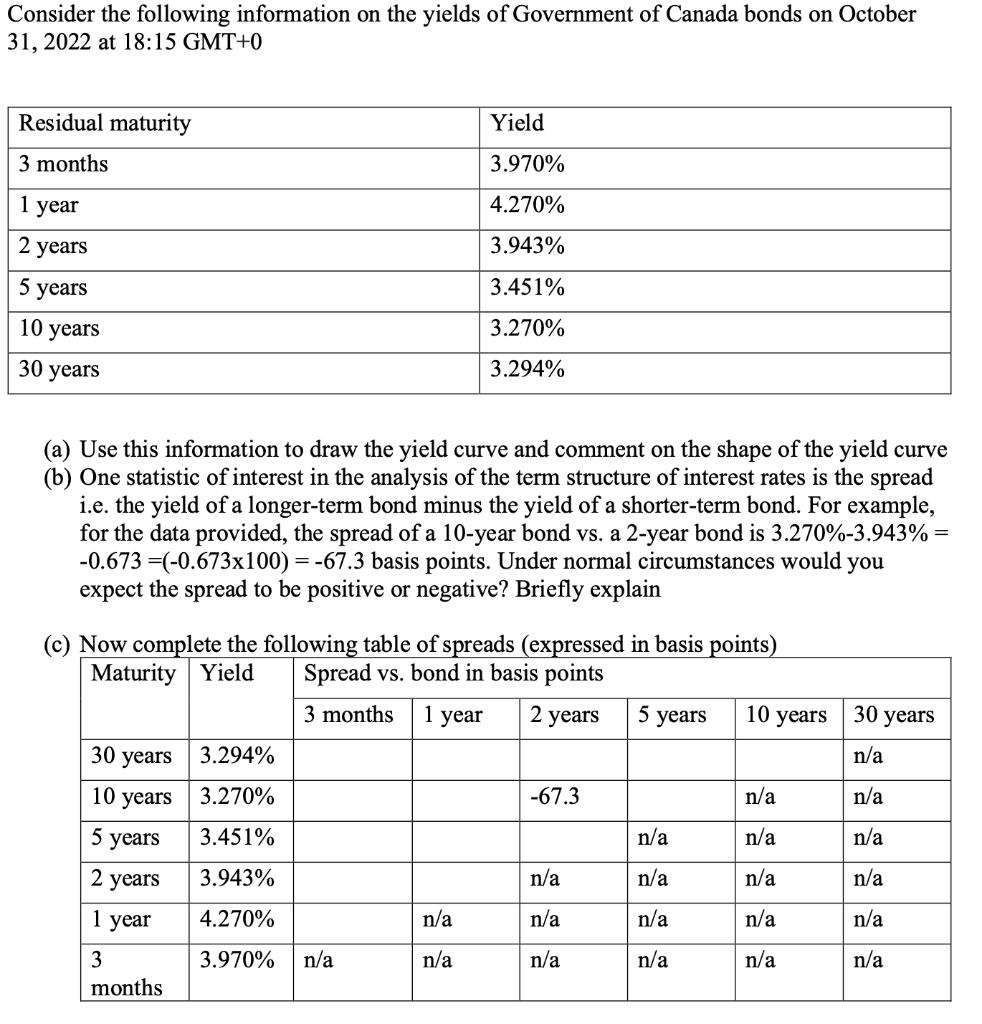

Consider the following information on the yields of Government of Canada bonds on October 31, 2022 at 18:15 GMT+0 Residual maturity 3 months 1

