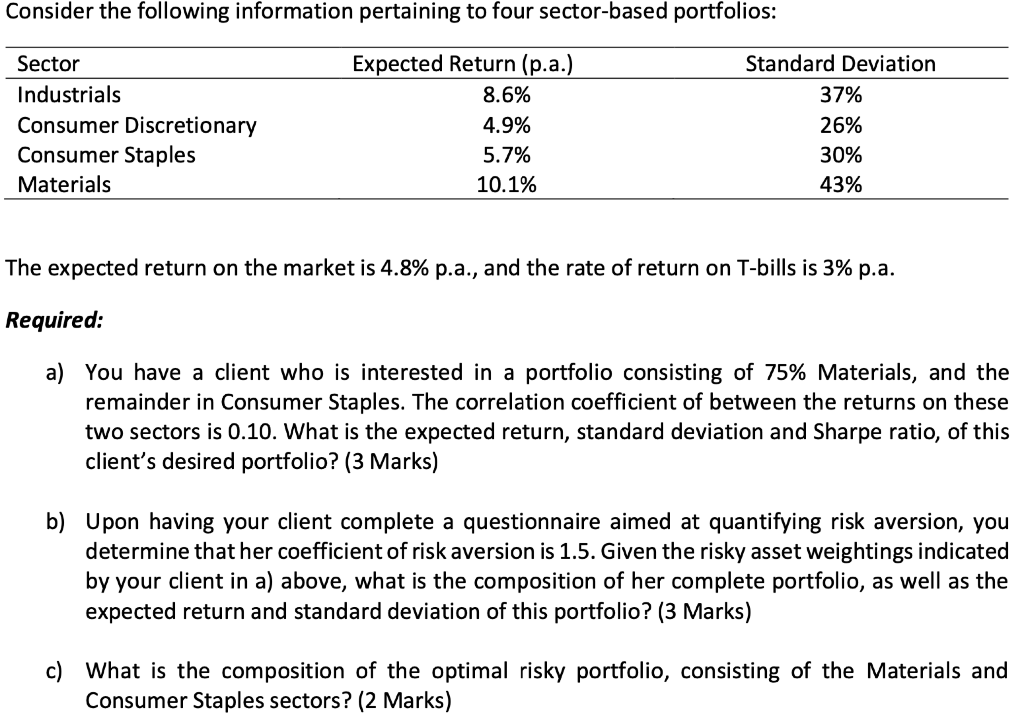

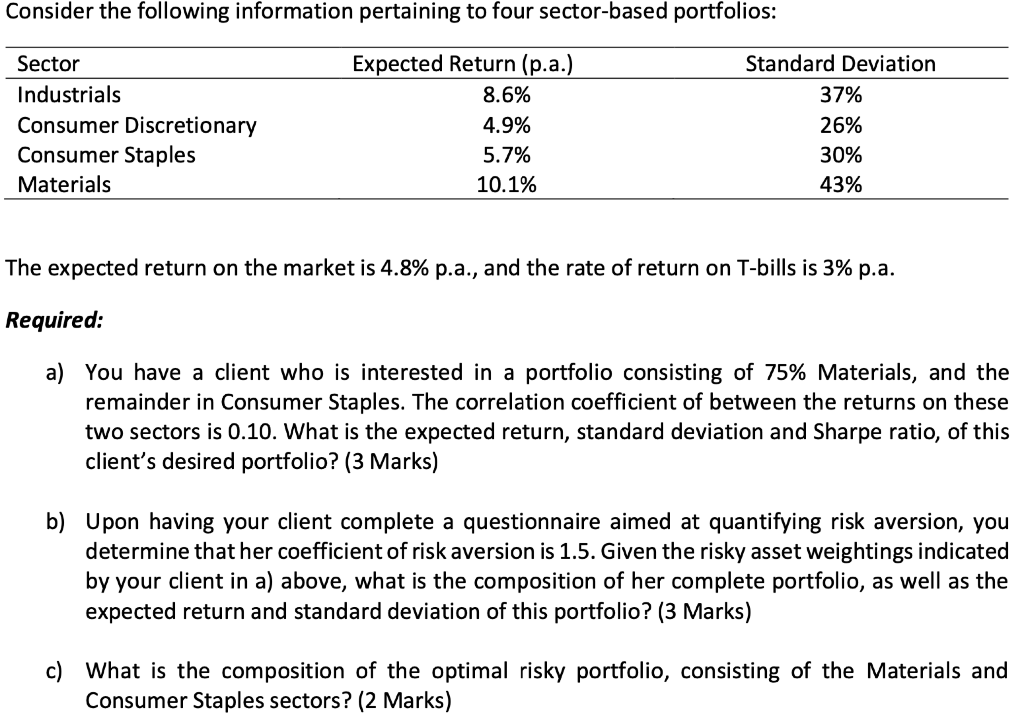

Consider the following information pertaining to four sector-based portfolios: Sector Industrials Consumer Discretionary Consumer Staples Materials Expected Return (p.a.) 8.6% 4.9% 5.7% 10.1% Standard Deviation 37% 26% 30% 43% The expected return on the market is 4.8% p.a., and the rate of return on T-bills is 3% p.a. Required: a) You have a client who is interested in a portfolio consisting of 75% Materials, and the remainder in Consumer Staples. The correlation coefficient of between the returns on these two sectors is 0.10. What is the expected return, standard deviation and Sharpe ratio, of this client's desired portfolio? (3 Marks) b) Upon having your client complete a questionnaire aimed at quantifying risk aversion, you determine that her coefficient of risk aversion is 1.5. Given the risky asset weightings indicated by your client in a) above, what is the composition of her complete portfolio, as well as the expected return and standard deviation of this portfolio? (3 Marks) c) What is the composition of the optimal risky portfolio, consisting of the Materials and Consumer Staples sectors? (2 Marks) Consider the following information pertaining to four sector-based portfolios: Sector Industrials Consumer Discretionary Consumer Staples Materials Expected Return (p.a.) 8.6% 4.9% 5.7% 10.1% Standard Deviation 37% 26% 30% 43% The expected return on the market is 4.8% p.a., and the rate of return on T-bills is 3% p.a. Required: a) You have a client who is interested in a portfolio consisting of 75% Materials, and the remainder in Consumer Staples. The correlation coefficient of between the returns on these two sectors is 0.10. What is the expected return, standard deviation and Sharpe ratio, of this client's desired portfolio? (3 Marks) b) Upon having your client complete a questionnaire aimed at quantifying risk aversion, you determine that her coefficient of risk aversion is 1.5. Given the risky asset weightings indicated by your client in a) above, what is the composition of her complete portfolio, as well as the expected return and standard deviation of this portfolio? (3 Marks) c) What is the composition of the optimal risky portfolio, consisting of the Materials and Consumer Staples sectors? (2 Marks)