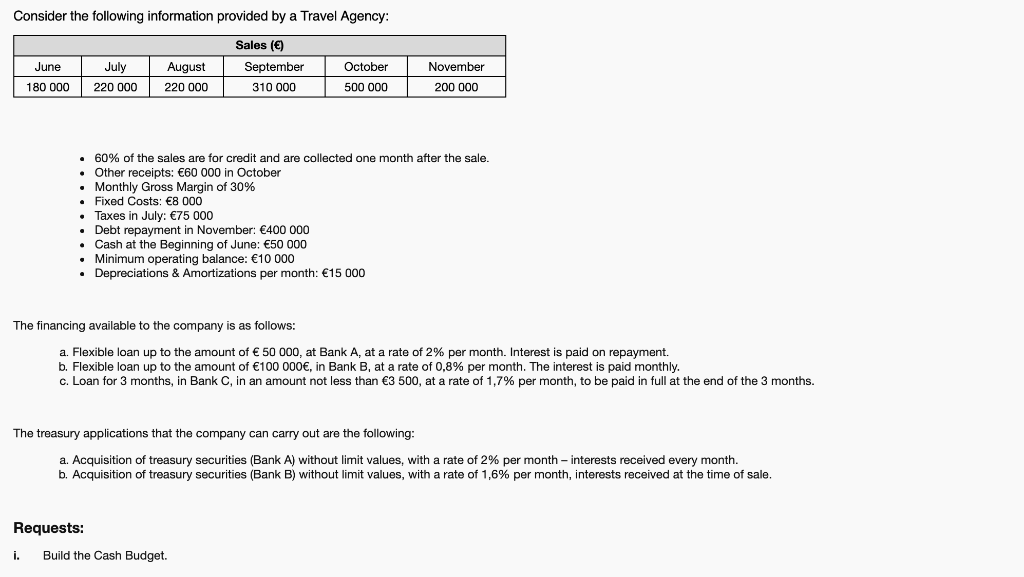

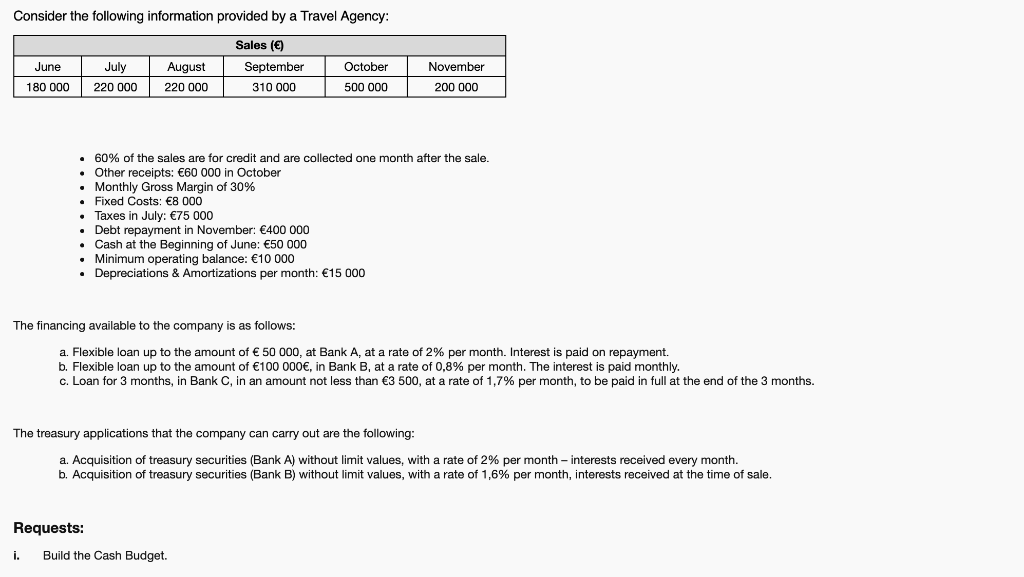

Consider the following information provided by a Travel Agency: June 180 000 July 220 000 August 220 000 Sales () September 310 000 October 500 000 November 200 000 60% of the sales are for credit and are collected one month after the sale. Other receipts: 60 000 in October Monthly Gross Margin of 30% Fixed Costs: 8 000 Taxes in July: 75 000 Debt repayment in November: 400 000 Cash at the Beginning of June: 50 000 Minimum operating balance: 10 000 Depreciations & Amortizations per month: 15 000 The financing available to the company is as follows: a. Flexible loan up to the amount of 50 000, at Bank A, at a rate of 2% per month. Interest is paid on repayment. b. Flexible loan up to the amount of 100 000, in Bank B, at a rate of 0,8% per month. The interest is paid monthly. c. Loan for 3 months, in Bank C, in an amount not less than 3 500, at a rate of 1,7% per month, to be paid in full at the end of the 3 months. The treasury applications that the company can carry out are the following: a. Acquisition of treasury securities (Bank A) without limit values, with a rate of 2% per month - interests received every month. b. Acquisition of treasury securities (Bank B) without limit values, with a rate of 1,6% per month, interests received at the time of sale. Requests: i. Build the Cash Budget. Consider the following information provided by a Travel Agency: June 180 000 July 220 000 August 220 000 Sales () September 310 000 October 500 000 November 200 000 60% of the sales are for credit and are collected one month after the sale. Other receipts: 60 000 in October Monthly Gross Margin of 30% Fixed Costs: 8 000 Taxes in July: 75 000 Debt repayment in November: 400 000 Cash at the Beginning of June: 50 000 Minimum operating balance: 10 000 Depreciations & Amortizations per month: 15 000 The financing available to the company is as follows: a. Flexible loan up to the amount of 50 000, at Bank A, at a rate of 2% per month. Interest is paid on repayment. b. Flexible loan up to the amount of 100 000, in Bank B, at a rate of 0,8% per month. The interest is paid monthly. c. Loan for 3 months, in Bank C, in an amount not less than 3 500, at a rate of 1,7% per month, to be paid in full at the end of the 3 months. The treasury applications that the company can carry out are the following: a. Acquisition of treasury securities (Bank A) without limit values, with a rate of 2% per month - interests received every month. b. Acquisition of treasury securities (Bank B) without limit values, with a rate of 1,6% per month, interests received at the time of sale. Requests: i. Build the Cash Budget