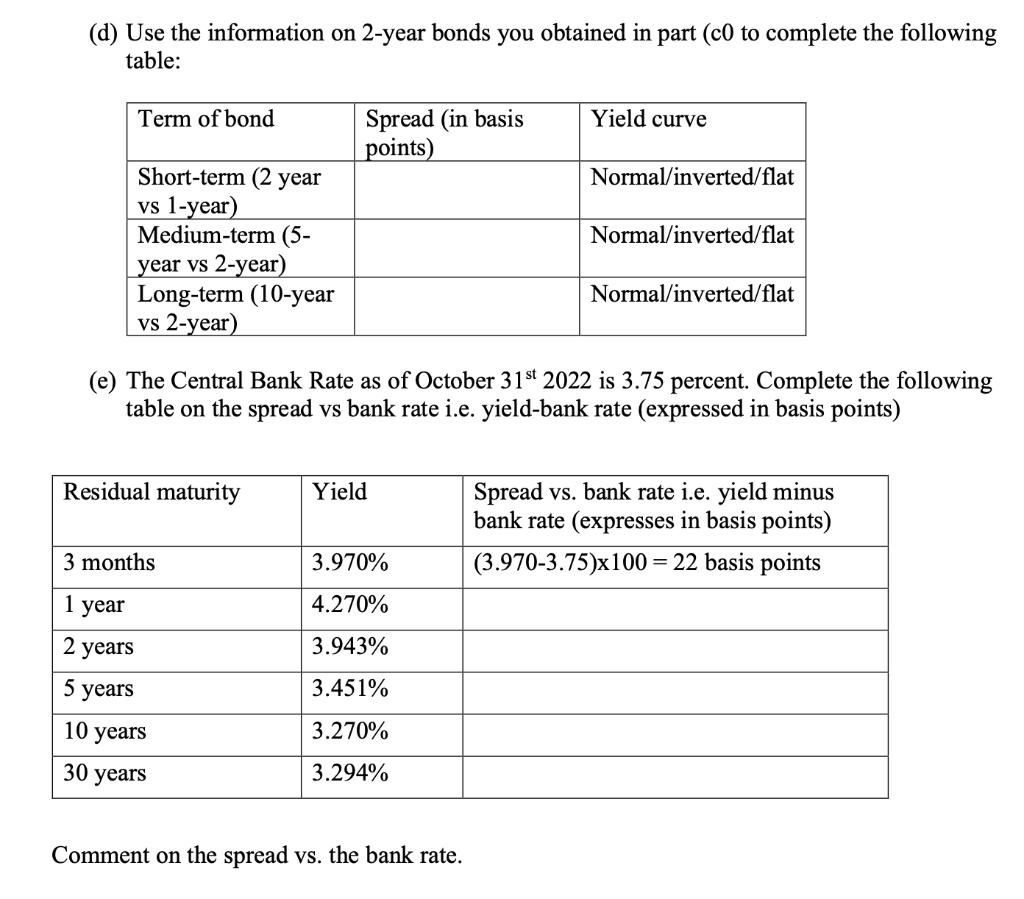

Consider the following information on the yields of Government of Canada bonds on October 31, 2022 at 18:15 GMT+0 Residual maturity 3 months 1 year 2 years 5 years 10 years 30 years (a) Use this information to draw the yield curve and comment on the shape of the yield curve (b) One statistic of interest in the analysis of the term structure of interest rates is the spread i.e. the yield of a longer-term bond minus the yield of a shorter-term bond. For example, for the data provided, the spread of a 10-year bond vs. a 2-year bond is 3.270%-3.943%= -0.673=(-0.673x100) = -67.3 basis points. Under normal circumstances would you expect the spread to be positive or negative? Briefly explain (c) Now complete the following table of spreads (expressed in basis points) Maturity Yield Spread vs. bond in basis points 3 months 1 year 2 years 30 years 10 years 5 years 2 years 3.943% 1 year 4.270% 3 months 3.294% 3.270% 3.451% Yield 3.970% 4.270% 3.943% 3.451% 3.270% 3.294% 3.970% n/a n/a n/a -67.3 n/a n/a n/a 5 years n/a n/a n/a n/a 10 years n/a n/a n/a n/a n/a 30 years n/a n/a n/a n/a n/a n/a (d) Use the information on 2-year bonds you obtained in part (c0 to complete the following table: Term of bond Short-term (2 year vs 1-year) Medium-term (5- year vs 2-year) Long-term (10-year vs 2-year) Residual maturity Spread (in basis points) 3 months 1 year 2 years 5 years 10 years 30 years Yield (e) The Central Bank Rate as of October 31st 2022 is 3.75 percent. Complete the following table on the spread vs bank rate i.e. yield-bank rate (expressed in basis points) 3.970% 4.270% 3.943% 3.451% 3.270% 3.294% Yield curve Comment on the spread vs. the bank rate. Normal/inverted/flat Normal/inverted/flat Normal/inverted/flat Spread vs. bank rate i.e. yield minus bank rate (expresses in basis points) (3.970-3.75)x100 = 22 basis points

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a The yield curve is a graphical representation of the yields of bonds with different maturities Plo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started